Shopify SHOP is scheduled to report its third-quarter 2024 results on Nov. 12.

For the to-be-reported quarter, Shopify expects revenue growth at a low to mid-20% range on a year-over-year basis.

The Zacks Consensus Estimate for revenues is currently pegged at $2.11 billion, suggesting growth of 22.96% from the year-ago quarter’s reported figure.

The consensus mark for earnings is pegged at 27 cents per share, which remained unchanged over the past 60 days. This indicates 12.50% growth from the figure reported in the year-ago quarter.

Shopify Inc. Price and EPS Surprise

Shopify Inc. price-eps-surprise | Shopify Inc. Quote

SHOP’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 31.17%.

See the Zacks Earnings Calendar to stay ahead of market-making news.

Let’s see how things might have shaped up prior to the announcement.

SHOP’s Q3 Earnings: Key Factors to Note

Shopify is benefiting from strong growth in its merchant base, a trend to be reflected in third-quarter results. Merchant-friendly tools like Shop Pay, Shopify Payments, Shopify Collective, Shopify Audiences, Shopify Capital and Shop Cash offers are helping it win new merchants amid a challenging economic environment. Shopify’s platform is widely used by small and medium businesses that are suffering from persistent inflation.

Shopify has added support for UPS and managed markets, enabling merchants to offer competitive expedited shipping rates for international customers. Its continued efforts to streamline operations have been attracting both new, smaller merchants and established, large brands to the platform.

The company has been investing in developing the best solutions for modern e-commerce. Product offerings like Shop Pay, Bill Pay, Tax Platform, Collective and the Marketplace Connect app.

Integration of AI through Shopify Magic across products and workflows is helping merchants expand their footprint. Shopify Checkout is helping merchants offer secure and seamless checkout options for customers.

Merchant expansion is expected to have aided Gross Merchandise Volume (GMV) growth in the to-be-reported quarter. In the second quarter of 2024, Shop Pay processed $16 billion in GMV and accounted for 39% of SHOP’s Gross Payments volume (GPV). In the second quarter, GPV grew to $41.1 billion, constituting 61% of GMV processed.

Offline GMV grew 27% year over year, highlighting increased adoption of SHOP’s platforms by larger global merchants with multiple locations. A major milestone in the second quarter was the online and offline launch of multinational brands EVEREVE and MAJOURI in partnership with Shopify, spanning over 130 locations across four regions — a major achievement for the company.

In the second quarter, more than 50% of merchants joining SHOP’s platform came from the non-English-speaking markets, a trend expected to continue gaining momentum in the third quarter.

The Zacks Consensus Estimate for third-quarter GMV is currently pegged at $68 billion, indicating 25.93% year-over-year growth.

The consensus mark for third-quarter Subscription solutions revenues is pegged at $593 million, indicating 28.08% year-over-year growth. The Zacks Consensus Estimate for Merchant Solutions is pegged at $1.51 billion, suggesting 26.04% year-over-year growth.

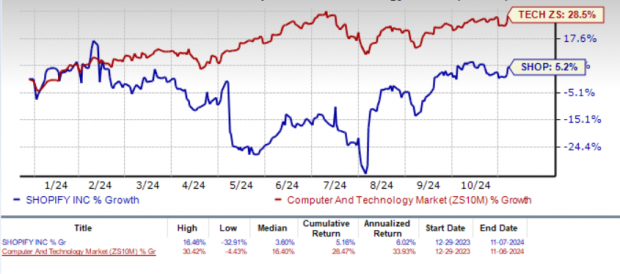

SHOP Shares Underperform Sector, Industry

SHOP shares have increased 5.2%, underperforming the Zacks Computer & Technology sector’s return of 28.5% and the Zacks Internet Services industry’s appreciation of 19.8%.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

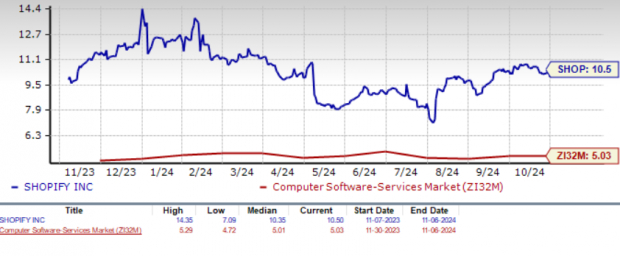

Shopify Trading at a Premium

The Value Style Score of F suggests a stretched valuation for Shopify at this moment.

SHOP stock is trading at a premium with a forward 12-month Price/Sales of 10.5x compared with the industry’s 5.03x.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

SHOP Stock to Ride Higher on Strong Merchant Base

Shopify’s long-term prospects are strong, given its growing merchant base and an expanding partner base. Its strategy of adding features and updates frequently — 400 in the past couple of years — has been the key catalyst. SHOP has added more than 150 new product updates and features in the second quarter of 2024.

An expanding partner base that includes TikTok, Snap, Pinterest, Criteo, IBM, Cognizant, Amazon AMZN, Target, Manhattan Associates MANH, COACH and Adyen is expected to expand its merchant base further. Exiting the second quarter, Shopify has also secured a new partnership with Oracle ORCL.

Shopify’s strategy to focus on the core business by divesting the logistics business is a noteworthy development. Its partnership with Amazon allows Shopify merchants to use the former’s massive fulfillment network. The relationship with Target also strengthens SHOP’s footprint.

The partnership with Avalara now helps Shopify merchants of any size to easily manage and automate global tax compliance. The collaboration with Manhattan helps it offer world-class unified omnichannel shopping experiences for consumers.

Shopify’s expanding international footprint is noteworthy. In the first quarter, it launched point-of-sale go and point-of-sale terminal in Australia. Expanding the availability of the Markets Pro into international markets is a game changer. In the second-quarter 2024, 14% of SHOP’s GMV was contributed by cross-border sales.

Conclusion

Shopify is benefiting from strong growth in its merchant base. The expansion of back-office merchant solutions to more countries is strengthening SHOP’s international footprint.

Although the current valuation is stretched, the long-term growth prospects are hard to ignore.

Shopify currently sports a Zacks Rank #1 (Strong Buy) and a Growth Score of B, a favorable combination that offers a strong investment opportunity, per the Zacks Proprietary methodology.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Free Today: Profiting from The Future’s Brightest Energy Source

The demand for electricity is growing exponentially. At the same time, we’re working to reduce our dependence on fossil fuels like oil and natural gas. Nuclear energy is an ideal replacement.

Leaders from the US and 21 other countries recently committed to TRIPLING the world’s nuclear energy capacities. This aggressive transition could mean tremendous profits for nuclear-related stocks – and investors who get in on the action early enough.

Our urgent report, Atomic Opportunity: Nuclear Energy's Comeback, explores the key players and technologies driving this opportunity, including 3 standout stocks poised to benefit the most.

Download Atomic Opportunity: Nuclear Energy's Comeback free today.Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.