By Goran Damchevski

This article was originally published on Simply Wall St News

Walmart Inc. ( NYSE:WMT ) is continuously introducing new improvements, product lines, supportive services and is growing by acquisition of smaller brands. Our timeline below, outlines many significant events that show just how active this company is.

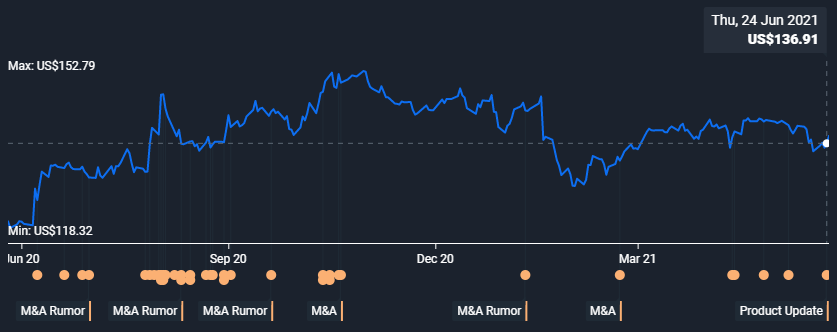

NYSE:WMT Price and notable event history in the last 12 months

NYSE:WMT Price and notable event history in the last 12 monthsThe quality of these additions will ultimately determine the future growth of Walmart and it is important for investors to know if the company has its spending under control and invested in smart projects.

One of the main sources of financing for large projects is debt - and that is why we will take a closer look at the debt management at Walmart.

When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin.

Debt is another way to utilize capital more efficiently, and a good balance between debt and equity is the foundation of the long-term future for a company. We can also think of debt as a fixed expense, which reliably increases the risk of a company. However, when an optimal amount of debt is being utilized, this can have boosting effects on projects and future earnings.

As with many other companies, Walmart makes use of debt. But is this debt a concern to shareholders, or is the company effectively turning debt into a money making asset?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't reliably pay it off, either by raising capital or with its own cash flow.

In general, debt is available to, and primarily made use of, by mature companies with predictable cash flows.

If companies are mismanaging debt, we often see them permanently diluting shareholders because lenders force them to raise capital at a distressed price.

Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels together.

View our latest analysis for Walmart

What Is Walmart's Net Debt?

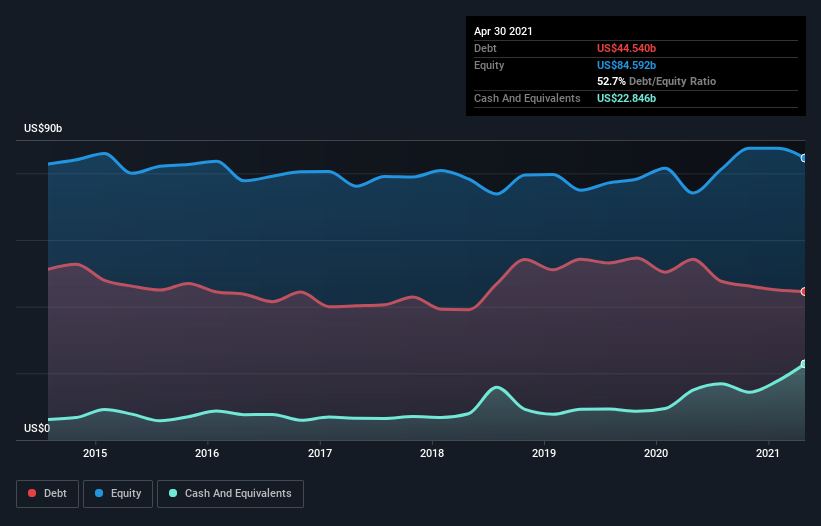

The graph below shows that Walmart had US$44.5b of debt in April 2021, down from US$54.2b, one year before. However, it does have US$22.8b in cash offsetting this, leading to net debt of about US$21.7b.

We can see that Walmart used their excess cash to both payout shareholders and reduce debt. This is a reasonable and stable approach to a healthy balance sheet.

We usually consider a debt to equity ratio of above 40% to be high, but when taken in junction with the large cash position, we can effectively be reassured that the company has the capacity to manage its debt.

NYSE:WMT Debt to Equity History, June 2021

NYSE:WMT Debt to Equity History, June 2021A Look At Walmart's Liabilities

We can see from the most recent balance sheet that Walmart had liabilities of US$80.8b falling due within a year, and liabilities of US$71.1b due beyond that. Offsetting this, it had US$22.8b in cash and US$5.80b in receivables that were due within 12 months. So, it has liabilities totaling US$123.3b more than its cash and near-term receivables, combined.

With a large company like Walmart, we can set the bar lower regarding the short term liabilities, because it currently has the market share power to offset payment and liquidity issues from suppliers.

Additionally, Walmart has a very large market capitalization of US$378.8b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover).

This way, we consider both the absolute quantum of the debt, and the interest rates paid on it.

Walmart has a low net debt to EBITDA ratio of only 0.55. And its EBIT easily covers its interest expense, being 13.1 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse.

In addition to that, we're happy to report that Walmart has boosted its EBIT by 32%, thus reducing the spectrum of future debt repayments.

When analyzing debt levels, the balance sheet is the obvious place to start. But ultimately, the future profitability of the business will decide if Walmart can strengthen its balance sheet over time.

So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow.

During the last three years, Walmart produced sturdy free cash flow equating to 76% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Conclusion

Walmart is a company that is set on maximizing value. They are engaged in financing expansion and technological development.

Walmart runs a highly efficient business in segments where they make considerable profit. The balance sheet analysis shows a stable and rational structure with good coverage both from an earnings and cash perspective.

Specifically, Walmart retains the ability to cover its interest expense with its EBIT. And the good news does not stop there, as its EBIT growth rate also supports that impression!

Zooming out, Walmart seems to use debt quite productively. Walmart’s sensible leverage can boost returns on equity.

There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside the balance sheet. For example - Walmart has 3 warning signs we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.