The semiconductor market is trying to stage a comeback after suffering for most of 2023. Higher demand for semiconductors across a large number of industries and the ongoing enthusiasm surrounding artificial intelligence (AI), especially generative, has been boosting sales.

Given this situation, investing in semiconductor stocks like Taiwan Semiconductor Manufacturing Company Limited TSM, NVIDIA Corporation NVDA Applied Materials, Inc. AMAT, and Semtech Corporation SMTC will be a wise decision.

Semiconductor Stocks to Gain as Sales Soar

The Semiconductor Industry Association (SIA) said on Tuesday that global semiconductor sales totaled $51.3 billion in July 2024, jumping 18.7% from July 2023’s total of $43.2 billion. Month over month, semiconductor sales rose 2.7% from June’s total of $50.0 billion.

John Neuffer, SIA president and CEO, said, “The global semiconductor market continued to grow substantially on a year-to-year basis in July, and month-to-month sales increased for the fourth consecutive month.”

“The Americas market experienced particularly strong growth in July, with a year-to-year sales increase of 40.1%,” he added.

Regionally, year-over-year sales grew 40.1% in the Americas, 19.5% in China and 16.7% in Asia Pacific/All Other.

Cooling Inflation, AI Craze Boost Semiconductor Stock Demand

Cooling inflation is finally helping boost semiconductor sales. Easing price pressures have seen demand rebound. Also, the tech rally this year has largely been driven by NVIDIA Corporation. The semiconductor leader has been at the forefront of the generative AI sector, driving the surge in interest and development in this area.

Experts believe that AI has considerable untapped potential, with much still to be witnessed by the world. This growing interest is likely to boost demand even more as more semiconductor manufacturers are exploring the field. The AI market is expected to explode in the coming days with demand for AI chipsets already surging.

According to the World Semiconductor Trade Statistics (“WSTS”), the semiconductor industry is expected to grow by 16% this year, up from a previous forecast of 13.1%. Global semiconductor sales are projected to reach $611.2 billion this year. Sales in the Americas are expected to lead with an estimated increase of over 25%. Looking ahead to 2025, WSTS expects global sales to grow by 12.5%, reaching $687.4 billion.

Also, the Federal Reserve is gearing up to start its easing cycle, with the first rate cut likely coming in September. Market participants are anticipating a 25-basis- point rate cut this month. Lower interest rates typically help growth assets as they reduce the opportunity cost of holding assets that don’t provide yields, such as tech and semiconductor stocks.

Semiconductors Stocks Poised to Grow

We have chosen four semiconductor stocks that have a strong potential for 2024 and the coming year.

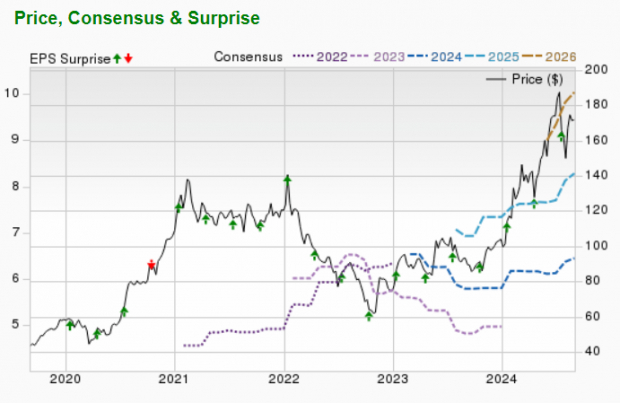

Taiwan Semiconductor Manufacturing Company

Taiwan Semiconductor Manufacturing Company Limited is the world's largest dedicated integrated circuit foundry. As a foundry, TSM manufactures ICs for its customers based on their proprietary IC designs using its advanced production processes. Taiwan Semiconductor Manufacturing Company Limited’s goal is to establish itself as one of the world's leading semiconductor companies by building upon the strengths that have made it the leading IC foundry in the world.

Taiwan Semiconductor Manufacturing Company Limited’s expected earnings growth rate for the current year is 24.5%. The Zacks Consensus Estimate for current-year earnings has improved 5.2% over the past 60 days. TSM presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Image Source: Zacks Investment Research

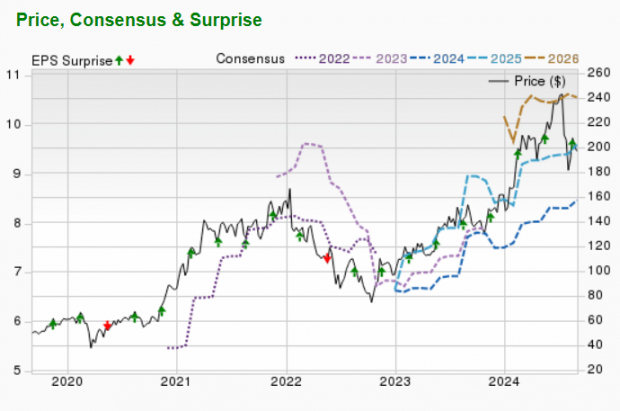

NVIDIA Corporation

NVIDIA Corporation is the worldwide leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Over the years, NVDA’s focus has evolved from PC graphics to AI-based solutions that now support high-performance computing, gaming and virtual reality platforms.

NVIDIA Corporation’s expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings improved 0.4% over the past 60 days. NVDA presently has a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Applied Materials

Applied Materials, Inc. is one of the world's largest suppliers of equipment for the fabrication of semiconductors, flat panel liquid crystal displays, and solar photovoltaic cells and modules. AMAT also offers deployment and support services related to the equipment supplied.

Applied Materials’ expected earnings growth rate for the current year is 5.2%. The Zacks Consensus Estimate for current-year earnings has improved 1.7% over the past 60 days. AMAT currently carries a Zacks Rank #3.

Image Source: Zacks Investment Research

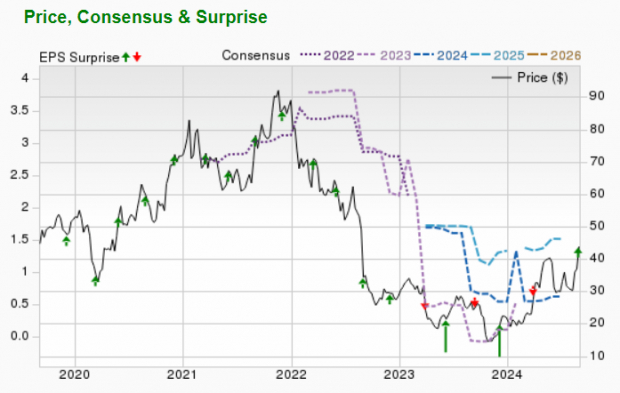

Semtech Corporation

Semtech Corporation designs, manufactures and markets a wide range of analog and mixed-signal semiconductors for commercial applications. SMTC’s product line comprises Signal Integrity Products, Protection Products, Power and High-Reliability Products, Wireless and Sensing Products, and Systems Innovation Group.

Semtech’s expected earnings growth rate for the current year is more than 100%. The Zacks Consensus Estimate for current-year earnings improved 6.3% over the past 60 days. SMTC presently carries a Zacks Rank #3.

Image Source: Zacks Investment Research

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpNVIDIA Corporation (NVDA) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Semtech Corporation (SMTC) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.