News & Insights

- Investors’ love affair with past winners is insatiable. The ‘conventional wisdom’ on Wall Street is that semi-conductors, US mega-cap growth stocks, and market cap weighted strategies will continue to be the ‘big winners’ in 2025. Unfortunately, yesterday’s darlings seldom outperform in the future with the same risk-adjusted returns per unit of liquidity risk (this is important) as they did in the past. Paradigm shifts typically happen slowly and quietly, with most investors realizing after the fact.

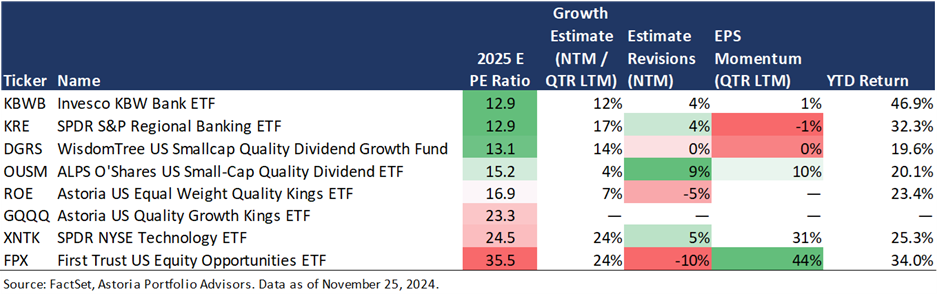

- Last year, we were bulled up in our 10 ETFs for 2024. This year, we are taking our bullishness down a notch. We find ourselves having to go into far corners of the market to produce an asymmetric risk/return (i.e., merger arbitrage, IPOs, spin-offs, banks, cryptos) given how expensive valuations have gotten in both equities (excluding US value, US SMID, and international) and fixed income. Outside of select pockets of the equity market, there are not many attractive opportunities in the US large-cap space. Hence, history suggests the market is overdue for a big, fat correction. The good news is that the Fed has a lot of levers to pull with Fed Funds at the 4.50-4.75% range if the economy hits an air pocket.

- Many firms put out their 2025 reports with forecasts and predictions, but we find very few of them are actionable. We wish the authors would attach a link to their prior-year forecasts so we can judge how well they did. The goal of this piece is to not only provide unique thought leadership but to provide investors with actionable investment ideas. Here are our 10 ETFs for 2024 (click here).

2025: Get Ready for an Epic Trump Put

- As investors who were trained under the creator of the Greenspan Put, we can’t help but think the Trump Put will be deep with wide strikes. No other president has hung their hat on the stock market’s performance more than Trump. We are not political experts, but it seems that the cabinet members being elected could potentially radically transfer the legal system resulting in deregulation, creating a boom for the banking system, crypto, merger and acquisition, and the IPO market. Trump’s mantra has always been ‘win at all costs,’ so it feels to us there should be a new playbook for portfolios in the years to come.

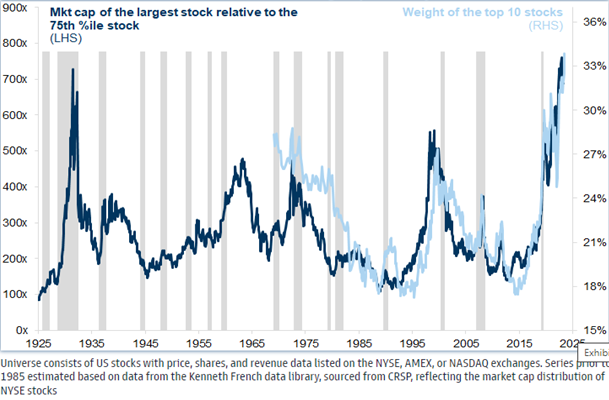

- Inevitably there will be a recession at some point during Trump’s administration, but the good news is that there is plenty of room for the Fed to cut rates to stimulate the economy. Our bigger concern is how portfolios will deal with the back end of the curve (inflation is ticking higher, the deficit will likely get worse) along with the fact that there are very little bargains in fixed income. Another concern is there is endless money going into passive US large-cap ETFs which creates a never-ending feedback loop (money goes into the same stocks, distort valuations, pushes prices up, forces more people to buy the asset, etc). This is reflexivity at its finest.

- Trump’s pro-growth policies, tariffs, and protectionism stance coupled with the Fed who wants to lower rates could shift demand curves and possibly re-ignite inflation, leading to rate hikes being priced back into the market. We argued in 2020 that inflation would be a sticky problem lasting for many years. This is a key reason why we argued investors should own inflation-linked assets. The irony of this call is that inflation-linked assets have a low correlation to US index beta, carry well in a multi-asset portfolio, and trade at a discount of approximately 40% to the S&P 500 Index.

Owning Small-Caps is a Once in a Decade Opportunity

- A new cycle usually signals a change in market leadership. Increase your equity beta, be overweight equities, and tilt away from the Magnificent Seven. We believe this late cycle reflation bounce continues in 2025 but shifts to non-Mag 7 stocks (specifically US SMID, cyclicals). Inflation expectations are rising, and the inflation hawks were right all along. Once the inflation genie comes out of the bottle, it is not trivial to put it back in.

- The distribution of outcomes next year is much wider (valuations are largely expensive in US large-cap index space, fixed income spreads are tight, multiple ongoing wars, strained relations between the two largest economies in the world, etc.). The US economy was improving (actually it was getting stronger) before Trump’s red sweep, so the question now becomes how does the administration shift back to a pro domestic policy without further increasing the deficit, sending bond term premiums higher, and reigniting inflation? It’s no small feat and we believe it’s easy to see a scenario where left tail risks surface in 2025. For us, this means portfolios should carry some type of protection strategy beyond real assets.

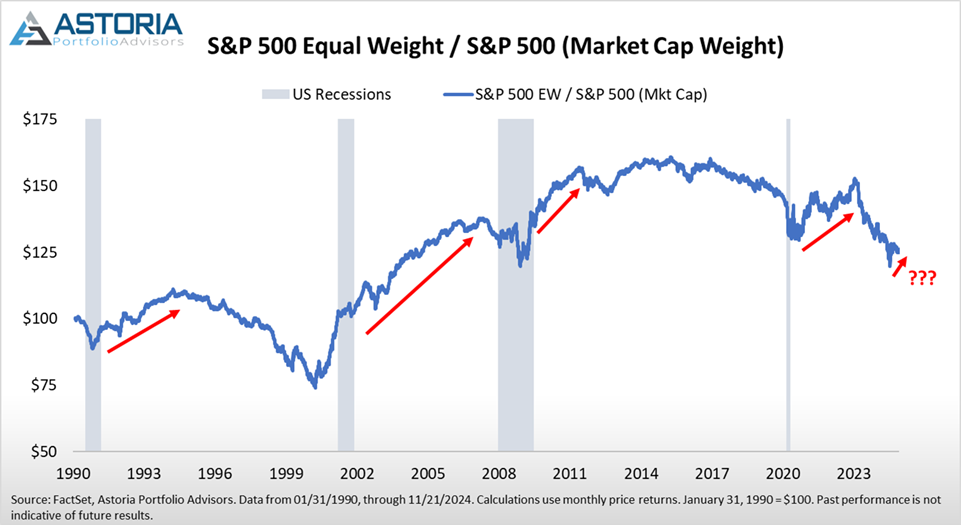

- Equal weight over market cap weight. It’s okay to own the Mag 7 stocks, but we advocate reducing one’s exposure to these stocks and capping their weights in one’s portfolio. As seen in the chart below, new market cycles have historically corresponded with equal weight outperforming market cap weight.

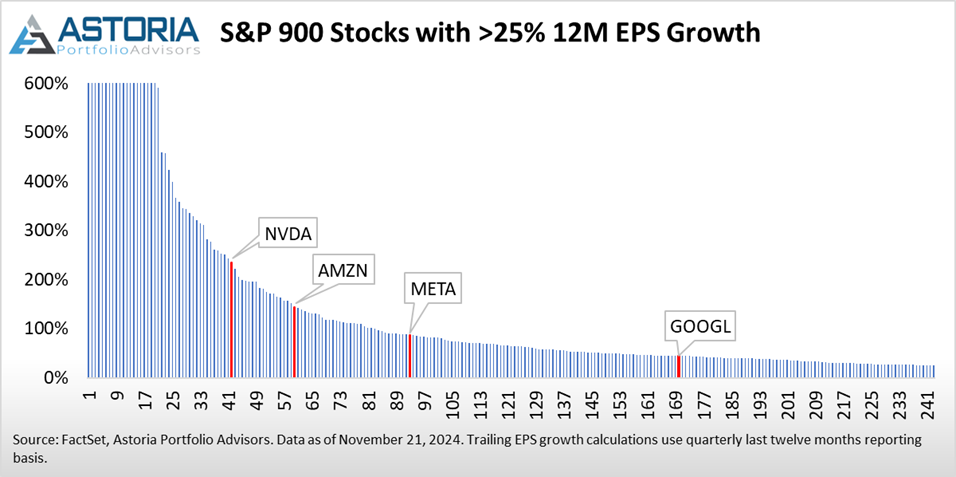

- Moreover, as you can see from the chart below, there are plenty of growth opportunities outside of the Mag 7. In fact, out of the S&P 900 Index, over 240 stocks have seen earnings growth greater than 25% over the last twelve months. Among these, 41 companies are growing faster than NVDA, 59 faster than AMZN, 92 faster than META, and 169 faster than GOOGL.

- Owning Small Caps is a once in a decade opportunity. The need to be more tactical is clear with the S&P 500 Index forward PE at 22, and the index up over 59% from December 30th, 2022, through November 21st, 2024. It appears that the stars need to align for large-cap stocks to rally further (i.e. earnings have to deliver). Estimate revisions will likely get revised higher now that election uncertainty is over. Companies have also piled billions into capex to not get behind the artificial intelligence movement, so productivity needs to increase, and margins improve accordingly.

- The concentration risk is at 100-year highs, according to research by Goldman Sachs, so investors have a decision to make. Do they want to be overweight US large-cap growth stocks which have produced attractive returns over the past 10 years, or take a shot with value, small-caps, mid-caps and cyclicals?

- According to Morgan Stanley research, small-cap earnings are set to surpass large-cap earnings in 2H25. Per their research, using a median multiple (which removes the large unprofitable cohort in small-caps and smooths the skew in mega-cap valuations), small-caps trade in the bottom 35th percentile, while large-caps trade in the top decile.

- At Astoria, we focus on buying low and selling high, so we have a tough time being overweight large-cap US equities. Our portfolios have been shifted towards cyclicals, equal weight, and mid-caps for the better part of 15 months. A pro-growth, pro-domestic administration should in theory benefit small-cap and mid-cap stocks. Don’t be afraid to stick your neck out!

Buy Ethereum. As of 11/21/2024, it is Still Approximately 35% from its All-Time High on 11/30/2021.

- Crypto is no longer a product to ignore. Astoria penned a constructive report on Bitcoin on January 9th, 2018 when Bitcoin was trading at 14,600. It remains our most widely read report after hundreds of papers written in the past 8 years (click here).

- We have always been supporters of real assets and assets with unique sources of risk and return (it’s hard to argue that crypto doesn’t have unique sources of risk/return). We have owned gold since the firm began in 2017 and we have owned other real assets as well. Unfortunately, spot Bitcoin ran up too much leading to the launch of the Bitcoin ETFs, and we are sticklers for our entry point, so we have not added Bitcoin to our models.

- Bitcoin has moved a lot, but we can’t help but think this asset class may demonstrate positive convexity as we continue to mine towards 21 million coins. It’s clear this administration wants to pursue a pro crypto policy. The fact that the administration named Department of Government Efficiency (DOGE) with Elon Musk co-heading after his vocal support for the Dogecoin crypto currency suggests the government is willing to provide some type of floor to the asset class.

- As mentioned earlier, our call for 2025 is to trade markets more tactically. We expect at least a 25-30% pullback in cryptos at some point next year so have patience if you do not own any now (despite all the convexity attributes Bitcoin has, it will not go to the moon just yet).

- The reality is that there will be other winners in the crypto landscape beyond Bitcoin which is why we are interested in BITW, an index fund approach to owning a basket of cryptos. The title of this report is 10 ETFs for 2025 and BITW is currently on the OTCQX market with plans to move it on the NYSE. For now, we throw our hat into the ring with ETHW for our 10 ETFs for 2025.

Be Tactical in Fixed Income. Spreads are Tight and Inflation is Ticking Higher

- Last year, we had only one fixed income idea and a lot of fixed income product sponsors complained, saying we were missing the big picture. What has the US bond market done in 2024? The US Aggregate Bond index is up 1.5% YTD through November 21st, 2024. Meanwhile the S&P 500 Equal Weight index is up 18.4% over the same period.

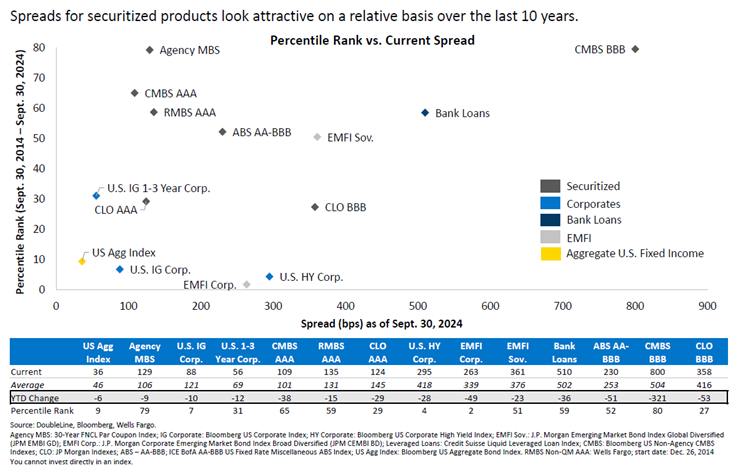

- Spreads are very narrow for corporate credit and high yield bonds, and our view is that the risk vs. reward is unattractive. If there is an asset class you want to be tactical among, it is fixed income. We prefer mortgage-backed securities where at least spreads are attractive, and prepayment risk is low (30-year mortgage back over 7%).

- We think the odds are that long end rates move higher (inflation and deficit concerns) while the Fed cuts one or two more times, so we expect the curve to steepen

Inflation/Real Assets are Trading Approx. 40% Cheaper than the S&P 500 multiple.

- We are entering into a world of deglobalization, onshoring, and reshoring. In this new environment, investors should own real assets, commodities, and stocks in sectors such as industrials, materials, energy, etc. From the thousands of portfolios we oversee, we still see remnants of the prior decade that are present in most advisors’ accounts. Our view is that portfolios should be readjusted to reflect structurally higher real rates.

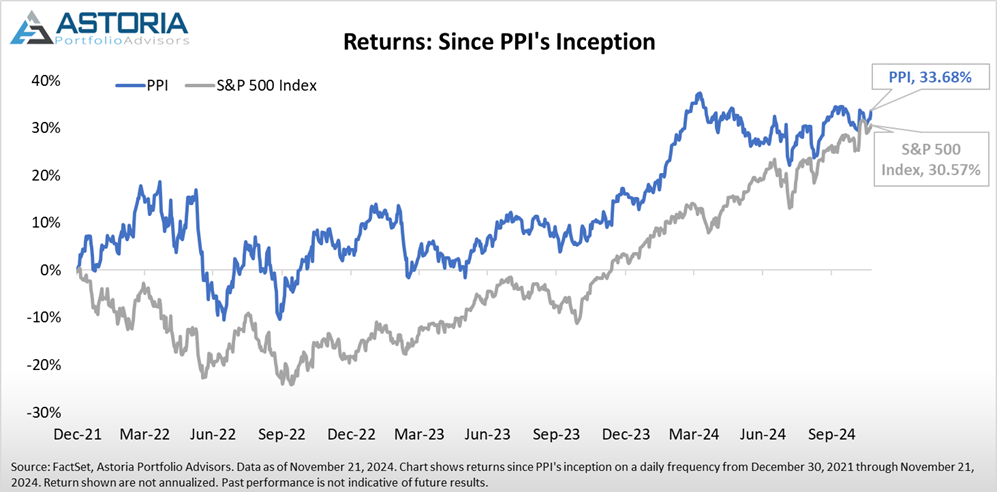

- We launched an inflation/real assets ETF (PPI) on December 30th, 2021. At the time, everyone wanted to own mega-cap tech stocks (that hasn’t changed), but PPI has marginally outperformed the S&P 500 Index by 311bps from December 30th, 2021, through November 21st, 2024 (past performance is not indicative of future results). Is value investing really dead, or are investors just not buying the right value stocks?

- Inflation-sensitive stocks (i.e. real assets) have demonstrated asymmetric risk characteristics for the past three years. They have not gone down as much as the market and have outperformed on the way up (past performance is not indicative of future results). This is every portfolio manager’s dream scenario.

- At the time of the PPI launch, the PE ratio of the fund was around 7x. We felt like kids in a candy store on Christmas Eve without parental supervision. Real assets are not the bargain they were 3 years ago, but PPI still trades at 40% discount to the S&P 500 Index multiple. In our view, real assets are still worth owning and can potentially benefit from higher real rates from Trump’s anticipated pro-growth, tariff, and protectionism policies.

International Equities

- Investing is about buying assets below intrinsic value, having a clear catalyst for the market to realize the asset’s potential, and then moving onto the next opportunity. Investing is not only about Sharpe Ratio, downside protection, or moving averages.

- Unfortunately for Non-US stocks, there is not only a missing catalyst, but they face significant headwinds. For instance, China has a non-linear growth policy, Europe’s reliance on Russia for gas/energy, a lack of technology sector, complicated cross border bureaucracy which prohibits some companies from leveraging their neighbors, and a lack of talent to drive shareholder value (most highly educated foreigners want to work in the US). Hence, Europe trades (and should generally trade) at a lower multiple than the US. There are plenty of value opportunities within the US industrials, materials, energy, and financials space, along with the mid-cap and small-cap space. Moreover, there is a catalyst for these US segments to have their discount narrow.

Background Information on 10 ETFs for 2025

- Our team has been producing a dedicated year-ahead ETF outlook for over a decade. We were the first group to publish a dedicated ETF outlook with actionable ideas (i.e. a top 10 ETF list) and we like the fact that our peers are starting to throw their hats into the ring. We try not to repeat our ETFs from one year to the next, as our goal is to communicate unique and actionable thematic ideas for the investment community.

- Astoria runs various ETF managed portfolios with different risk tolerance bands and with different holdings. The commentary in this report is generally centered around our Dynamic and Risk Managed ETF Portfolios. We offer strategic ETF Portfolios with lower tracking error vs. their benchmark in which case will have different holdings than what’s included in this report.

- The ETFs highlighted in this report are solutions that Astoria finds attractive on a per unit of risk basis. However, this list is not meant to be an asset allocation strategy, a trading idea, or an ETF managed portfolio. As such, this list does not constitute a recommendation of any ETF. There are other ETFs that Astoria currently owns which are not highlighted in this report. Contact us for a list of all of Astoria’s ETF holdings.

- Any ETF holdings discussed are for illustrative purposes only and are subject to change at any time. Readers are welcome to follow Astoria’s research, blogs, and social media updates to see how our portfolios may shift throughout the year. Refer to www.astoriaadvisors.com or @AstoriaAdvisors on Twitter.

- Past performance is not indicative of future results. Investors should understand that Astoria’s 10 ETF Themes for 2025 are not indicative of how Astoria manages money or risk for its investors. Note that Astoria shifts portfolios depending on market conditions, risk tolerance bands, and risk budgeting. As of the time this writing, Astoria held positions in ROE, ETHW, DMBS, SPMB, KBWB, KRE, PPI, and GQQQ on behalf of its clients.

Please note that Astoria Portfolio Advisors serves as a sub-advisor to the Astoria US Quality Growth Kings ETF (GQQQ), the Astoria US Equal Weight Quality Kings ETF (ROE), and the AXS Astoria Inflation Sensitive ETF (PPI). Please consult your financial advisor and review the prospectus to evaluate your suitability and investment risk tolerance before purchasing the GQQQ, ROE, or PPI ETFs. The Funds (GQQQ and ROE) are distributed by Quasar Distributors, LLC. The Funds’ investment advisor is Empowered Funds, LLC, which is doing business as ETF Architect. The Fund (PPI) is distributed by ALPS Distributors, Inc, which is not affiliated with AXS Investments.

Warranties & Disclaimers

There are no warranties implied. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Astoria Portfolio Advisors LLC’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Astoria Portfolio Advisors LLC’s website on the Internet should not be construed by any consumer and/or prospective client as Astoria Portfolio Advisors LLC’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Astoria Portfolio Advisors LLC with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of Astoria Portfolio Advisors LLC’s current written disclosure statement discussing Astoria Portfolio Advisors LLC’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from Astoria Portfolio Advisors LLC upon written request. Astoria Portfolio Advisors LLC does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Astoria Portfolio Advisors LLC’s website or incorporated herein and takes no responsibility, therefore. All such information is provided solely for convenience purposes only, and all users thereof should be guided accordingly. This website and the information presented are for educational purposes only and do not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.

Past performance is not indicative of future performance. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information and are subject to change at any time without notice and with no obligation to update. Any ETF Holdings shown are for illustrative purposes only and are subject to change at any time. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by Astoria Portfolio Advisors LLC. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of Astoria Portfolio Advisors LLC. Investing entails risks, including the possible loss of some or all the investor’s principal. The investment views and market opinions/analyses expressed herein may not reflect those of Astoria Portfolio Advisors LLC as a whole, and different views may be expressed based on different investment styles, objectives, views, or philosophies. To the extent that these materials contain statements about the future, such statements are forward-looking and subject to a number of risks and uncertainties.

Latest articles

This data feed is not available at this time.