NVIDIA Corporation NVDA is set to report third-quarter fiscal 2025 results on Nov. 20.

For the fiscal third quarter, the company expects revenues of $32.5 billion (+/-2%). The Zacks Consensus Estimate is pegged at $32.81 billion, which indicates a whopping 81% increase from the year-ago reported figure.

Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

The Zacks Consensus Estimate for quarterly earnings has been revised upward by a penny to 74 cents per share over the past 60 days. This suggests year-over-year growth of 85% from the year-ago quarter’s earnings of 40 cents per share.

Image Source: Zacks Investment Research

Earnings of the pioneer of graphics processing unit (GPU)-accelerated computing surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.7%.

NVIDIA Corporation Price and EPS Surprise

NVIDIA Corporation price-eps-surprise | NVIDIA Corporation Quote

Earnings Whispers for NVIDIA

Our proven model predicts an earnings beat for NVIDIA this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate (76 cents per share) and the Zacks Consensus Estimate (74 cents per share), is +2.30%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: NVDA carries a Zacks Rank #2.

Factors Shaping NVIDIA’s Upcoming Results

The continued strength of its Datacenter business on the increasing adoption of cloud-based solutions amid the growing hybrid working trend is expected to have boosted NVDA’s third-quarter revenues. An increase in Hyperscale demand and growing adoption in the inference market are likely to have been tailwinds in the to-be-reported quarter.

The Datacenter end-market business is likely to have benefited from the growing demand for generative AI and large language models using GPUs based on NVIDIA Hopper and Ampere architectures. The strong demand for its chips from large cloud service and consumer internet companies is anticipated to have aided the segment’s top-line growth in the to-be-reported quarter. Our third-quarter revenue estimate for the Datacenter end market is pegged at $28.48 billion, which indicates robust year-over-year growth of 96%.

Moreover, NVIDIA’s third-quarter performance is likely to have benefited from the recovery across its Gaming and Professional Visualization end markets. The Gaming end market’s last five quarters’ results improved year over year as inventory with channel partners reached normal levels. The company also registered strong demand across most regions for its gaming products. Revenues from the Gaming end market increased 16% year over year to $2.88 billion in the second quarter of fiscal 2025. Our third-quarter revenue estimate for the Gaming end market stands at $3.11 billion, which implies a 9% increase from the year-ago quarter.

NVIDIA’s Professional Visualization segment performance also reflected recovery, with revenues increasing in the four consecutive quarters. We believe that the trend is likely to have continued in the third quarter for the end market. Our third-quarter revenue estimate for the Professional Visualization end market is pegged at $557 million, which suggests a 34% increase from the year-ago quarter.

The company’s Automotive segment showed an improvement in trends in eight of the last nine quarters. The positive trend is likely to have continued in the fiscal third quarter due to increasing investments in self-driving and AI cockpit solutions. Our third-quarter revenue estimate for the Automotive end market is pegged at $340 million, which indicates year-over-year growth of 30%.

NVIDIA Stock Price Performance & Valuation

Year to date (YTD), NVDA stock has skyrocketed 196.2%, outperforming the Zacks Semiconductor – General industry’s growth of 139.5%. Moreover, NVIDIA shares have outpaced the gains of major chip makers, including Micron MU, Marvell Technology MRVL and Advanced Micro Devices AMD. Micron and Marvell Technology have registered an increase of 16% and 50.4%, respectively, while Advanced Micro Devices declined 5.8% YTD.

YTD Price Return Performance

Image Source: Zacks Investment Research

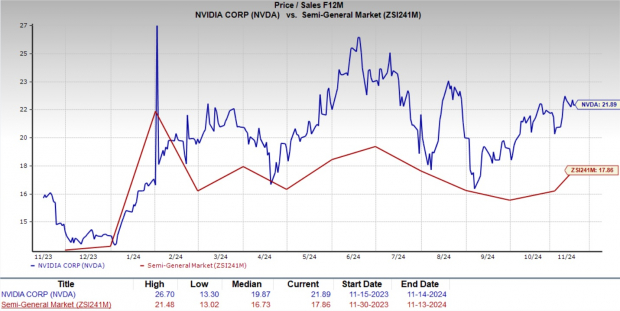

Now, let’s look at the value NVIDIA offers investors at the current levels. NVIDIA is trading at a premium with a forward 12-month P/S of 21.89X compared with the industry’s 17.86X, reflecting a stretched valuation.

Image Source: Zacks Investment Research

Investment Consideration for NVDA

Over the past year, NVIDIA’s revenue growth has been fueled by robust demand for chips needed for generative AI model development. NVIDIA dominates the market for generative AI chips, which have already proven useful across multiple industries, including marketing, advertising, customer service, education, content creation, healthcare, automotive, energy & utilities and video game development.

The growing demand to modernize the workflow across industries is expected to drive the demand for generative AI applications. The global generative AI market size is anticipated to reach $967.6 billion by 2032, according to a new report by Fortune Business Insights. The market is expected to expand at a CAGR of 39.6% from 2024 to 2032.

However, the complexity of generative AI, which demands vast knowledge and immense computational power, means that enterprises will need to upgrade their network infrastructures significantly. NVIDIA’s AI chips, including the A100, H100 and B100, are the top choices for building and running these powerful AI applications, positioning the company as a leader in this space. As the generative AI revolution unfolds, we expect NVIDIA's advanced chips to drive substantial growth in both its revenues and market presence.

NVDA: In a Nutshell

As a leading player in the semiconductor industry, NVIDIA has benefited from its dominance in GPUs and strategic expansion into AI, data centers and autonomous vehicles. The company's strong product portfolio, leadership in AI and relentless innovation present a compelling investment opportunity.

While NVDA stock’s premium valuation might be perceived as a risk, the premium is justified due to its consistent financial performance and substantial growth prospects in emerging sectors such as automotive, healthcare and manufacturing. The company enjoys high market esteem, and savvy investors should consider leveraging NVDA’s potential for sustained long-term growth.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpAdvanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.