Small Business Retirement Guide: 5 Reasons to Consider Auto-Enrollment for Your 401(k)

Auto-enrollment, a feature that automatically registers employees for their company’s retirement plan once eligible, could be a potent tool in the fight to close the savings gap.

According to the study Auto-Enrollment's Long-Term Effect on Retirement Saving, auto-enrollment can yield serious benefits for a business’s employees. The authors found that employees who were required to opt-into enrollment "were more likely to participate and contribute a higher percentage of pay." For certain types of workers, this effect was most noticeable: low-wage earners who were inclined to put off saving were more likely to participate, while younger workers were found to benefit from the early access to compound interest that investing brings.

However, there are always trade offs to consider when choosing a plan design feature such as auto-enrollment. For some employees, decreasing their take-home pay by even a small percentage can spark financial hardship. Additionally, employees who would prefer not to participate may not appreciate having to make the choice to opt out. Ultimately, auto-enrollment is just one potential plan feature that will make sense for some businesses, but not for others.

In this article, we’ll review what small businesses need to know about auto-enrollment to make an informed decision about their plan design. We’ll also list five reasons auto-enrollment is gaining popularity in the world of retirement planning.

What Does "Auto-Enrollment" Mean for Retirement Plans?

Auto-enrollment is a retirement plan feature that automatically signs an employee up for their workplace-sponsored plan once they become eligible to participate. In practice, auto-enrollment makes plan participation “opt out” by default, rather than “opt in.” By making participation the default status for employees, the feature can help workers save for retirement without having to navigate a sign-up process.

Auto-enrollment is also fairly common among workplace retirement plans, with one-third of employers providing the feature. Congress has also given special attention to auto-enrollment, introducing new tax credits for small businesses who add the feature to their retirement benefit.

The Three Types of Auto-Enrollment: BAEA, EACA, & QACA

Broadly speaking, there are three types of auto-enrollment plans: a basic automatic enrollment arrangement (BAEA), an eligible automatic enrollment arrangement (EACA), or a qualified automatic enrollment arrangement (QACA).

Basic Automatic Enrollment Arrangement (BAEA)

Under a plan meeting BAEA criteria, employees are automatically enrolled in their plan unless they choose to opt out. The plan document specifies the percentage of wages an employee will have automatically deducted, and employees can choose not to contribute or to contribute a different percentage of their pay.

Eligible Automatic Enrollment Arrangement (EACA)

Under a plan meeting EACA criteria, all employees uniformly contribute the plan’s default percentage after being given written notice of the auto-enrollment. Additionally, employees must be allowed to withdraw their automatic contributions and earnings, so long as they do so through the process prescribed by their plan document. On top of this, employees are 100% vested in their automatic enrollment contributions as soon as they’re eligible.

Qualified Automatic Enrollment Arrangement (QACA)

Under a plan meeting QACA criteria, employees are uniformly subject to a minimum default contribution rate of 3%, which then gradually increases each year that the employee participates. Additionally, the business is required to make employer contributions and must provide either:

- A contribution of 3% of compensation to all participants, including those who choose not to contribute any amount to the plan; or

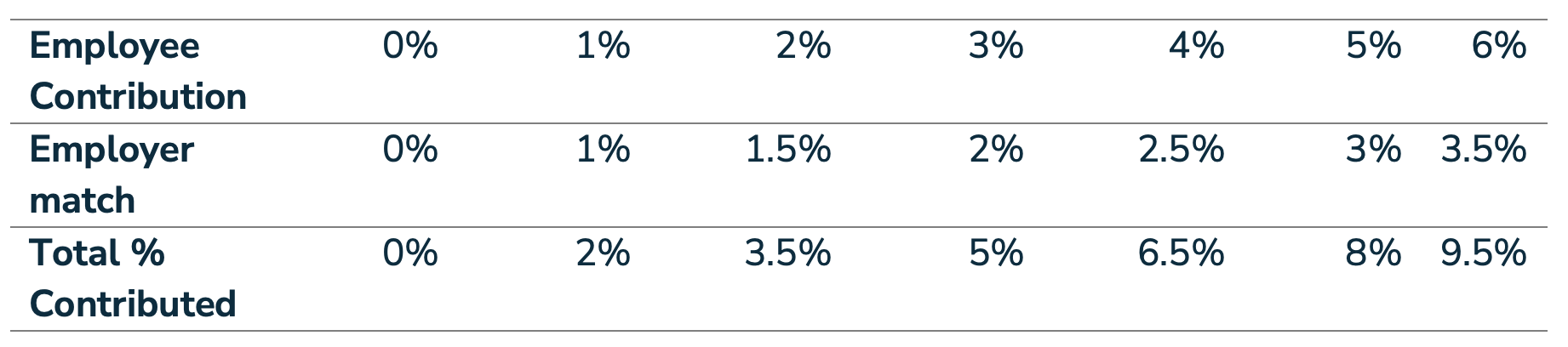

- A matching contribution of 100% of an employee's contribution up to 1% of compensation, and a 50% matching contribution for the employee's contributions above 1% and up to 6% of compensation. In practice, this leads to a maximum potential employer match of 3.5% of compensation, if an employee is contributing at least 6% of their salary. This can be visualized as:

Contribution Percentages Under QACA

Additionally, employees must be 100% vested in the employer’s contributions after no more than two years of tenure.

Other Requirements for Auto-Enrollment Plans

Importantly, participants in an auto-enrollment plan always reserve the right to opt of participation in the plan. Auto-enrollment simply makes this the default selection, rather than an active choice.

Additionally, auto-enrollment is a feature that can be applied to a wide range of qualified retirement plans. Any plan that allows for elective salary deferrals—such as a 401(k) or 403(b) plan—can have this feature.

5 Reasons to Consider Auto-Enrollment

#1: $1,500 Tax Credit for New Auto-Enrollment Plans

Because of the SECURE Act, small businesses can receive up to $500 per year in tax credits, for three years, if they implement a retirement plan with auto-enrollment features. Even better, if a small business already has a retirement plan in place, they can still receive these tax credits by adding auto-enrollment to their current plan. In this way, adding auto-enrollment to a plan can actually make it more affordable, rather than less.

#2: Improve Retention Among Participants

In a study published by the International Journal of Education and Research, the authors found that there is a positive relationship between retirement plan participation and employees’ retention. Additionally, the authors conducted a survey of previous research, finding that 84% of companies who offer a retirement benefit believe it improves their retention.

#3: Reduce Financial Stress for Employees

Stress is a cognitively draining emotion, which can leave workers with less mental bandwidth to bring to their jobs. In her report on financial stress and employee performance, Professor Carrie Leana found that professional truck drivers who were worried about their finances were more likely to have a preventable accident compared to truck drivers with lower levels of stress. For this reason, offering a retirement program can potentially raise employee performance.

#4: Helps Pass Common Compliance Tests

Auto-enrollment can help employers pass the non-discrimination testing certain retirement plans are subject to, a process that helps ensures a business isn’t selectively favoring its highly-compensated employees. By automatically enrolling the vast majority of a business’s employees into a plan, an employer can rest assured that their lower wage employees are reaping the plan’s benefits, too. It is worth noting, however, that safe harbor plans are already exempted from these requirements.

#5: Help Employees Save Sooner

By enrolling employees into their workplace-sponsored retirement as soon as they're eligible, auto-enrollment helps employees get a jump start on savings. This could be especially impactful for younger employees, as auto-enrollment can help them build a nest egg long before they’d prioritize doing so on their own. Additionally, according to Plan Sponsor Council of America, only 62% of businesses with a 401(k) offer auto-enrollment, meaning enterprising small business owners can differentiate themselves by offering this feature.

Conclusion: Consider Auto-Enrollment for Your Small Business Retirement Plan

Though retirement plans are a great way to save money for retirement, there are always ways to improve the system. Setting up auto-enrollment can unlock a suite of benefits for the small businesses who try it, on top of making their employees’ lives both more convenient and secure.

If you think a company-sponsored plan with auto-enrollment would be beneficial to your business, you can contact Vestwell to determine if you are eligible to receive up to $16,500 in tax credits, which can help cancel out administration costs. Learn more here.

Originally published on Vestwell.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.