2020 was a paradigm shifting year for Bitcoin and the cryptocurrency asset class.

After being a primarily retail-driven phenomenon for most of its 12 year history, 2020 saw bitcoin (BTC) breaking into the hallowed ranks of macro-investor icons, traditional institutional investors and even corporate balance sheets - all at once.

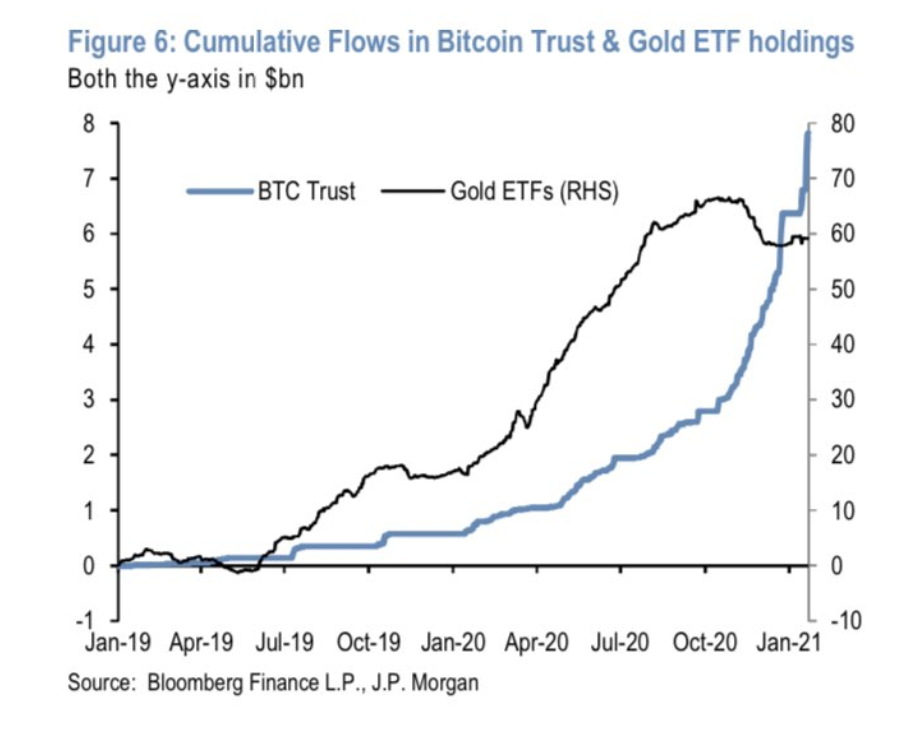

For an asset class that some advisors once (and perhaps still) considered fly-by-night, it has been an incredible transition to watch. Skeptics must now reckon with the growing lists of top-tier backers and increasing consensus around bitcoin as an emerging digital gold and hedge against monetary inflation. JP Morgan recently highlighted some of the data that backs up the narrative - BTC inflows to exchange-traded products outpacing that of the traditional monetary inflation hedge: gold.

Current advocates of bitcoin include the legendary macro investors Paul Tudor Jones, Stanley Druckenmiller and Bill Miller - all who have been vocally bullish and disclosed positions in bitcoin. In the institutional market, insurance giant Mass Mutual has gone long with a $100 billion BTC purchase, followed by Guggenheim’s eye-watering $400,000 long term price target for bitcoin.

And then there are the public-company corporate treasury allocators: Microstrategy purchased over 70,000 bitcoin ($2+ billion at the time of writing) and was followed by fintech darling Square’s 4,700 BTC purchase ($150+ million).

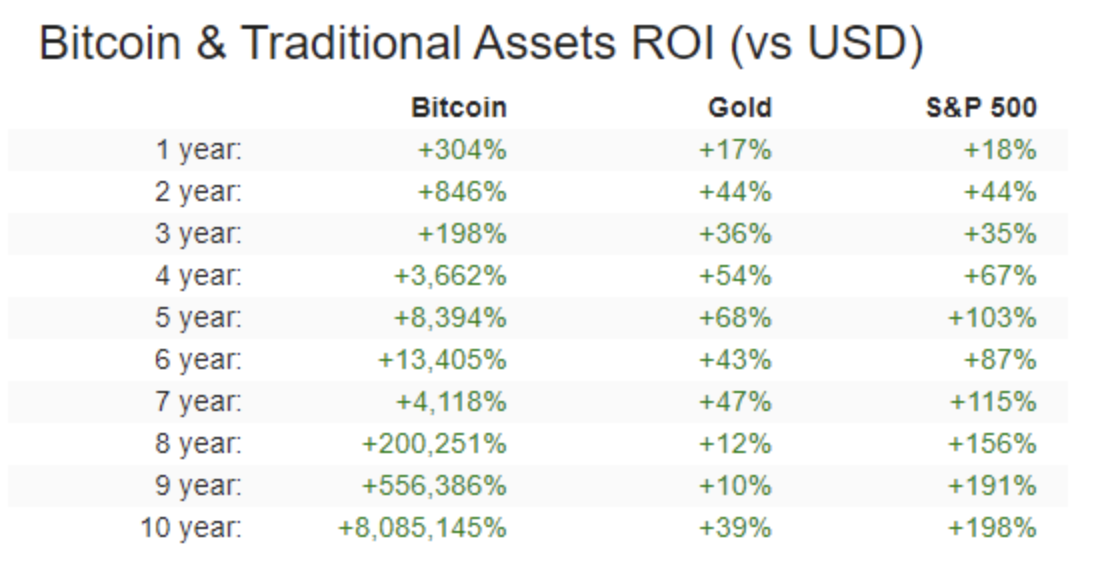

It’s no surprise that these developments helped bitcoin continue its long-running outperformance over both equities and gold:

What about financial advisors?

While these macro, institutional and corporate purchases signal that bitcoin is here to stay as an investable asset, the most interesting data for advisors might be from clients themselves.

A 2020 Bitwise survey of financial advisor attitudes towards cryptoassets revealed that 76% of financial advisors reported receiving questions from clients and 72% thought clients may be investing in cryptocurrency on their own, outside the advisory relationship. Those were significantly higher than the percentage of advisors planning to allocate portions of their clients’ portfolios to cryptocurrency, which was 13% (up from 6% the year before).

The takeaway is clear and for some, uncomfortable: clients are already investing in cryptocurrency and they are doing it outside their advisor relationships.

Cryptocurrency investing happening behind the scenes poses problems for advisors and clients alike. Clients trust advisors to be at the center of their financial lives and provide direction on how to manage their entire portfolio. When assets are excluded from the complete picture, both trust in the relationship and the advisor’s ability to provide comprehensive financial management are eroded.

Outside of the client being worse off, there are also clear economic drawbacks for advisors who ignore cryptocurrency holdings. Today many clients, particularly in the millennial and higher net worth demographics, hold significant sums of cryptocurrency. Because these holdings are custodied on retail exchange platforms or inside self-custody wallets, they are not captured as part of advisor assets under management (AUM) and therefore do not generate advisor fees.

Importantly, these cryptocurrency holdings are not created in a vacuum - they are acquired using capital that would normally be allocated into other asset categories, including commodities, alternatives and even equities, all of which would normally be captured in advisor AUM.

For advisors, it’s revenue left on the table.

How can advisors tackle cryptocurrency?

Fortunately, there are some easy steps advisors can take to close the cryptocurrency gap and start incorporating the asset class into their practices.

The first is to get educated on the asset class. New certificate programs have emerged that allow advisors and financial planners to get up to speed on cryptocurrency, while also counting towards CFP Board continuing education credits that are required each year. For a less formal education, advisors can also review best-in-class resources on the topic, which will help frame conversations with clients.

The second critical step is to start tracking clients’ existing cryptocurrency holdings. Client cryptocurrency that remains segregated from the complete financial picture results in the worst case scenario for both advisors and clients. Tracking cryptocurrency exchanges and wallets has become easier than ever before with new portfolio tracking tools built specially for advisors. Even for advisors skeptical of Bitcoin or cryptocurrency, knowing what assets clients hold and how they fit into their total net worth is critically important.

With cryptocurrencies (finally) tracked, advisors can start to include the accounts in AUM calculations that form the basis fee revenue and begin to factor the assets into clients’ total financial picture.

Summary

Love it or hate it, bitcoin and cryptocurrencies as an asset class are here to stay and will very likely grow significantly in the coming years. The current environment of clients investing in cryptocurrencies outside the scope of their financial advisor relationship does not serve clients or the advisors they trust to manage their money.

As with any new innovation or major shift in the marketplace, the winning playbook for advisors is simple: adapt and continue to serve your clients’ interests. Otherwise advisors risk being left behind as clients gravitate towards solutions that better fit their needs and interests.

About the Author

Alex Treece is the Co-Founder and President of Zabo, a financial technology and data aggregation platform for cryptocurrency accounts.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.