Retail Investors Show TINA Trade Is Over

Last time we looked at retail trading, at the end of November 2022, we noted that retail had turned sellers of stocks as the market sold off – but remained buyers of ETFs.

Today we are updating our retail flow data. We see that:

- Retail activity remains high and much firmer than market-wide volumes.

- As January economic data improved, retail returned to buying stocks.

- The TINA trade (There Is No Alternative - to stocks) is over, with increasing flows into Fixed Income ETFs as higher rates mean yields on bonds have risen.

Retail trading holding U.S. volumes up

Gross levels of retail trading have actually increased further since 2022, with our retail measure averaging around $37 billion per day this year, an increase from the $35 billion per day by retail in 2022 (green area in Chart 3).

That’s happened while other activity in the market has fallen. Market-wide value traded has fallen 25%, from $665 billion per day in the first half of 2022 to closer to $500 billion per day this year (blue line) – roughly in line with the drop in stock valuations.

The fact that retail value traded has increased, despite the fall in stock prices, is also consistent with recent data that shows the TRF back at around 46.5% of total shares traded (ADV) since the start of the year.

Interestingly, the $55 billion that retail traded on Feb. 2, 2023 was the largest retail day since Jan. 24, 2022. That activity spike was spurred by positive earnings news (especially for tech stocks that retail likes), slowing rate hikes from the Bank of England and the European Central Bank combined with dovish comments from Powell, indicating U.S. rate hikes might stop soon too, reducing a headwind for the market. The Nasdaq Composite reached its highest level in nearly five months.

For comparison, market-wide value traded on Feb. 2, 2023 was “just” $740 billion, almost 40% less than the roughly $1.2 trillion that the market traded on Jan. 24, 2022.

Chart 1: Retail has had a strong start to 2023, while the industry has lagged behind

January economic data has been surprisingly strong

Last year’s economic data ended disappointingly, with the economy seemingly weakening toward a recession after a year of rapid rate hikes. Retail sales, Manufacturing and even Services PMIs were seen to be contracting.

However, January data seems to have reversed those trends, with strong employment, spending and a recovery in services activity.

Chart 2: Strong data to start 2023 has offset weak data into the end of last year

Retail back to buying stocks

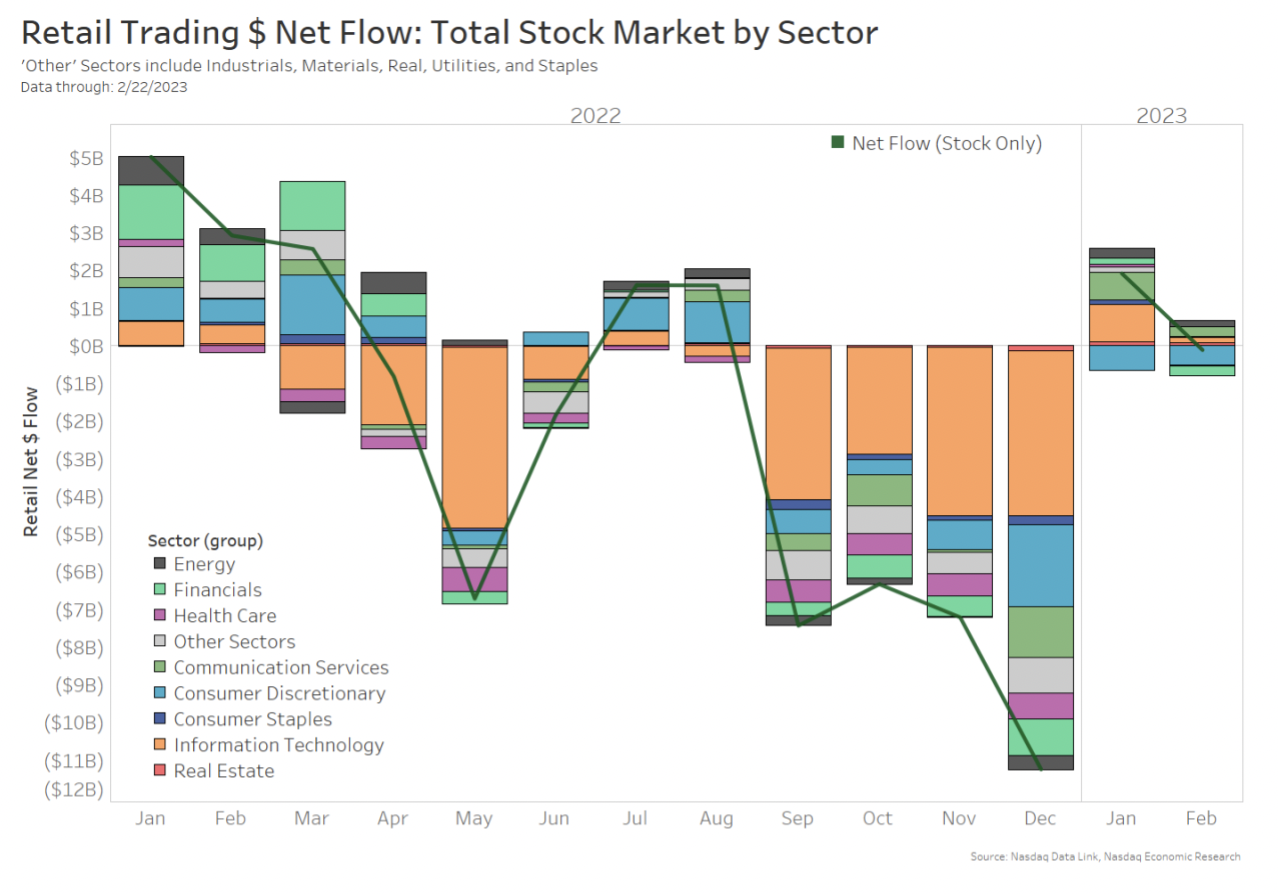

In line with the data strengthening, we have also seen net retail activity in corporate stocks recover. So far this year, retail has been a net buyer of $1.9 billion in corporate stocks. That comes after net selling a combined $28 billion in stocks last year.

Overall, buying has been strongest in Tech and Communications sector stocks (noting that Communications now includes GOOG, META and NFLX).

Chart 3: Monthly net retail flows by sector

ETF trading shows the TINA trade is over

As interest rates hovered close to zero back in 2021 and rate hikes became increasingly likely, bonds started to look unattractive on a yield and appreciation basis. The term the TINA trade (“there is no alternative” – to stocks) was coined. Retail ETF flows seem to confirm the TINA trade is over. Bond ETFs are seeing persistent inflows across the broad maturity and credit spectrum. Since the middle of 2022, retail has been a more net buyer of fixed-income ETFs, adding to $7.9 billion.

Chart 4: Retail investors have been net buyers of fixed-income ETFs across all durations since Jan. ’22

ETFs are among the most traded single tickers

We know that retail tend to be net buyers of ETFs – regardless of market direction. That has continued this year with retail buying of ETFs so far adding to $11.6 billion, with strong flows into SPY, QQQ and VOO.

Looking at stock tickers with the most activity, we see that retail also likes many Nasdaq-listed stocks, with TSLA, NVDA, AAPL, AMZN, AMD and META seeing the most activity so far this year. Although, not all saw net buying during the period. In fact, the selling of TSLA so far this year, to the tune of $2.5 billion, more than accounts for the consumer discretionary sector's net selling year-to-date (Chart 3).

Table 1: 2023 YTD Retail Top Tickers (by gross value traded)

Retail liquidity remains important to markets

Rather than retail fading from view as the market has sold off, the data seems to confirm the opposite. Retail investors are persistent buyers of stocks (mostly via ETFs) and add an increasing amount of liquidity to the overall market.

That’s good for markets and good for investors.