Few money managers have grabbed more headlines than Cathie Wood in the past few years. The chief executive officer of ARK Invest grew in prominence when her investment firm's actively managed exchange-traded funds (ETFs) crushed the market in the early days of the pandemic.

Though her performance has been tamer since, there is still plenty to learn by paying attention to her stock picks. With that said, let's consider one company Wood is doubling down on, Shopify (NYSE: SHOP). The e-commerce specialist is the largest holding in ARK Invest's combined portfolio. Should you follow Wood's lead by investing in Shopify?

The ABCs of Shopify's business

First, let's remember what Shopify does. The company offers a platform for merchants to build online storefronts, which is practically necessary for success in today's business world.

It focuses particularly on small and medium-size companies. The e-commerce specialist has an app store where developers have created countless tools to facilitate inventory management, payment processing, cross-platform selling, and other services.

Shopify's app store has a network effect. The more merchants that are on its platform, the more attractive it is to developers. It becomes more appealing to merchants as more apps are introduced.

We can also point to Shopify's switching costs: Merchants spend a lot of time and money building their ideal storefront, and attracting customers to it requires a significant investment. So, Shopify's customers won't want to jump ship without an excellent reason or incentive.

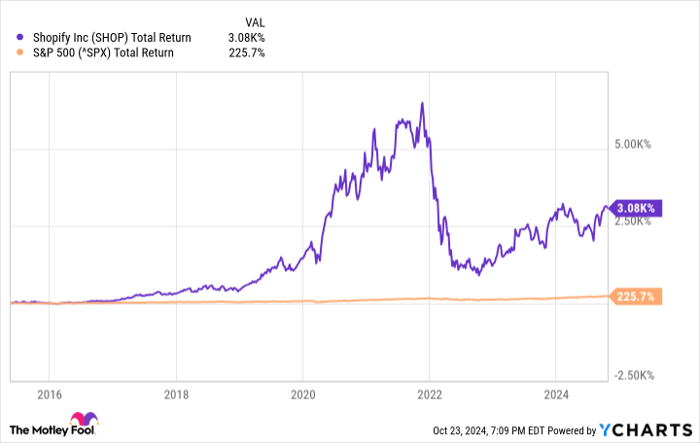

These factors give the company a strong competitive moat. Its financial results have generally been good. True, the top-line growth has slowed in recent years, and it has historically struggled to turn a profit. That's why Shopify has substantially lagged the market during the past three years, but its performance since its 2015 initial public offering (IPO) remains well above that of a broader range of equities.

SHOP total return level; data by YCharts.

The question is, which way will it go for Shopify over the long run?

There is significant white space ahead

Wood's ARK Invest focuses on disruptive innovation: companies that are building the future and, potentially, can deliver outsize returns for their trouble.

The e-commerce industry is the future of retail. It provides substantial advantages over the brick-and-mortar model. If not for e-commerce, thousands of stores and merchants around the world wouldn't be accessible to customers in different geographical locations. It also helps decrease overhead, savings that can be passed on to customers.

Some might argue that online retail is already ubiquitous, but that's hardly true. Even in the U.S., e-commerce sales accounted for 15.2% of total retail sales in the second quarter; that metric was about 7% in the first quarter of 2015. So, it has more than doubled in less than a decade.

This is all good news for Shopify, which is imposing in its niche. The company holds a 30% share of the U.S. e-commerce software market, 8% higher than its closest competitor. Its competitive edge should allow it to remain a leader in the industry -- at least for a while.

The significant opportunities ahead will help it maintain steady revenue growth. Most companies' top-line growth rates decrease as they become larger. It's not a cause for alarm, especially considering the enormous boom Shopify experienced during the early days of the pandemic. It would always be almost impossible for the company to follow that act.

And it has made moves recently that are helping its margins and bottom line. The company got rid of its expensive logistics business, which was never going to be big enough to profitably compete with established players.

Free cash flow (what's left of cash flow after capital investments) has been trending up, and the company made a profit in the second quarter. Consistent earnings will come soon enough. Shopify wants to be a 100-year company.

It's too soon to tell whether it can pull that off, but the stock looks likely to perform well at least in the foreseeable future. I would advise investors to follow Wood's lead and double down on Shopify.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,154!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,777!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $406,992!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 21, 2024

Prosper Junior Bakiny has positions in Shopify. The Motley Fool has positions in and recommends Shopify. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.