Schlumberger Limited SLB announced the initiation of Schlumberger End-to-end Emissions Solutions (“SEES”) — a business directed toward reducing methane and flare emissions from oil and gas operations.

Methane and routing flare emissions are currently responsible for more than 60% of direct greenhouse gas emissions from the industry.

Investors and environmentalists put immense pressure on energy companies to reduce greenhouse gas emissions. Due to the growing urgency to curb climate change, energy companies are aiming to operate with a more sustainable approach to reduce methane and flaring emissions. Hence, Schlumberger has developed SEES to help customers address one of the most critical issues of climate change — the urgency to cut methane emissions.

The new business provides a broad range of services and state-of-the-art technologies. It will allow operators to measure, monitor, report, and eventually eliminate methane and routing flare emissions. Notably, operators will be able to develop a methane emission elimination strategy by means of SEES.

In the first stage, Schlumberger screens a wide range of measurement and abatement solutions to identify the most affordable technology mix for operators’ specific assets. After that, operators get access to curated third-party and in-house solutions after analyzing around 97 methane measurement technologies. Finally, SEES detects emissions and takes proper measures to eliminate them through its end-to-end offering.

SEES combines Schlumberger’s long-standing measurement and planning expertise with the ability to assess and implement emerging technology, foundational data, AI and digital capabilities. SEES commits to be a reliable partner for operators, aiming to reduce emissions quickly and feasibly to benefit the industry.

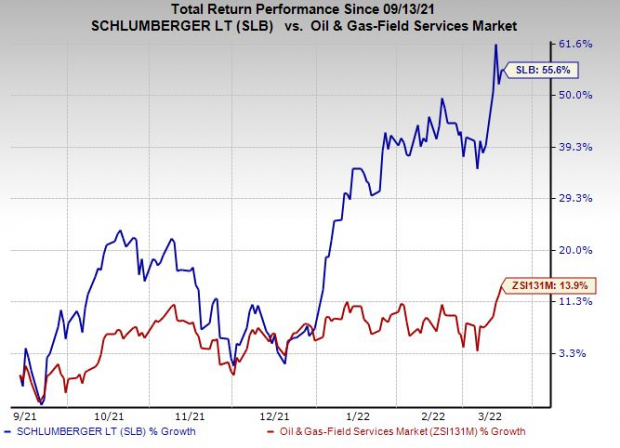

Company Profile & Price Performance

Headquartered in Houston, TX, Schlumberger is a leading oilfield service provider.

Shares of the company have outperformed the industry in the past six months. Its stock has gained 55.6% compared with the industry’s 13.9% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

The company currently carries a Zacks Rank #2 (Buy).

Investors interested in the energy space could look at some other top-ranked companies like Imperial Oil Limited IMO, Valero Energy Corporation VLO and Centennial Resource Development, Inc. CDEV. All companies sport a Zacks Rank #1 (Strong Buy) at present.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Imperial Oil is one of the largest integrated oil companies in Canada. Its debt-to-capitalization of 19.3% is quite conservative versus 32.7% for the sub-industry to which it belongs. Apart from low leverage for its industry, Imperial Oil has ample liquidity, with cash and cash equivalents of C$1.5 billion.

Imperial Oil is expected to see earnings growth of 74.8% in 2022. IMO remains strongly committed to returning money to investors via dividends. The company's board of directors recently approved a hike in quarterly dividend payment. The new payout of 34 Canadian cents is 26% above the prior dividend.

Valero is the largest independent refiner and marketer of petroleum products in the United States. At the fourth-quarter end, VLO had cash and cash equivalents of $4,122 million.

Valero's earnings for 2022 are expected to surge 185.4% year over year. VLO currently has a Zacks Style Score of A for both Value and Growth. Through the December-end quarter, Valero returned $401 million to stockholders as dividend payments.

Centennial is an independent oil and gas exploration and production company. Centennial announced its proved reserves for 2021-end at 305 MMBoe, representing growth from 299 MMBoe at the end of the prior year.

Centennial's earnings for 2022 are expected to surge 98.6% year over year. CDEV announced the launch of its stock repurchase program of $350 million. The authorization of the plan is for two years.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB): Free Stock Analysis Report

Valero Energy Corporation (VLO): Free Stock Analysis Report

Imperial Oil Limited (IMO): Free Stock Analysis Report

Centennial Resource Development (CDEV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.