Ceragon Networks Ltd. CRNT will report its fourth-quarter 2024 results on Feb. 11, before the market opens.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

The Zacks Consensus Estimate for earnings in the to-be-reported quarter is pegged at 10 cents, indicating 150% growth from the year-ago reported quarter. The consensus estimate for total revenues is pinned at $104 million, implying 15% year-over-year growth.

CRNT beat the Zacks Consensus Estimate for earnings in the last reported quarter by 77.8%.

What Our Model Predicts for CRNT’s Q4

Our proven model does not conclusively predict an earnings beat for Ceragon this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that is not the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

CRNT has an Earnings ESP of -5.26% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ceragon Networks Ltd. Stock Price and EPS Surprise

Ceragon Networks Ltd. price-eps-surprise | Ceragon Networks Ltd. Quote

Factors to Focus Ahead of CRNT Q4 Earnings

Strong demand for its solutions is likely to have cushioned the top-line performance in the fourth quarter. CRNT is witnessing a strong funnel of opportunities, particularly in the private networks vertical in the North American markets. North America contributed $24.5 million to overall revenues in the third quarter of 2024. Ceragon remains focused on diversifying its business into private network business.

A strong presence in India is likely to have acted as another tailwind. Ceragon commands a solid position in the Indian telecommunications market, which is expanding rapidly as it upgrades to 4G and 5G infrastructure. Increasing demand for high-capacity wireless products, particularly microwave and E-Band solutions within this market, bodes well. In the last reported quarter, revenues from India were $50.5 million, accounting for nearly half of the overall revenues in the third quarter. On the lastearnings call management noted that it had gotten off to a stronger start in the fourth quarter related to bookings.

Synergies from acquisitions are likely to have contributed to top-line expansion in the to be reported quarter. The acquisition of Siklu is likely to have aided in gaining market share in the Enterprise Security domain in North America. CRNT is also leveraging Siklu’s PtMP technology to gain market share as various service providers focus on fixed subscriber growth and deploy wireless technology with 5G high frequencies.

For 2024, CRNT expects revenues (including contribution from Siklu) between $390 million and $400 million, indicating growth of 12% to 15% year over year.

Image Source: Zacks Investment Research

Improving top-line performance is likely to have positively impacted profitability. Management expects non-GAAP operating margins to be at least 10% at the mid-point of the revenue guidance.

Nonetheless, a slowdown in certain public network domains outside of India, mainly due to a weak global macro environment, as well as demand for 5G by network users, remains concerning for CRNT. Intense competition from Chinese players in Latin America, Africa and some parts of Asia-Pacific is another headwind.

Ceragon’s Communications Service Provider (“CSP”) business saw a slowdown in the orders from Tier 1 customers in the third quarter of 2024. CRNT highlighted that the slowdown was due to the timing of network builds throughout the year, suggesting that the delay could be short-term. Nonetheless, tier 1 customers are often the largest sources of revenue for telecommunications equipment providers, so any slowdown in orders from this segment could lead to reduced revenue visibility.

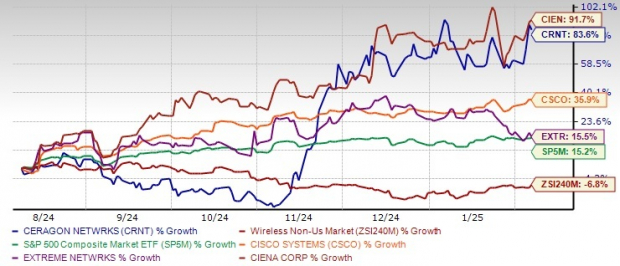

CRNT Stock Soars

CRNT shares have skyrocketed 83.6% in the past six months. It has significantly outpaced the 6.8% decline of its Wireless Non-U.S.industry and the 15.2% rally of the Zacks S&P 500 composite.

CRNT Stock Price Performance

Image Source: Zacks Investment Research

The increase is also better than some of its notable peers in the same space. Cisco Systems (CSCO) and Extreme Networks EXTR have surged 35.9% and 15.5%, respectively. On the other hand, Ciena Corporation CIEN has surged 91.7% in the same time frame.

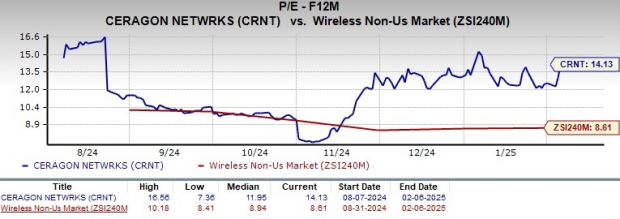

Key Valuation Metric for CRNT Stock

CRNT stock is trading at a premium, with a forward 12-month Price/Earnings of 14.13X compared with the industry’s 8.61X.

Image Source: Zacks Investment Research

Ceragon’s Investment Considerations

CRNT aims to gain from its focus on growth initiatives, including mmW products, Private Networks and Managed Services. This highlights Ceragon’s efforts to capitalize on the increasing demand for high-performance wireless technologies, strengthening its competitive edge in the market. Ceragon is making significant strides with its product roadmap and has secured orders from its new IP50EX solution.

The strategic acquisition approach is aiding the company in developing the business. Acquisitions aid in obtaining synergies, leading to cost reduction and enhanced operational efficiency through the integration of resources. Apart from Siklu, CRNT recently completed the earlier announced buyout of End 2 End Technologies, LLC, a leading systems integration and software development company in the United States. The transaction is valued at approximately $8.5 million, with an additional potential payment of up to $4.3 million contingent on the company meeting specific financial targets in 2025, to be paid primarily in 2026.

However, frequent buyouts increase integration risks. Buyouts do have an impact on the company’s balance sheet in the form of high levels of goodwill and net intangible assets.

Hold CRNT Stock This Earnings Season

While India and North American markets hold promise, several challenges could put downward pressure on CRNT’s stock price. The slowdown of certain public network domains outside of India, slow CSP ordering, premium valuation and integration risks from acquisitions remain concerns.

For now, holding CRNT stock remains the most prudent strategy, allowing investors to benefit from its growth prospects while navigating external risks.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpCisco Systems, Inc. (CSCO) : Free Stock Analysis Report

Ciena Corporation (CIEN) : Free Stock Analysis Report

Extreme Networks, Inc. (EXTR) : Free Stock Analysis Report

Ceragon Networks Ltd. (CRNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.