When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the Kimball Electronics, Inc. (NASDAQ:KE) share price has soared 102% in the last half decade. Most would be very happy with that. In the last week shares have slid back 1.2%.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

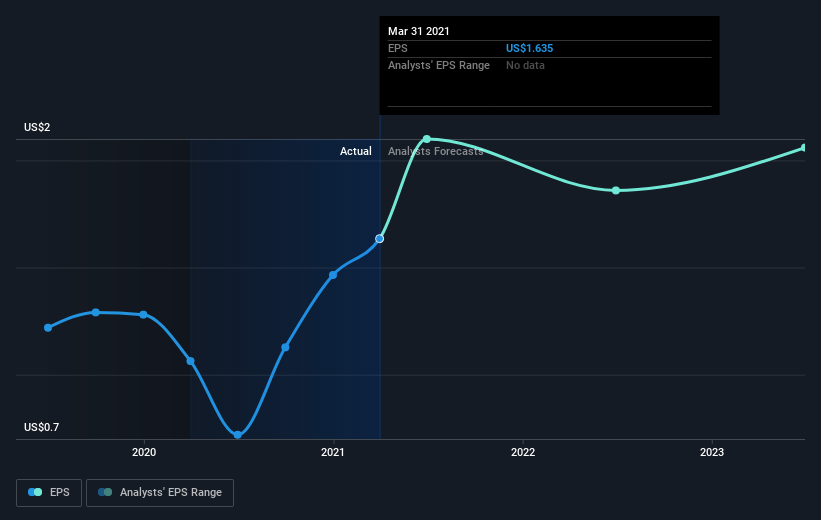

Over half a decade, Kimball Electronics managed to grow its earnings per share at 15% a year. That makes the EPS growth particularly close to the yearly share price growth of 15%. That suggests that the market sentiment around the company hasn't changed much over that time. Indeed, it would appear the share price is reacting to the EPS.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Kimball Electronics has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Kimball Electronics' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Kimball Electronics shareholders have received a total shareholder return of 87% over the last year. That's better than the annualised return of 15% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Kimball Electronics that you should be aware of before investing here.

Of course Kimball Electronics may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.