In the past few decades, space exploration has evolved from predominantly government-led projects to a vibrant sector dominated by private enterprises. Companies like SpaceX and Blue Origin have taken the lead, drawing significant interest from investors eager to capitalize on the burgeoning industry.

However, SpaceX has made it clear that it does not plan to launch a public stock offering in the near future. So for investors seeking alternatives, Rocket Lab USA (NASDAQ: RKLB) is one compelling option. The company has experienced remarkable growth, with its stock price skyrocketing by 389% from its 52-week low in mid-April.

Rocket Lab has made a name for itself as the second-most-used company in the U.S. for space launches. It continues to increase its launch cadence and boasts a robust order backlog. Here's what you should know if you're considering an investment in Rocket Lab today.

A key player in the growing space economy

The private sector has taken the lead regarding space exploration and travel. Several exciting projects are under way, including satellites that can beam service from space to deliver communication to hard-to-reach places and remote rovers that facilitate research on the Moon. According to McKinsey, the global space economy could be worth $1.8 trillion by 2035.

Rocket Lab's flagship rocket is the Electron, which is the second-most-used orbital rocket in the U.S., behind SpaceX's Falcon launch vehicle. Last year, SpaceX dominated the market, making 98 launches, or 90% of the launches from U.S.-based companies.

While SpaceX has a tight grip on the launch market, Rocket Lab is making strides and catching up; it made nine launches last year and has successfully completed 12 launches this year through October.

Growth is solid, but it is still losing money

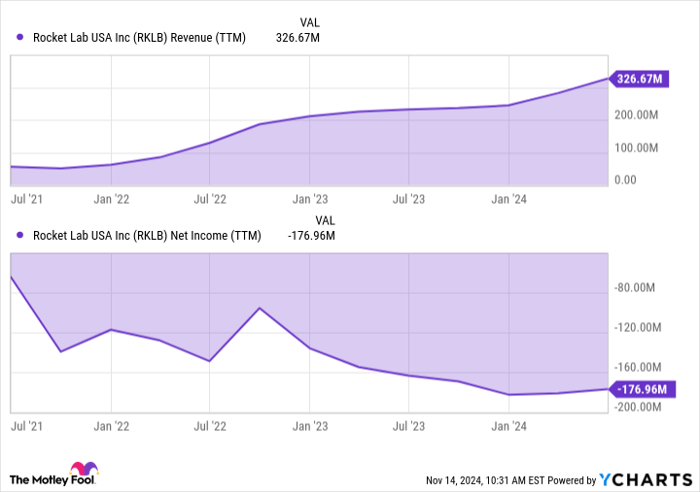

Rocket Lab's growth has been excellent. In the third quarter, the company's revenue was $105 million, up 55% year over year. For the year, Rocket Lab's revenue has grown nearly 65% to $304 million, showing robust demand for its services, which include launches as well as the engineering and design of spacecraft components. The company expects revenue for the fourth quarter to be around $125 million to $135 million.

RKLB Revenue (TTM) data by YCharts

That said, Rocket Lab has yet to turn a profit. Its net loss is $138 million so far this year, up from $132 million last year.

What's next for Rocket Lab?

One drawback of Rocket Lab's Electron launch vehicle is that it is relatively small -- its carrying capacity is around 250 kilograms. Smaller rockets equal smaller margins on each launch; it also means that Rocket Lab cannot support many larger civil and defense payloads. This puts it at a distinct disadvantage to SpaceX, whose Falcon launch vehicle can carry 10 times that amount.

Image source: Rocket Lab USA.

Since 2021, Rocket Lab has been developing its medium-lift Neutron rocket. This launch vehicle will have a significantly larger payload capacity of 13,000 kilograms. This drastic increase in payload capacity means it can take on larger contracts and boost its margins.

The company has made solid progress in developing its Neutron rocket. In August, it fired its Archimedes engine, the one to be used for its larger rocket, for the first time. CEO Peter Beck says the tests keep it on track to launch Neutron by mid-2025. Not only will the rocket improve profit margins, but if things go according to plan, it will also put Rocket Lab on track to break even next year.

The company recently announced a multi-launch agreement with a confidential commercial satellite constellation operator for its Neutron rocket. The two dedicated missions will start in mid-2026 and begin a collaboration that could potentially see Neutron deploy the entire constellation for the customer.

Is it a buy?

Demand for Rocket Labs' services is robust. At the end of the third quarter, its backlog was $1.05 billion, half of which, according to CFO Adam Spice, it expects to realize as revenue in the next 12 months.

Over the past year, Rocket Lab stock has surged higher as it continues to grow its launch cadence and sign new agreements. At around 26 times sales and 20 times next year's projected sales, the stock looks quite expensive. However, Rocket Lab is making significant progress, and the launch of the Neutron rocket next year could be an inflection point for the up-and-coming space company.

If Rocket Lab's launch of its Neutron rocket is pushed back, that could impact its profitability goal and lead to further stock volatility. For this reason, Rocket Lab stock is ideal for investors looking to gain exposure to space stocks on a long-term basis and who don't mind the volatile ride as it builds on its position in the emerging space economy.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $363,386!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,183!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $456,807!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 18, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool recommends Rocket Lab USA. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.