Investors tracking the electric vehicle (EV) sector have had high hopes for the long-term success of Rivian Automotive (NASDAQ: RIVN). While no one expected it to be easy to follow a similar path blazed by Tesla, Rivian has some unique aspects that give it a reasonable chance.

But its path to success has had several roadblocks that have kept it from being further along its journey to profitability. Rivian's stock has paid the price, dropping by about 57% so far this year. The company has set itself up for a turnaround, though. Its upcoming quarterly report could offer investors reasons to think that the direction from here is up. Let's look at what could come from management on Nov. 7 when it provides that update.

Rivian's early cash crunch

Rivian had aggressive plans from the outset. It announced plans to invest $5 billion to build a second manufacturing facility in late 2021. Consider that Rivian produced only 1,015 EVs that year and delivered just 920. Its brand was well received, and it successfully ramped up volume and delivered more than 50,000 units just two years later.

But that volume increase was more costly than it had anticipated. Input material costs were high, and supply chain constraints increased expenses at the same time demand growth for EVs began to slow. The company reacted by quickly throttling back capital spending plans, including delaying plans to develop the second manufacturing site.

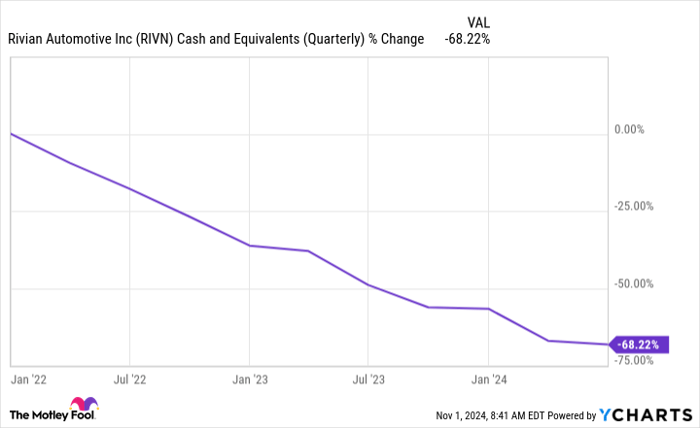

Rivian raised nearly $3 billion in 2023 alone, including a $1.5 billion bond issuance last October. Yet even as it raised money along the way, Rivian's cash position has decreased dramatically in the past three years.

RIVN Cash and Equivalents (Quarterly) data by YCharts.

But Rivian still had $7.9 billion in cash and equivalents as of June 30. That includes $1 billion from a convertible note issued to Volkswagen Group. That's part of an overall $5 billion investment the global automaker is making with Rivian. The companies also plan a technology joint venture (JV) as part of the agreement.

What could Nov. 7 bring?

There are three things Rivian management can focus on with the upcoming third-quarter update. But one major catalyst for the stock could be if the company confidently says it now has enough capital to get through the production and ramp-up stages for its next-generation R2 SUV. The R2 platform will be followed by the R3 and R3X, planned for 2027. But if Rivian has the capital to get to 2027 while still investing for future growth, it will also gain sales from the R2 launch in 2026.

The company's cash runway is critical, and stating confidence in that situation will likely boost the stock after Nov. 7. At the same time, what management says about 2025 production expectations will also play a role in how investors react. Rivian doesn't expect to produce more in 2024 than it did in 2023. Some of that is due to retooling its Illinois plant in preparation for the start of R2 production next year. A boost in production plans will also give investors a reason to bid the stock higher.

A third topic to monitor is discussion about ongoing cost reductions. Higher production and delivery volumes won't help the company or the stock if it isn't recording profitable sales. The Nov. 7 report from Rivian could be a turning point for the company and the stock.

The risk is still high that it won't provide the information investors want to hear. So an investment before the third-quarter report should still be at a proper allocation considering that risk. If all goes well, though, the stock could currently be in the range of a bottom with plenty of upside potential.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $833,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 4, 2024

Howard Smith has positions in Rivian Automotive and Tesla. The Motley Fool has positions in and recommends Tesla and Volkswagen. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.