Dallas, Texas-based Southwest Airlines Co. (LUV) is a passenger airline company, providing scheduled air transportation services in the U.S. and near-international markets. With a market cap of $20.3 billion, Southwest employs over 73,000 people and its operations span various U.S. states and 10 other nations.

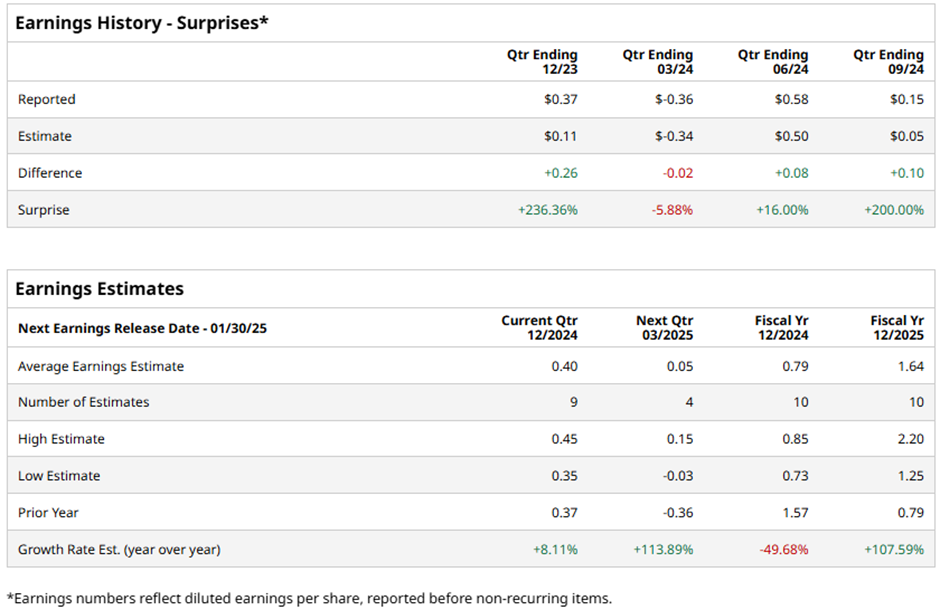

The airline giant is expected to release its fourth-quarter earnings before the market opens on Thursday, Jan. 30. Ahead of the event, analysts expect Southwest to report a non-GAAP profit of $0.40 per share, up 8.1% from $0.37 per share reported in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates thrice over the past four quarters while missing on one other occasion. Its adjusted EPS for the last reported quarter plunged 60.5% year-over-year to $0.15 but notably surpassed analysts’ estimates of $0.05.

For fiscal 2024, Southwest is projected to deliver an adjusted EPS of $0.79, down a massive 49.7% from $1.57 in fiscal 2023. Meanwhile, in fiscal 2025, its earnings are expected to rebound 107.6% year-over-year to $1.64.

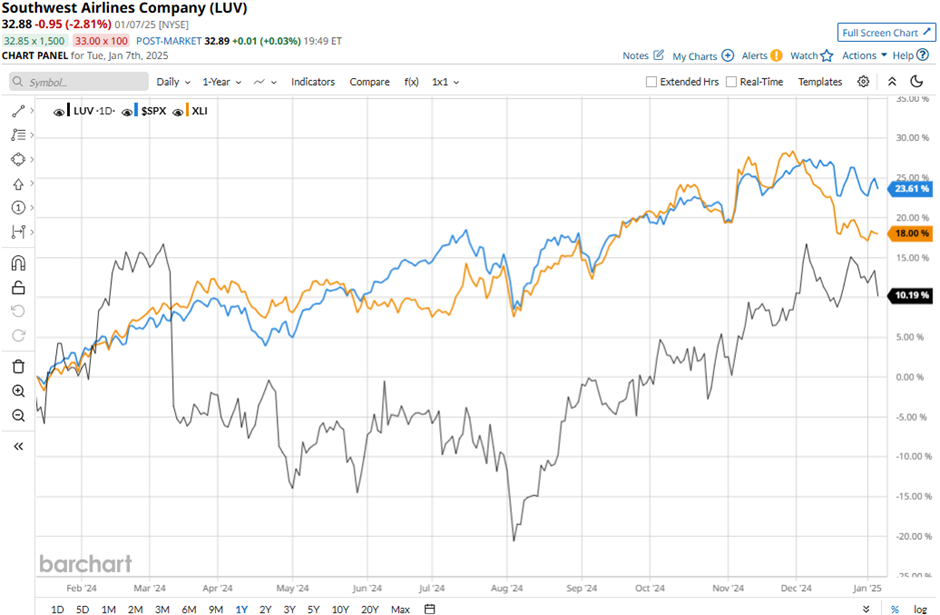

LUV stock has gained 12.8% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 25.8% surge and the Industrial Select Sector SPDR Fund’s (XLI) 18.7% gains during the same time frame.

Southwest Airlines’ stock plunged 5.6% after the release of its Q3 results on Oct. 24. Although the company reported a 5.3% year-over-year growth in operating revenues which surpassed Wall Street’s expectations, its profitability has gone for a toss. High labor costs have led to a 12.5% rise in expenses for salaries, wages, and benefits, totaling $3.1 billion. This, coupled with diminishing pricing power, resulted in a steep decline in operating income to $38 million, down from $117 million in the year-ago quarter. Additionally, the airline’s cash flow from operations has tanked 81.7% year-over-year, amounting to $113 million.

On a brighter note, Southwest Airlines has maintained significant cash reserves and short-term investments on its balance sheet, providing a financial runway to tackle upcoming challenges in the next quarters.

Analysts remain cautious about LUV’s prospects. The stock has a consensus “Hold” rating overall. Out of the 21 analysts covering the stock, four recommend “Strong Buy,” one advises “Moderate Buy,” 11 suggest “Hold,” and five advocate “Strong Sell” rating.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.