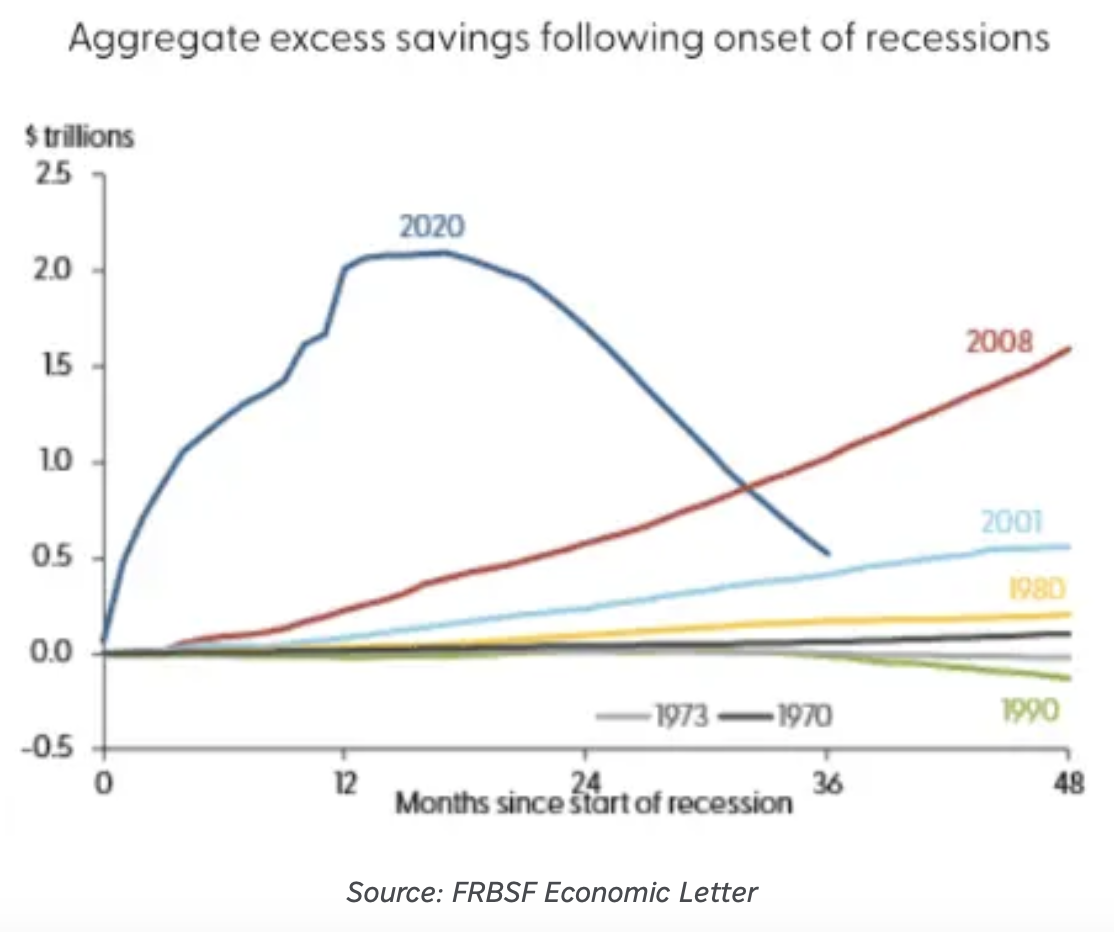

TLDR: Ok, not entirely yet but the big cash cushion the U.S. consumer built in the post-pandemic world is almost entirely gone. Gone. And if you’re the U.S. economy, this is akin to running low on jet fuel mid-air. Why?

In his blog, John Authers highlights some recent research from the Federal Reserve of San Francisco that basically argues the U.S. consumer has burned through much of the pandemic savings. Still a bit left - $500B or so - but it’s definitely on track to run out by year end.

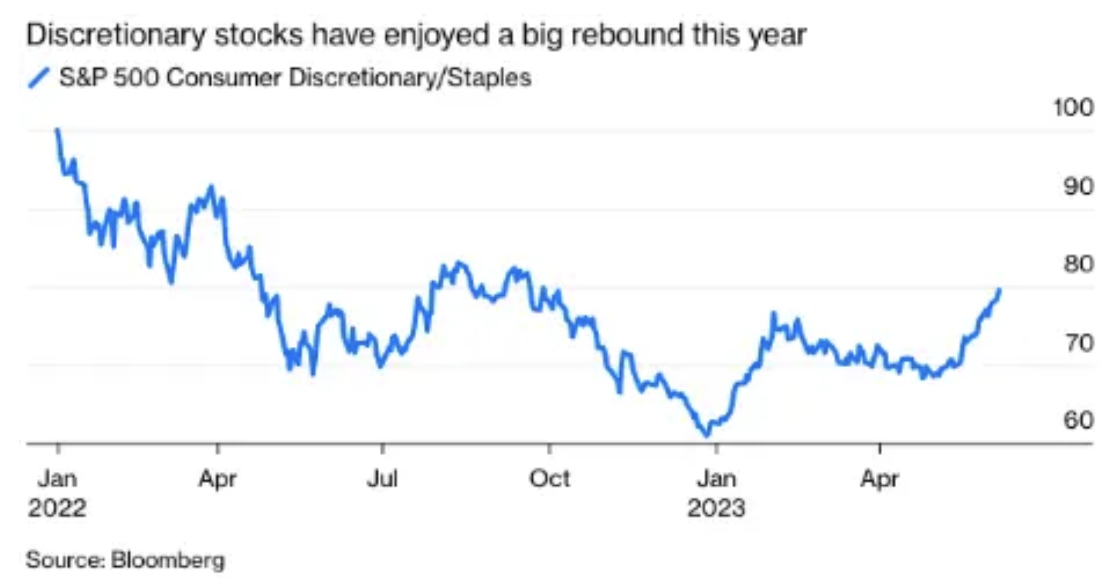

Not as if the market really worried about that, though. Consumer discretionary stocks have outperformed their duller staples brethren by an astounding margin since the start of the year.

As Authers writes:

Retail sales growth can be charitably called anemic. Orthodox surveys of consumer sentiment, such as the long-running polls run by the University of Michigan and by the Conference Board, agree that expectations have subsided since the start of the year. Consumers are still more hopeful than they were at the worst of 2022, but this doesn’t look like material for a rally. Indeed, the Michigan survey shows expectations almost as low as in the aftermath of the Lehman bankruptcy.

So what’s happening? What are markets seeing that the data is not showing (or what data are we missing)?

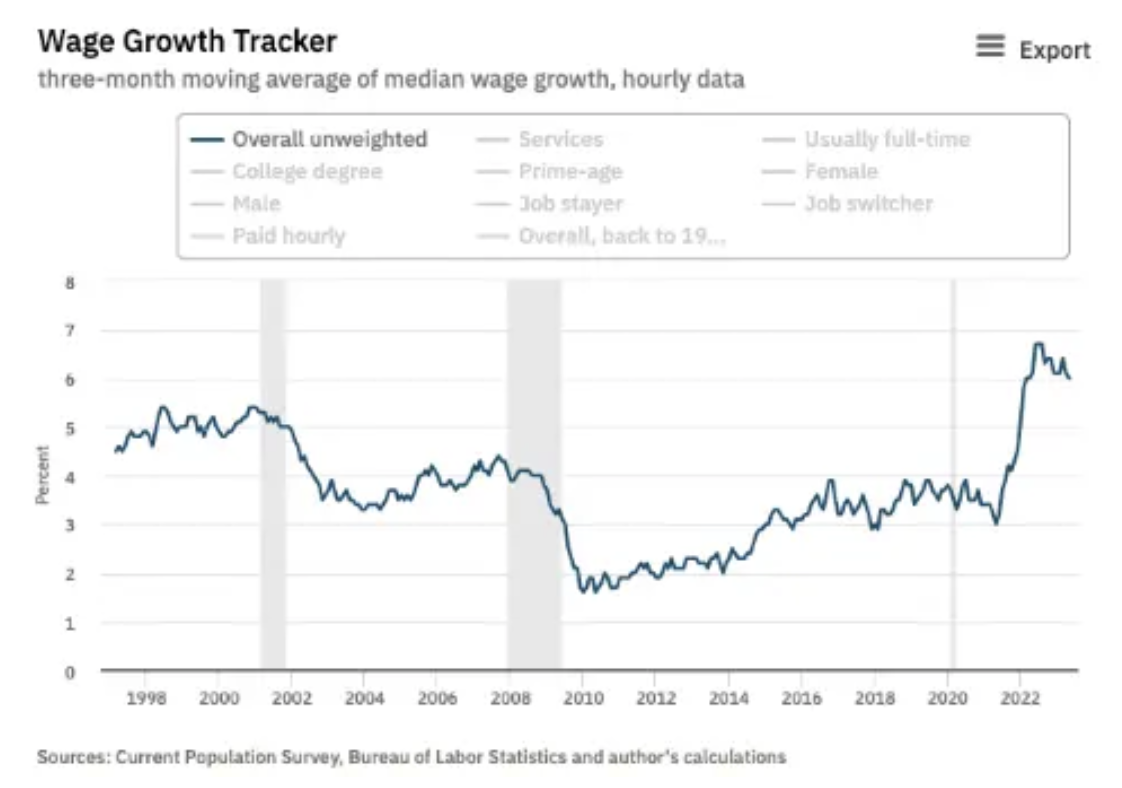

One big source of support is the labor market. Although it’s slowed from the peak, the monthly job creation remains very robust and wage growth and wage growth far above inflation.

Markets are implicitly betting inflation will come down faster than wage growth. Based on the recent data, they might be right.

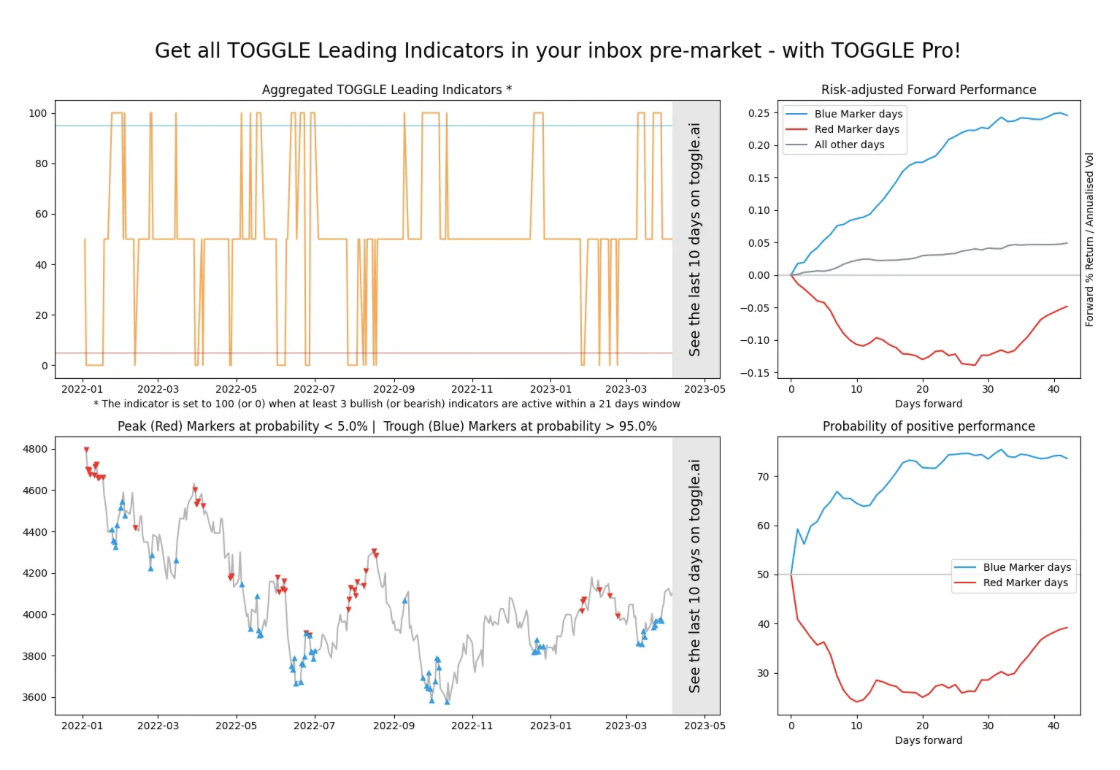

Aggregated Leading Indicators!

Subscribe to Pro here to receive our pre-market Leading Indicator newsletter and access all Leading Indicators online!

Learn more about the Leading Indicators in the Learn Center!

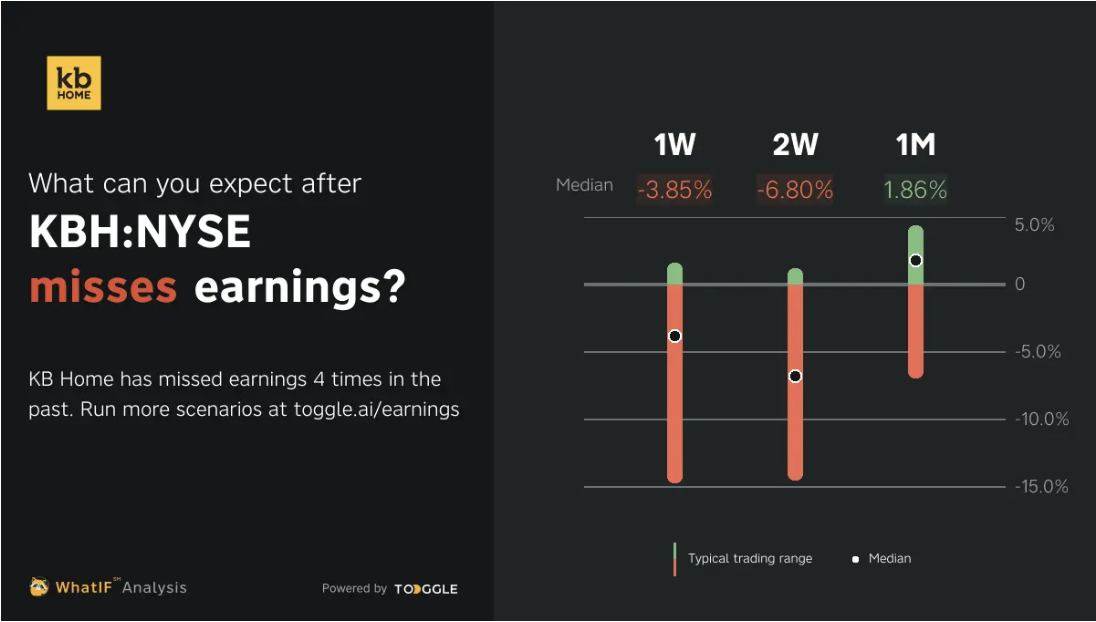

Earnings Update: KB Home (KBH) reports tomorrow

High mortgage rates and persistent inflation could result in a softer demand environment for the homebuilding company. Click here to observe how the stock could perform after earnings.

Discover how other companies could react post earnings with the help of TOGGLE's WhatIF Earnings tool.

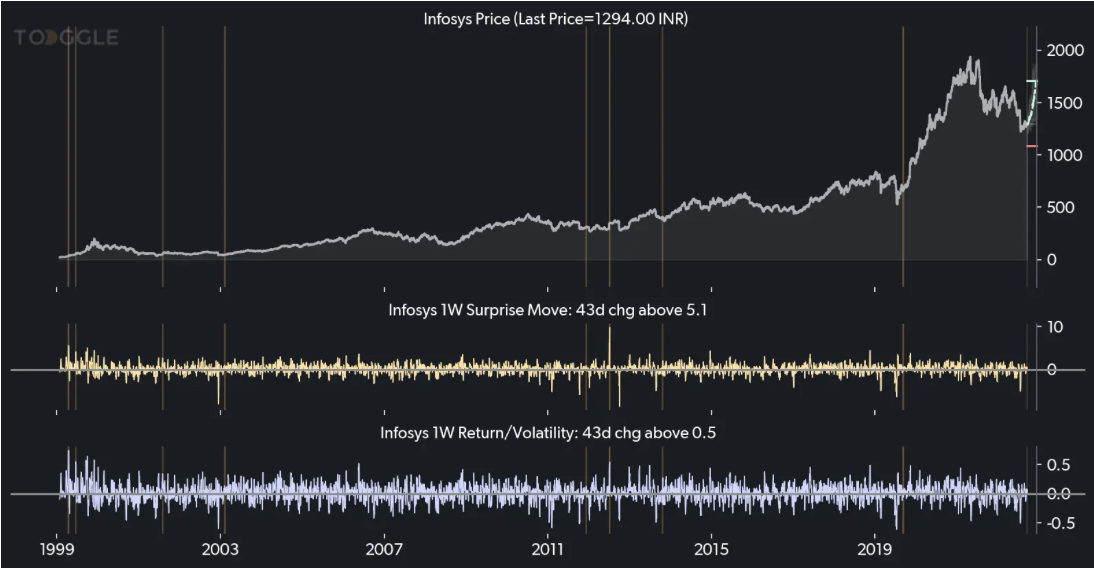

Asset Spotlight: Big move up in Infosys

TOGGLE observed 10 similar occasions in the past where there was a big move up in Infosys stock and historically this led to a median increase in the stock price over the following 3M.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.