Nu Holdings (NYSE: NU) is one of the most overlooked stocks on the market among everyday investors. While many notable hedge funds and famous investors like Warren Buffett have gotten involved, the company has little name recognition among most retail investors. That's because the company operates exclusively in Latin America. If you live in the U.S., there's a good chance you've never even heard of Nu. That has created a buying opportunity, especially with shares right around $15 -- $15.02, as of Thursday's close.

But before you jump in, you should know two things.

This stock is a growth machine

Pretty much any way you cut it, Nu is a growth machine. Back in 2013, when the company was first getting started, it had roughly zero customers. Today, it has more than 100 million. How was this massive growth possible? Nu simply gave the market what it craved: cheap, highly accessible financial services.

In decades past, the Latin American banking market was dominated by a handful of powerful operators. They charged high fees for simple services, mostly delivered via a vast network of physical branches. Nu turned the industry upside down by offering its services directly through a smartphone app. Nu's cost base was significantly lower than the competition's, and its straight-to-smartphone strategy allowed it to innovate quickly. When it first launched its crypto trading platform, for example, it acquired 1 million users in the first month.

Over the past few years, Nu has averaged annual sales growth of more than 100%, significantly higher than most traditional banks'. Last quarter, for instance, Nu posted revenue growth of 55% year over year. Wells Fargo, by comparison, grew sales by less than 1%. Nu is clearly not another boring bank stock; it's a fintech business, capable of growing far faster and for far longer than most anticipate.

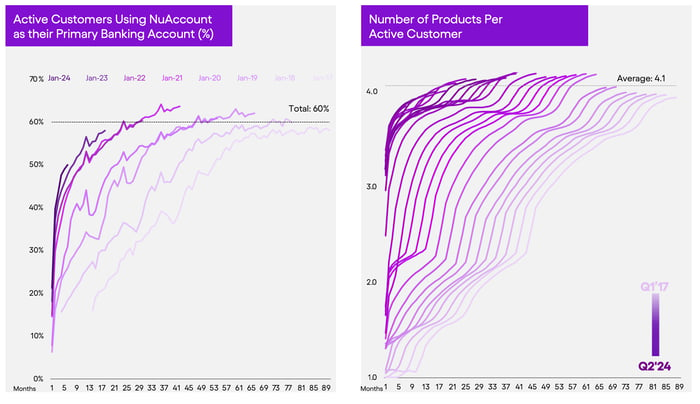

How has Nu maintained such high growth rates for so long? Its straight-to-smartphone strategy gets people in the door, but the real advantage has been to cross-sell new services to existing customers. Take a look at the charts below and you'll glean two important factors to Nu's success.

First, Nu customers stick around for the long haul. They really do prefer its banking platform to traditional alternatives. In the past, less than 10% of new customers were using Nu as their primary bank account. Today, after using Nu for just a few months, nearly half of all customers have decided to stick with Nu as their primary account.

The second factor to understand is how well Nu is able to get existing customers to start using more of its services. This, of course, generates more revenue opportunities. But it also makes the product more "sticky." That is, the more a customer relies on Nu for their financial life, the less likely they are to switch to a competitor due to friction costs. In the past, Nu customers used the bank for a debit or credit card only. Today, the average customer might still have a payment card, but also a bank account, insurance policy, or crypto trading account. All of this is good news for Nu's growth prospects, and for its ability to retain the customer base it already has.

Source: Nu Holdings Investor Presentation

Don't be afraid of the valuation

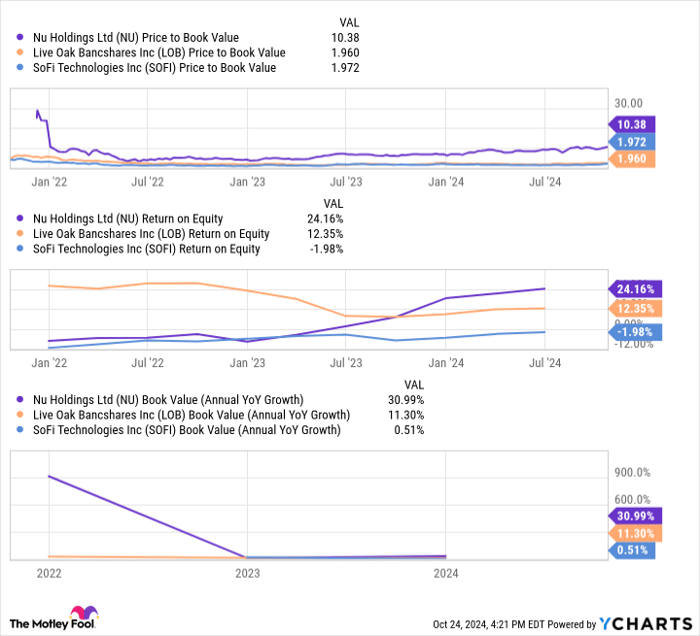

Compared to traditional bank stocks, Nu stock looks incredibly expensive. At recent prices, shares trade for more than 10 times book value, while other banks like Wells Fargo trade between 1 and 2 times book value. But don't be scared off -- there's a perfectly reasonable explanation for this.

As a fintech business, Nu is growing more rapidly than most other bank stocks. Its annual book value growth is nearly 10 times that of banks like Wells Fargo. And it's able to squeeze out way more profits, as evidenced by its superior returns on equity. Even on an earnings basis, these shares, whle expensive at a glance, are actually a bargain. The fintech nature of Nu puts it more in the category of companies like Live Oak and SoFi Technologies. Although even comparing Nu to these fintech stocks still demonstrates how strong the company is when it comes to annual sales growth and returns on equity -- yet more rationale for Nu's premium valuation.

NU Price to Book Value data by YCharts

As of Thursday's close, Nu trades at nearly 48 times earnings -- a multiple several times higher than that of most traditional bank stocks, as well as many fintech stocks. But due to its rapid growth, shares trade at 35 times forward earnings. If it sustains its current growth rate for even a few more years, Nu stock may quickly become a value stock based on today's prices.

Due to Nu's limited geographic focus, don't be surprised if it continues to fly under the radar for years to come. But the valuation makes it too good to pass up for patient investors looking for maximum growth. With shares still trading right around $15, there's still time for you to lock in a long-term position.

Should you invest $1,000 in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $855,238!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 21, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.