One of the most useful measures to help investors identify leading stocks and funds in any market environment is relative strength. This technical analysis tool assists us in gauging how an investment has performed relative to the market or another relevant benchmark. For example, we could use relative strength to detect stocks that have outperformed the S&P 500 so far this year.

This convenient measure is not to be confused with the relative strength index (RSI), which technical analysts use to generate overbought and oversold conditions. Investors using relative strength tend to assume that the trend of outperformance will continue into the future. However, we need to be careful about investing in stocks that are extended and have been outperforming for a prolonged period of time as they may be prone to a reversal.

That’s not the case with the two hotel operators we will discuss below. Critics of relative strength as an indicator typically associate it with momentum investing, but I don’t view it that way. The market ultimately decides which stocks are best positioned for the present and future periods, and this tool helps us recognize those stocks. These two hotel behemoths are witnessing substantial increases in their respective earnings estimates, and the market is rewarding these companies for the ensuing growth. The fact that their stocks are outperforming the market is simply a confirmation of the trend.

Marriott International, Inc. (MAR)

Marriott is the largest hotel company in the world. MAR operates, franchises, and licenses hotel, timeshare, and residential properties globally. Its portfolio includes recognized brands such as JW Marriott, Ritz-Carlton, St. Regis, Sheraton, Westin, Renaissance, Courtyard, and Residence Inn. Marriott International operates nearly 8,000 properties under 30 hotel brands in 139 countries and territories. MAR was founded in 1927 and is headquartered in Bethesda, MD.

Marriott is gaining from the reopening of international borders and greater leniency in travel restrictions. During Q4 of last year, the hotel giant added 120 new properties to its worldwide lodging portfolio. The strong expansion plans are set to continue this year, with MAR anticipating net rooms growth of 3.5-4% in 2022. Marriott is in a great spot as its strong brand position and increased demand for travel will continue to prove beneficial.

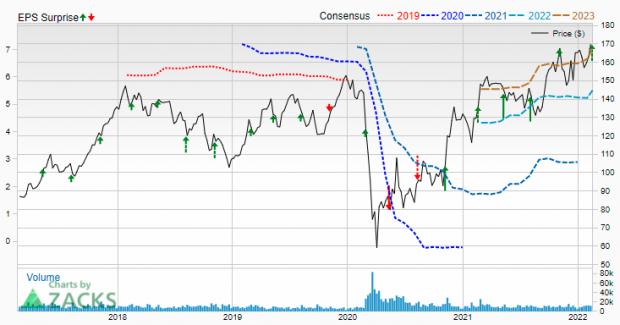

A Zacks Rank #1 (Strong Buy), MAR has exceeded earnings estimates in each of the past six quarters. The firm reported Q4 EPS on Tuesday this week of $1.30, beating the $1.02 consensus estimate by 27.45%. Marriott has delivered a trailing four-quarter average earnings surprise of 86.64%, helping shares advance nearly 36% in the past year.

Image Source: Zacks Investment Research

Analysts covering MAR are in agreement in terms of earnings estimate revisions. 2022 EPS estimates have been increased by 5.14% in the past 60 days. The Zacks Consensus Estimate now stands at $5.52, representing growth of 73.04% relative to last year. Sales are expected to climb by 40.3% to $19.44 billion. MAR is set to report its Q1 results on May 9th.

Intercontinental Hotels Group (IHG)

Intercontinental Hotels Group manages, franchises, and leases hotels worldwide. The company owns and operates a variety of resorts, restaurants, hotels and spas under recognized names such as Kimpton, Regent, Atwell, EVEN, and Holiday Inn. IHG has over 6,000 hotels under its umbrella and operates in over 100 countries. Intercontinental Hotels Group was founded in 1777 and is based in Denham, the United Kingdom.

A Zacks Rank #2 (Buy) stock, IHG has held up fairly well through the recent market volatility. The stock is up nearly 6% on the year, handily outperforming the S&P 500’s -8.5% decline.

Image Source: TradingView

The hotel operator has been on the positive end of earnings estimate revisions from analysts covering the firm. EPS estimates for 2022 have been revised upward by +0.39% in the past 60 days. The Zacks Consensus Estimate is now $2.60, translating to growth of 738.71% versus last year. Sales are anticipated to rise 65.75% to $3.97 billion. IHG is scheduled to report its recent Q4 results next week on February 22nd.

Keep an eye on these two hotel giants.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marriott International, Inc. (MAR): Free Stock Analysis Report

Intercontinental Hotels Group (IHG): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.