Seagen Inc. SGEN is making good progress with its portfolio of marketed drugs — Adcetris, Padcev, Tukysa and the newly approved Tivdak — targeting different types of cancer indications.

All these drugs have witnessed strong uptake so far, with Adcetris being the majority contributor to Seagen’s top line. The drug has been approved by the FDA for six cancer indications.

Several label expansion studies on Adcetris, Padcev, Tukysa and Tivdak are currently underway, wherein a potential approval is likely to drive sales further in 2022 and beyond.

The company’s top line mainly comprises product revenues, collaboration and license agreement revenues, and royalties.

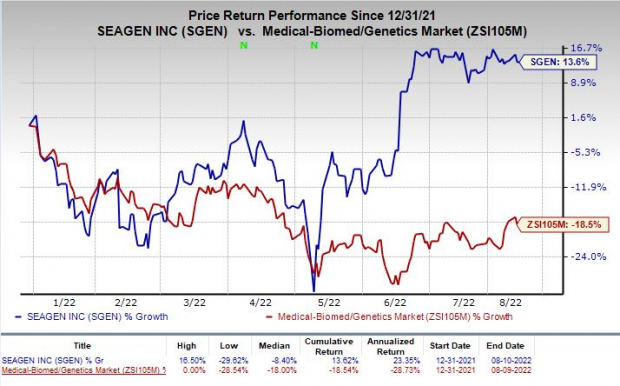

Shares of Segen have rallied 13.6% this year against the industry’s decrease of 18.5%.

Image Source: Zacks Investment Research

Recently, shares of SGEN surged significantly, following rumors of a potential acquisition by pharma giant Merck & Co., Inc. MRK.

Merck has been engaged in advanced talks with Seagen for potentially buying out the latter, per a Wall Street Journal article.

Both Seagen and Merck are yet to confirm the validity of the news through a formal statement. There is no guarantee that Merck would make a potential buyout offer.

Meanwhile, in May 2022, Seagen appointed Roger Dansey as the interim chief executive officer, after the company’s current CEO, president and member of its board of directors, Dr. Clay Siegall, resigned from all of his positions.

Although Seagen is riding high on the success of its portfolio of marketed drugs, it remains to be seen whether the company can continue its impressive growth trajectory and drive revenues further in future years. The approval for Tivdak has added a fourth drug to Seagen’s portfolio, which is likely to drive sales in the days ahead. Stiff competition in the market also remains a concern.

Seagen Inc. Price and Consensus

Seagen Inc. price-consensus-chart | Seagen Inc. Quote

Zacks Rank & Stocks to Consider

Seagen currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the biotech sector include Bio-Techne Corporation TECH and Atara Biotherapeutics, Inc. ATRA, both carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Bio-Techne’s earnings estimates have been revised 0.2% upward for 2022 and 0.7% upward for 2023 in the past 60 days.

Earnings of Bio-Techne have surpassed estimates in three of the trailing four quarters and missed on the remaining occasion. TECH delivered an earnings surprise of 3.30%, on average.

Atara Biotherapeutics’ loss per share estimates narrowed 9.2% for 2022 and 18.2% for 2023 in the past 60 days.

Earnings of Atara Biotherapeutics have surpassed estimates in three of the trailing four quarters and missed on the other occasion. ATRA delivered an earnings surprise of 4.83%, on average.

Zacks' Top Picks to Cash in on Electric Vehicles

Big money has already been made in the Electric Vehicle (EV) industry. But, the EV revolution has not hit full throttle yet. There is a lot of money to be made as the next push for future technologies ramps up. Zacks’ Special Report reveals 5 picks investors

See 5 EV Stocks With Extreme Upside Potential >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK): Free Stock Analysis Report

Seagen Inc. (SGEN): Free Stock Analysis Report

BioTechne Corp (TECH): Free Stock Analysis Report

Atara Biotherapeutics, Inc. (ATRA): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.