Fintel reports that on August 10, 2023, Stifel maintained coverage of Roblox Corporation - (NYSE:RBLX) with a Buy recommendation.

Analyst Price Forecast Suggests 48.55% Upside

As of August 2, 2023, the average one-year price target for Roblox Corporation - is 43.76. The forecasts range from a low of 20.20 to a high of $63.00. The average price target represents an increase of 48.55% from its latest reported closing price of 29.46.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Roblox Corporation - is 3,306MM, an increase of 35.89%. The projected annual non-GAAP EPS is -1.77.

What is the Fund Sentiment?

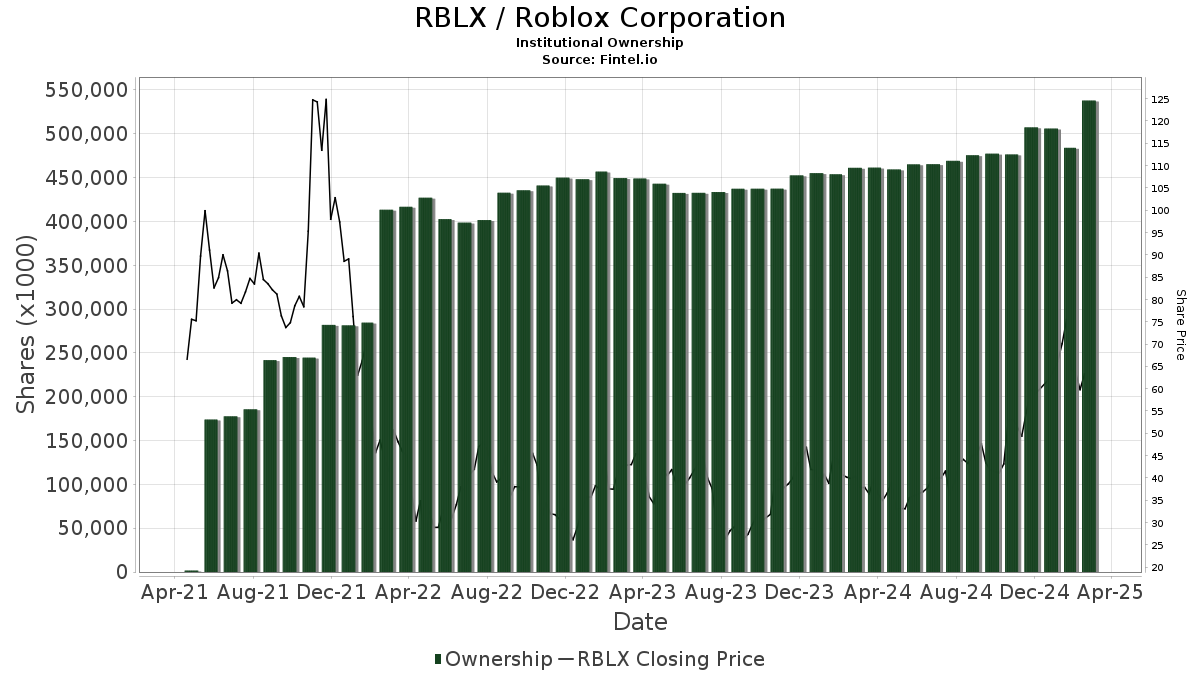

There are 1036 funds or institutions reporting positions in Roblox Corporation -. This is an increase of 54 owner(s) or 5.50% in the last quarter. Average portfolio weight of all funds dedicated to RBLX is 0.54%, an increase of 21.34%. Total shares owned by institutions decreased in the last three months by 2.50% to 432,874K shares.  The put/call ratio of RBLX is 0.65, indicating a bullish outlook.

The put/call ratio of RBLX is 0.65, indicating a bullish outlook.

What are Other Shareholders Doing?

Altos Ventures Management holds 70,892K shares representing 11.61% ownership of the company. In it's prior filing, the firm reported owning 78,672K shares, representing a decrease of 10.98%.

Baillie Gifford holds 28,549K shares representing 4.67% ownership of the company. In it's prior filing, the firm reported owning 29,004K shares, representing a decrease of 1.59%. The firm decreased its portfolio allocation in RBLX by 68.57% over the last quarter.

Temasek Holdings holds 11,365K shares representing 1.86% ownership of the company. No change in the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 11,125K shares representing 1.82% ownership of the company. In it's prior filing, the firm reported owning 10,004K shares, representing an increase of 10.08%. The firm increased its portfolio allocation in RBLX by 62.29% over the last quarter.

ARK Investment Management holds 9,319K shares representing 1.53% ownership of the company. In it's prior filing, the firm reported owning 9,026K shares, representing an increase of 3.13%. The firm decreased its portfolio allocation in RBLX by 10.90% over the last quarter.

Roblox Background Information

(This description is provided by the company.)

Roblox's mission is to build a human co-experience platform that enables shared experiences among billions of users. Every day, more than 36 million people around the world have fun with friends as they explore millions of immersive digital experiences. All of these experiences are built by the Roblox community, made up of over five million creators. Roblox believes in building a safe, civil, and diverse community-one that inspires and fosters creativity and positive relationships between people around the world.

Additional reading:

- Press Release dated August 9, 2023

- Exhibit 99.2 To Our Shareholders: We are pleased with our operating and financial performance in the first quarter of fiscal year 2023. Revenue was $655.3 million, up 22% over the first quarter of 2022. Net loss attributable to common stockholders wa

- Roblox Reports First Quarter 2023 Financial Results Strong year over year growth in Daily Active Users, Hours Engaged, Revenue, and Bookings

- Outside Director Compensation Policy, as amended

- Roblox Reports March 2023 Key Metrics

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.