Shares of Ryanair Holdings plc (RYAAY) scaled a 52-week high of $147.78 in the trading session on Apr 1, 2024, before closing a tad lower at $146.50.

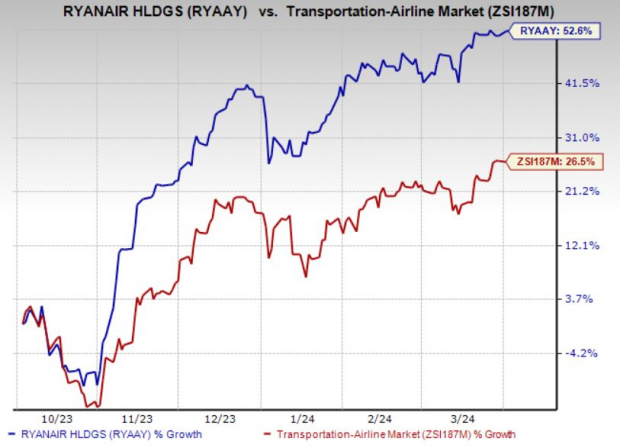

The company’s shares have gained 52.6% over the past six months, significantly higher than 26.5% growth of the industry it belongs to.

Image Source: Zacks Investment Research

Let’s find out the factors supporting the uptick.

Passenger volume has been robust at Ryanair over the past few months owing to the rebound in air-traffic from the pandemic lows. Ryanair’s third-quarter fiscal 2024 (ended Dec 31, 2023) revenues improved 23.1% year over year, driven by upbeat passenger volumes owing to the strong October 2023 mid-term and peak Christmas/New Year travel.

Ryanair continues to benefit from improved traffic growth. Traffic grew 10% during the first nine months of fiscal 2024. Management expects fiscal 2024 traffic to be 183.5 million. On the back of a buoyant traffic scenario, the company’s profit after tax also showed year-over-year improvement during the first nine months of fiscal 2024. The load factor was a healthy 94% in the first nine months of fiscal 2024.

Meanwhile, Ryanair recently reported solid traffic numbers for February 2024, driven by upbeat air-travel demand. The number of passengers ferried on RYAAY flights in February was 11.10 million, implying that 5% more passengers flew than a year ago. The load factor (percentage of seats filled by passengers) was high at 92% in February 2024. The reading was similar in the year-ago period. RYAAY operated more than 63,000 flights in February 2024. However, more than 800 flights got canceled due to the Israel/Gaza conflict.

Ryanair’s measures to expand its fleet to cater to the improvement in air-travel demand are encouraging. RYAAY’s total fleet included 536 aircraft as of Sep 30, 2023.

Zacks Rank & Other Stocks to Consider

Ryanair currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Zacks Transportation sector are Air Lease Corporation (AL) and SkyWest, Inc. SKYW. Each stock presently carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Air Lease has an impressive earnings surprise history. The company's earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average surprise of 20.15%.

The Zacks Consensus Estimate for 2024 earnings has been revised 27.7% upward over the past 90 days. AL has an expected earnings growth rate of 29.96% for 2024. Shares of AL have gained 31.7% in the past year.

SkyWest's fleet-modernization efforts are commendable. The Zacks Consensus Estimate for SKYW’s 2024 earnings has improved 27.3% over the past 90 days. Shares of SKYW have surged 211.1% in the past year.

SKYW has an expected earnings growth rate of more than 100% for 2024. SKYW delivered a trailing four-quarter earnings surprise of 128.02%, on average.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Ryanair Holdings PLC (RYAAY) : Free Stock Analysis Report

Air Lease Corporation (AL) : Free Stock Analysis Report

SkyWest, Inc. (SKYW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.