Seagate Technology Holdings plc STX recently joined forces with Climb Channel Solutions, a wholly-owned subsidiary of Wayside Technology Group, Inc., for expanding the latter’s data protection and storage portfolio. Seagate’s Lyve Mobile data transfer services will now be offered by Climb to the channel community.

Climb is a global specialty distributor committed to enabling channel partners with the latest in emerging and disruptive technologies. Its focused solutions and high-touch servicing provide value-added resellers (VARs) and managed service providers (MSPs) with the enablement and support required to showcase their expertise and meet customer needs. It provides solutions for Security, Data Management, Connectivity, Storage &Hyper Converged Infrastructure, Virtualization & Cloud and Software & Application Lifecycle.

Benefits of the Alliance

Today, data movement, data mobility, and data migration are vital challenges faced by all major industries. The channel community is working at the forefront to address these challenges for their clients. However, complex issues like data sprawl, data overflow, unstructured data and bandwidth limitations are some of the hurdles faced by the solution providers. This has made it imperative for the channel community to develop an innovative solution to enable next-generation data mobility for their clients.

Amid this scenario, Lyve Mobile – Seagate’s data transfer service – is a simple, secure storage solution designed to overcome the bottlenecks of data gravity. It is a must-have tool for solution providers as it gives a secure and cost-effective way of rapidly moving massive volumes of data across enterprises.

The latest collaboration between Seagate and Climb gives solution providers access to the Lyve Mobile Services through a trusted channel provider. This will enable solution providers to expedite their clients’ time to data, bringing data transfer as-a-service to the channel community. The collaboration will bring incremental revenue opportunities for solution providers by providing best-in-class services to their clients.

With the help of this alliance, Lyve Mobile will play a vital role in solving clients’ data mobility challenges. Lyve Mobile enables hardware, software, and managed services opportunities behind its subscriptions by providing an agnostic tool for managing data workflows. Lyve Mobile aligns perfectly with Climb’s portfolio and will enable the channel community to continue providing services that support the market’s need for edge-to-core data services.

This transformative alliance will provide the channel community with a service-ready solution to bring next-generation data capture, mobility and migration practices to the market.

Improving Prospects for Seagate

Seagate’s performance is benefitting from surging demand for its mass storage capacity solutions, driven by robust cloud data center demand, recovery in the enterprise market and increasing investments in digital transformation by business enterprises. Strengthening enterprise and video and image applications markets, and the healthy uptake of its mass capacity storage solutions in the edge computing vertical also augur well.

In the last reported quarter, the company reported non-GAAP revenues of $3.116 billion, improving 19% on a year-over-year basis but unchanged sequentially. Robust demand for its mass capacity storage solutions, especially nearline products from cloud data center customers, boosted the top line.

However, supply-chain constraints, component shortages and logistics bottlenecks are concerns. Further, higher freight costs and stiff competition in the disk drive market remain near-term headwinds.

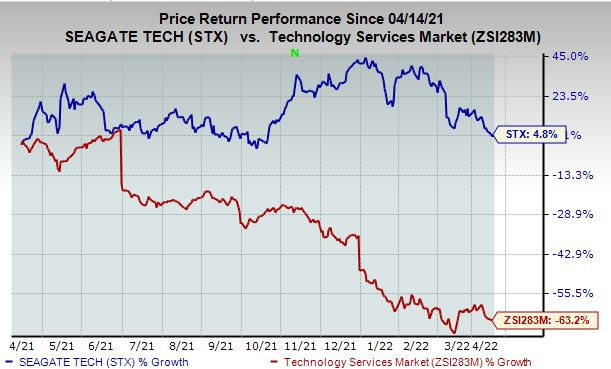

At present, Seagate carries a Zacks Rank #4 (Sell). Shares of STX have gained 4.8% against the industry’s fall of 63.2% in the past year.

Image Source: Zacks Investment Research

3 Key Picks

Some better-ranked stocks from the broader technology space include Bel Fuse BELFB, American Software AMSWA and Iridium Communications IRDM. While Bel Fuse sports a Zacks Rank of 1 (Strong Buy), American Software and Iridium carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Bel Fuse has a projected earnings growth rate of 3.65% for 2023. The Zacks Consensus Estimate for Bel Fuse’s 2023 earnings has remained unchanged in the past 30 days.

Bel Fuse’s first-quarter 2022 earnings per share are estimated at 22 cents, suggesting year-over-year growth of 195.65%. Shares of BELFB have dropped 15.2% in the past year.

American Software has a projected earnings growth rate of 24.24% for fiscal 2022. The Zacks Consensus Estimate for American Software’s fiscal 2022 earnings has been revised upward by 4 cents in the past 60 days.

American Software’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 92.14%. Shares of AMSWA have declined 5.5% in the past year.

Iridium has a projected earnings growth rate of 157.14% for 2022. The Zacks Consensus Estimate for Iridium’s 2022 earnings has been revised upward by 2 cents in the past 60 days.

Iridium’s earnings beat the Zacks Consensus Estimate in two of the last four quarters and met the same twice, the average surprise being 39.4%. Shares of IRDM have dropped 0.7% in the past year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Seagate Technology Holdings PLC (STX): Free Stock Analysis Report

Iridium Communications Inc (IRDM): Free Stock Analysis Report

Bel Fuse Inc. (BELFB): Free Stock Analysis Report

American Software, Inc. (AMSWA): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.