Oracle's ORCL introduction of the Exadata X11M platform marks a significant technological leap that could strengthen its competitive position in 2025. The new platform delivers impressive performance improvements, including 55% faster AI Vector searches, 2.2X faster analytics scan throughput, and 25% faster transaction processing, all while maintaining the same price point as its predecessor. This strategic pricing approach, combined with enhanced capabilities, positions Oracle to potentially capture a larger market share in the growing AI and data analytics segments.

Performance and Cost Efficiency

The Exadata X11M's optimization for AMD EPYC processors demonstrates Oracle's commitment to performance excellence across multiple workloads. The platform's ability to deliver up to 25% faster transaction processing and significant improvements in analytic query processing could attract enterprises looking to upgrade their database infrastructure. More importantly, the maintenance of previous-generation pricing while delivering substantial performance improvements presents a compelling value proposition for both existing and potential customers.

AI and Analytics Capabilities

The platform's enhanced AI capabilities, particularly the 55% faster persistent vector index searches and 43% faster in-memory vector index queries, align well with the company's broader AI strategy. As evidenced in Oracle's second-quarter fiscal 2025 results, which showed GPU consumption up 336%, the company is experiencing strong momentum in AI-related workloads. The Exadata X11M's capabilities in this area could further accelerate this growth trajectory.

Energy Efficiency and Sustainability

The Exadata X11M's focus on energy efficiency through intelligent power management and workload consolidation addresses growing corporate sustainability concerns. The platform's ability to help customers reduce power consumption and data center space while improving performance efficiency could be particularly attractive to enterprises facing increasing pressure to meet environmental goals while maintaining operational excellence.

Multi-Cloud Strategy and Market Expansion

Oracle's announced that Exadata X11M will be available across all major cloud platforms — OCI, Amazon AMZN-owned Amazon Web Services, Alphabet GOOGL-owned Google Cloud, and Microsoft MSFT Azure — reinforces its multi-cloud strategy. Google, Microsoft and AWS combined accounted for a whopping 68% of the global cloud services market in the third quarter of 2024, according to new data from IT market research firm Synergy. Their third-quarter worldwide market shares were 31%, 20% and 13% respectively.

This broad availability, combined with 100% database compatibility across deployments, could help Oracle expand its market reach and accelerate cloud adoption among its traditional customer base.

Financial Implications and Growth Potential

Looking ahead to 2025, Oracle's financial prospects appear compelling, driven by multiple growth catalysts. The Exadata X11M platform's combination of enhanced performance at maintained pricing levels could accelerate adoption and revenue growth, while its efficiency improvements help protect margins against competitive pressures. The platform's advanced AI capabilities and energy efficiency features position ORCL to capitalize on both enterprise AI adoption trends and growing corporate ESG initiatives, creating potential demand streams throughout 2025. Additionally, the workload consolidation capabilities could contribute to improved operational economics for customers.

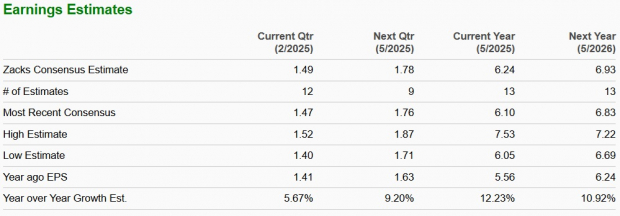

The Zacks Consensus Estimate for ORCL’s fiscal 2025 revenues is pegged at $57.65 billion, indicating year-over-year growth of 8.85%. The consensus mark for fiscal 2025 earnings is pegged at $6.24 per share, up 1.3% in the past 30 days. The figure indicates year-over-year growth of 12.23%.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks Earnings Calendar.

Investment Considerations

For investors, Oracle's strategic positioning with the Exadata X11M platform presents several compelling considerations for 2025. The company's ability to deliver significant performance improvements while maintaining pricing demonstrates both technological leadership and market awareness. The platform's broad availability across major cloud providers could accelerate Oracle's cloud transition and expand its market opportunities.

Furthermore, the integration of advanced AI capabilities and energy efficiency features addresses two major enterprise priorities: AI adoption and sustainability. With second-quarter fiscal 2025 results showing strong cloud growth and AI momentum, the Exadata X11M platform could serve as a catalyst for continued growth in these key areas.

While ORCL has been a standout performer with a 14.3% gain over the past six-month period, significantly outpacing both the Zacks Computer and Technology sector’s decline of 1% and the S&P 500's modest growth of 6.3%, respectively, this impressive run-up has pushed valuations to a concerning level.

6-Month Price Performance

Image Source: Zacks Investment Research

Trading at an elevated EV/EBITDA multiple of 21.28X compared with the Zacks Computer-Software industry’s 17.89X, the stock appears to have gotten ahead of its fundamental growth prospects. The enterprise software giant's rich valuation metrics suggest investors are pricing in overly optimistic growth expectations, despite mounting challenges in the competitive cloud computing landscape.

ORCL’s EV/EBITDA TTM Ratio Depicts Premium Valuation

Image Source: Zacks Investment Research

Market Outlook

While Oracle faces intense competition in the cloud and database markets, the Exadata X11M's comprehensive capabilities and strategic pricing position the company well for 2025. The platform's ability to support both traditional enterprise workloads and emerging AI applications, combined with its multi-cloud availability and sustainability features, creates multiple growth vectors.

Investors should monitor Oracle's ability to convert these technological advantages into market share gains and revenue growth throughout 2025. Key metrics to watch include cloud revenue growth rates, AI workload adoption and customer migration patterns across different deployment options. The company's execution in leveraging the Exadata X11M platform to accelerate its cloud and AI strategy could significantly influence its performance and market position in 2025. ORCL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

See Stocks Now >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.