Solventum SOLV recently launched the 3M Clarity precision grip attachments for the 3M Clarity aligners. These attachments, available exclusively with Clarity aligners, represent a significant advancement in aligner technology by addressing one of the longstanding challenges in clear aligner treatments — achieving durable, accurately shaped and stain-resistant attachments.

With this development, Solventum aims to enhance treatment outcomes for orthodontic patients, offering both clinicians and patients a more efficient and effective solution.

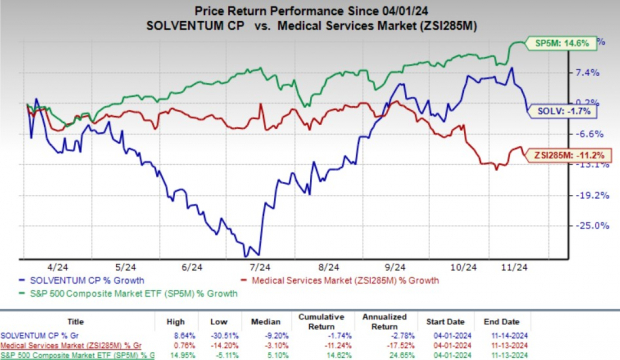

SOLV’s shares plunged 3.1% on Nov. 14, continuing its month-long downtrend, despite the launch. The stock fell 1.7% since its IPO on April 1, 2024, compared with the industry’s decline of 11.2%. The S&P 500 Index gained 14.6% during the same period.

Image Source: Zacks Investment Research

Innovative Features of SOLV’s New Grip Attachments

The Clarity precision grip attachments offer several innovative features designed to improve the quality and accuracy of aligner treatment. One of the key benefits is the elimination of the technique-sensitive, time-consuming attachment creation process that can bring variability in treatment. Clarity precision grip attachments are accurately positioned, precisely shaped and designed to reduce the risk of misplaced and malformed attachments resulting from the conventional approach.

Another major advantage is the attachments' stain resistance. Featuring a blend of inorganic filler and organic resin, along with advanced post-processing techniques, the attachments can resist stains for a long time. This means that patients can expect attachments to remain more discreet and aesthetically pleasing throughout their treatment, a key concern for many aligner users.

The Clarity attachments also simplify the clinical process. Traditional attachments require a technique-sensitive bonding process that can result in "composite flash" — residual cured material left on the tooth surface — which may stain over time and interfere with aligner fit. Clarity attachments minimize this risk by using an alternative bonding approach that eliminates flash, making the attachment process faster, cleaner and less prone to error. Clinicians report that the attachments’ efficiency and consistency translate to greater predictability in treatment outcomes, allowing them to achieve challenging tooth movements with improved control.

Moreover, the 3D printing manufacturing approach for Clarity precision grip attachments provides other benefits, including customization to fit each patient's unique tooth anatomy.

SOLV’s Future Development and Global Expansion Plan

Solventum previewed the Clarity precision grip attachments at the 2024 American Association of Orthodontists meeting. The product is currently available in the United States and Canada. Solventum is pursuing regulatory approvals in other global markets to expand availability. The company has indicated plans to continue enhancing its Clarity product line, potentially integrating further advances in 3D printing and material science to improve aligner treatment.

Favorable Industry Prospects for SOLV

Per a report by Fortune Business Insights, the global clear aligners market was valued at approximately$3.8 billion in 2023 and is anticipated to surpass $28.15 billion by 2032 at a CAGR of 25.2%.

A significant surge in prevalence of malocclusion, technological advancement, improvement in per capita healthcare spending, and increasing penetration of key companies to cater to the growing demand for aesthetics in developing nations are likely to be the key drivers for clear aligners demand.

Given the market potential, the latest launch of Clarity precision grip attachments is likely to boost SOLV’s aligner business.

Solventum Corporation Price

Solventum Corporation price | Solventum Corporation Quote

SOLV’s Zacks Rank & Stocks to Consider

Solventum currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the medical industry are Masimo MASI, AngioDynamics ANGO and Globus Medical GMED.

Masimo, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated growth rate of 10.4% for 2025. You can seethe complete list of today’s Zacks #1 Rank stocks here.

MASI’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 17.10%. Masimo’s shares have risen 37.2% year to date compared with the industry’s 6.7% growth.

AngioDynamics, carrying a Zacks Rank #2 (Buy) at present, has an estimated growth rate of 38.2% for 2025. ANGO’s earnings surpassed estimates in three of the trailing four quarters and missed once, delivering an average surprise of 31.71%.

AngioDynamics’ shares have lost 8.9% year to date against the industry’s 6.7% growth.

Globus Medical, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.7%. GMED’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 12.1%. Its shares have risen 56.5% year to date compared with the industry’s 6.7% growth.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

AngioDynamics, Inc. (ANGO) : Free Stock Analysis Report

Masimo Corporation (MASI) : Free Stock Analysis Report

Globus Medical, Inc. (GMED) : Free Stock Analysis Report

Solventum Corporation (SOLV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.