As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term ShotSpotter, Inc. (NASDAQ:SSTI) shareholders have had that experience, with the share price dropping 32% in three years, versus a market return of about 64%. More recently, the share price has dropped a further 13% in a month. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

We don't think that ShotSpotter's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, ShotSpotter saw its revenue grow by 17% per year, compound. That's a fairly respectable growth rate. Shareholders have endured a share price decline of 10% per year. This implies the market had higher expectations of ShotSpotter. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

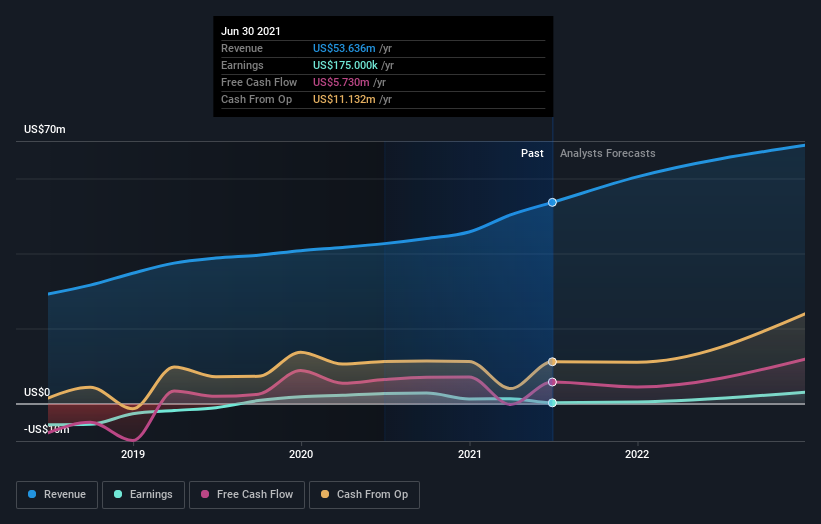

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for ShotSpotter in this interactive graph of future profit estimates.

A Different Perspective

ShotSpotter shareholders are up 27% for the year. Unfortunately this falls short of the market return of around 30%. On the bright side, that's certainly better than the yearly loss of about 10% endured over the last three years, implying that the company is doing better recently. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand ShotSpotter better, we need to consider many other factors. For example, we've discovered 5 warning signs for ShotSpotter that you should be aware of before investing here.

ShotSpotter is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

%20investors%20are%20sitting%20on%20a%20loss%20of%2032%25%20if%20they%20invested%20three%20years%20ago%20%7C%20Nasdaq&_biz_n=31&rnd=635773&cdn_o=a&_biz_z=1743343114723)

%20investors%20are%20sitting%20on%20a%20loss%20of%2032%25%20if%20they%20invested%20three%20years%20ago%20%7C%20Nasdaq&rnd=964353&cdn_o=a&_biz_z=1743343114727)