While not a mind-blowing move, it is good to see that the Absci Corporation (NASDAQ:ABSI) share price has gained 21% in the last three months. But that hardly compensates for the shocking decline over the last twelve months. During that time the share price has plummeted like a stone, down 79%. Arguably, the recent bounce is to be expected after such a bad drop. The real question is whether the company can turn around its fortunes.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Because Absci made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Absci's revenue didn't grow at all in the last year. In fact, it fell 11%. That's not what investors generally want to see. The share price fall of 79% in a year tells the story. Holders should not lose the lesson: loss making companies should grow revenue. But markets do over-react, so there opportunity for investors who are willing to take the time to dig deeper and understand the business.

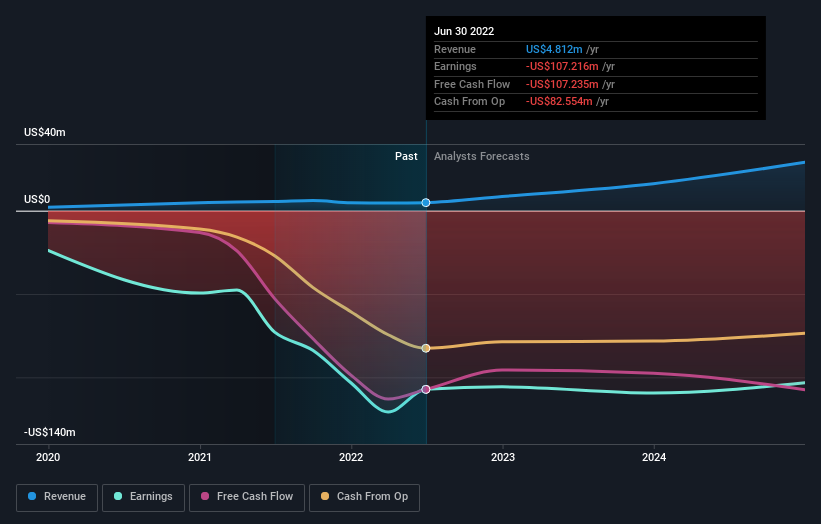

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We doubt Absci shareholders are happy with the loss of 79% over twelve months. That falls short of the market, which lost 7.1%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 21% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand Absci better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for Absci you should be aware of.

But note: Absci may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.