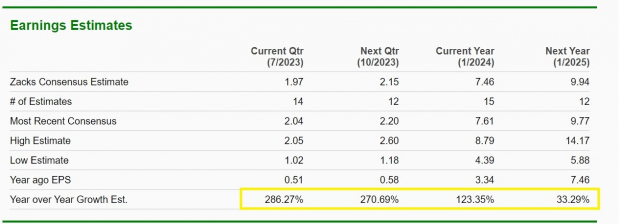

2023 has been one of the most divergent and lopsided years in recent memory in equities markets. After value dominated 2022, tech is back to being king this year - bolstered by the AI revolution and big forward expectations in AI-related stocks such as Rambus (RMBS) and Nvidia (NVDA).

Image Source: Zacks Investment Research

Pictured: NVDA EPS Estimates

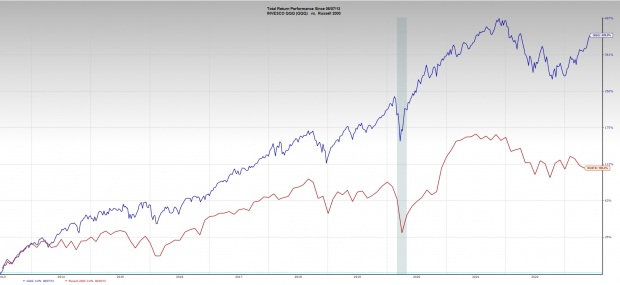

Even within tech, there are significant divergences. The Nasdaq 100 ETF (QQQ) is up by a supersized 33% year-to-date. Conversely, the Nasdaq 100 Equal Weight ETF (QQQE) is only higher by ~17% year-to-date. In other words, mega-cap tech stocks such as Microsoft (MSFT), Apple (AAPL), and Advanced Micro Devices (AMD) are responsible for much of the market’s positive performance.

Meanwhile, the dramatic hike in interest rates had the opposite effect on banks that most predicted. Usually, interest rate hikes are positive for banks. However, several regional banks were ill-prepared for the magnitude and speed of the rate hikes. The Russell 2000 Small Cap Index ETF (IWM) has dramatically underperformed due to its high composition of regional banks. IWM is up a minuscule 4.78% year-to-date. Below are 3 reasons why the current trend of tech strength and small-cap weakness is likely to close over the next few months:

The spread between the Nasdaq 100 and the Russell 2000 Index performance is at historic levels.

Image Source: Zacks Investment Research

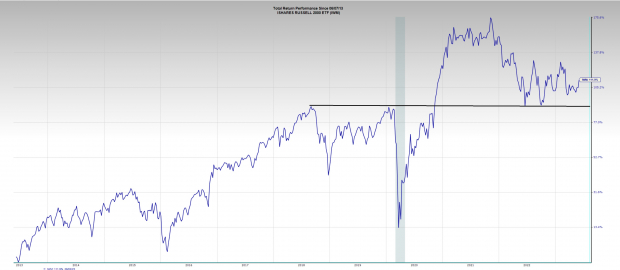

In the fashion world, if you wait long enough, the old style becomes new and in vogue again. Finance is like fashion; it tends to mean revert to old trends if you wait long enough. For example, last year, value stocks outperformed while tech underperformed. Because small caps have underperformed for months, one would expect them to begin to outperform again soon based on historical precedent. Furthermore, the long-term chart of IWM shows that the index is constructively testing support thus far.

Image Source: Zacks Investment Research

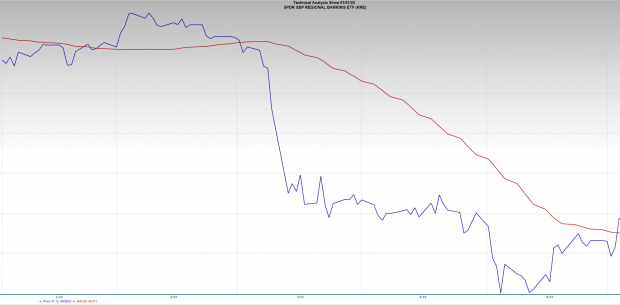

Lastly, the QQQ is higher for seven straight weeks and is extended by three standard deviations from its 50-day moving average. Typically, when an index becomes extended by such a large magnitude, it must digest. Because the IWM is just beginning to break above its 200-day moving average, investors may rotate some funds in that direction.

Image Source: Zacks Investment Research

Regional Banking Rebound: At the heart of the small-cap weakness are the regional banking woes and relative underperformance. Though the Regional Banking ETF (KRE) has underperformed dramatically this year, the chart shows signs that the trend may be turning. Late last week, KRE and select regional banks such as BankUnited (BKU) closed above the 50-day moving average for the first time since March. Today, the KRE index is jumping more than 4% on heavy volume.

Image Source: Zacks Investment Research

Beyond the solid technical performance, the pullback in price in many banks is attracting value investors such as Warren Buffett. In the most recent 13F disclosures, “The Oracle of Omaha” and investing legend Michael Burry took on positions in select banks such as Capital One Financial (COF).

Seasonality: Over the past 20 years, IWM has performed the best in June out of any of the index ETFs. IWM is higher 60% of the time with an average performance of +0.5%. Meanwhile, the S&P 500 Index ETF (SPY) is higher only 45% of the time on average, with an average gain of -0.4%.

Conclusion

The historical spread between tech and small caps, a rebounding banking sector, and strong seasonal trends favor outperformance in small-cap stocks over the next few weeks.

Free Report: Top EV Battery Stocks to Buy Now

Just-released report reveals 5 stocks to profit as millions of EV batteries are made. Elon Musk tweeted that lithium prices have gone to "insane levels," and they're likely to keep climbing. As a result, a handful of lithium battery stocks are set to skyrocket. Access this report to discover which battery stocks to buy and which to avoid.

Download free today.Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Capital One Financial Corporation (COF) : Free Stock Analysis Report

Rambus, Inc. (RMBS) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

BankUnited, Inc. (BKU) : Free Stock Analysis Report

iShares Russell 2000 ETF (IWM): ETF Research Reports

SPDR S&P Regional Banking ETF (KRE): ETF Research Reports

Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE): ETF Research Reports

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.