Walmart WMT shares were down in response to the last quarterly release on November 16th following modestly underwhelming guidance, but the analyst commentary about the report was generally favorable. The analysts’ positive take on the quarterly results can also be gauged from their earnings estimates for the following periods, which have increased slightly since then.

Walmart shares remained under pressure for roughly three weeks following the mid-November 2023 quarterly report, during which the stock lost more than -10% of its value. The stock has made an impressive rebound since then and is currently trading at its 52-week high, outperforming the market since the start of January 2024 (+8.9% vs. +5.3%).

It will be interesting to see if this performance momentum can be sustained following fresh quarterly results on Tuesday, February 20th. We wouldn’t be surprised by a sell-the-news type of reaction as we saw following the November 2023 release.

The expectation is that the company will bring in $1.65 per share in earnings on $170.6 billion in revenues, representing year-over-year changes of -3.5% and +4%, respectively. Please note that the $1.65 per share estimate is up from $1.63 per share a few days back.

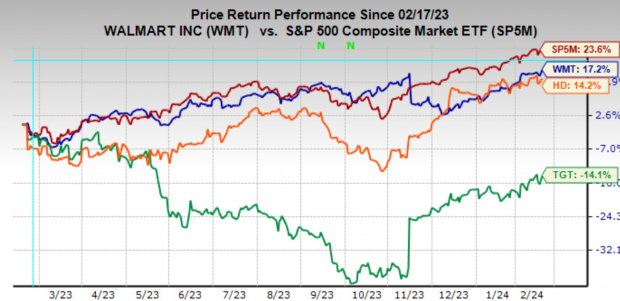

Target TGT isn’t expected to report quarterly results till March 5th, though Home Depot is also on deck to report results Tuesday morning along with Walmart. The chart below shows the one-year performance of Walmart, Home Depot, and Target relative to the S&P 500 index.

Image Source: Zacks Investment Research

With respect to the Retail sector 2023 Q4 earnings season scorecard, we now have results from 17 of the 33 retailers in the S&P 500 index. Regular readers know that Zacks has a dedicated stand-alone economic sector for the retail space, which is unlike the placement of the space in the Consumer Staples and Consumer Discretionary sectors in the Standard & Poor’s standard industry classification.

The Zacks Retail sector includes not only Walmart, Target, and other traditional retailers, but also online vendors like Amazon AMZN and restaurant players. The 17 Zacks Retail companies in the S&P 500 index that have reported Q4 results already belong to the e-commerce and restaurant industries.

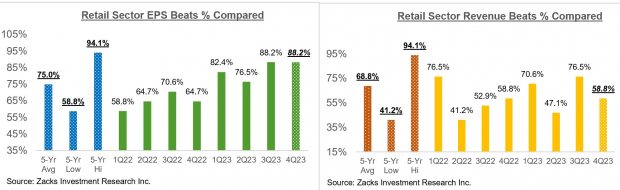

Total Q4 earnings for these 17 retailers that have reported are up +72.4% from the same period last year on +10.7% higher revenues, with 88.2% beating EPS estimates and 58.8% beating revenue estimates.

The comparison charts below put the Q4 beats percentages for these retailers in a historical context.

Image Source: Zacks Investment Research

As you can see above, the online players and restaurant operators easily beat EPS estimates but have struggled to beat top-line estimates.

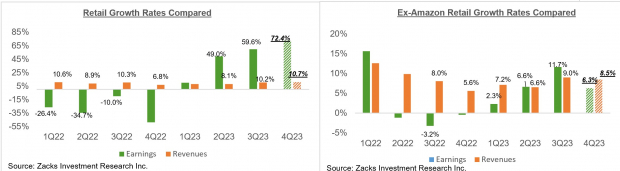

Concerning the earnings and revenue growth rates, we like to show the group’s performance with and without Amazon, whose results are among the 17 companies that have reported already. As we know, Amazon’s Q4 earnings were up +410.9% on +13.9% higher revenues, beating top and bottom-line expectations.

As we all know, the digital and brick-and-mortar operators have been converging for some time now. Amazon is now a decent-sized brick-and-mortar operator after Whole Foods, and Walmart is a growing online vendor. This long-standing trend got a massive boost from the Covid lockdowns.

The two comparison charts below show the Q4 earnings and revenue growth relative to other recent periods, both with Amazon’s results (left side chart) and without Amazon’s numbers (right side chart).

Image Source: Zacks Investment Research

We have started seeing signs of stress at the lower end of income distribution. One can intuitively project moderation in consumer spending as the economy further slows down under the weight of tighter monetary conditions. Inflation may be down from the multi-decade highs of a few quarters back, but it still remains a headwind, particularly for the lower end of income distribution. Other issues, like the resumption of student loan payments, are seen as weighing on spending trends. That said, the labor market remains very strong, with wages still going up.

We will hear more about issues on the Q4 earnings calls, likely in the context of their outlooks for the coming periods.

Standout Features of the Q4 Earnings Season

The overall picture that emerged from the Q4 earnings season is one of stability and resilience as a whole, with key pockets starting to enjoy notable acceleration in the growth momentum.

Earnings aren’t great, but no one expected corporate profitability to be strong. The earnings naysayers have been relatively less vocal in their doom-and-gloom pronouncements lately. But the fear of an impending earnings cliff has been in the back of market participants’ minds. These results have likely eased many of those fears.

With quarterly results from more than 79% of S&P 500 members already out through Friday, February 16th, here are the five key features that these quarterly results have confirmed.

First, the Q4 earnings and revenue growth pace represents an acceleration from what we have seen in recent quarters.

The absolute level of Q4 earnings and revenue growth isn’t much, and the improving trend may not seem like a big deal to some of you. But we nevertheless see this improving growth trend as significant and a sign of the things to come in the coming periods.

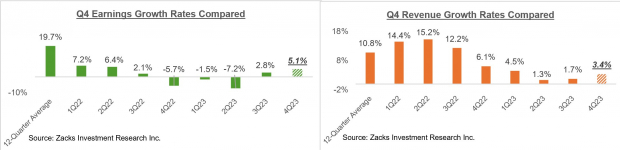

For the 396 S&P 500 members that have reported results through Friday, February 16th, total earnings and revenues are up +5.1% and +3.4% from the same period last year, respectively. Concerning the beats percentages, 78.8% of the companies have beaten EPS estimates, and 64.4% have beaten revenue estimates.

The comparison charts below put the Q4 earnings and revenue growth rates for these 396 index members in a historical context.

Image Source: Zacks Investment Research

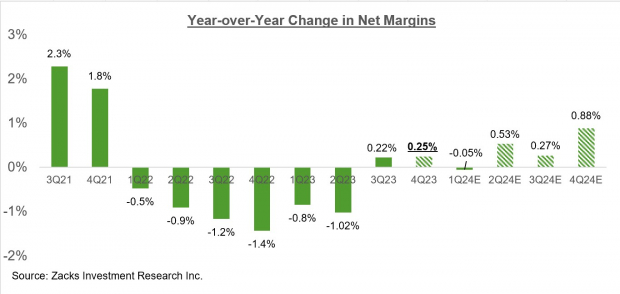

Second, companies are making good progress on the margins front.

The year-over-year change in net margins turned positive in 2023 Q3 after staying in negative territory for six consecutive quarters. This margins recovery is a key driver of earnings growth in the coming periods.

The chart below shows the year-over-year change in net margins.

Image Source: Zacks Investment Research

At the sector level, Q4 net margins are above the year level for 9 of the 16 sectors, with the biggest gains at Tech, Consumer Discretionary, Retail, Industrial Products, Utilities, Finance, and others.

On the negative side, Q4 margins are below the year-earlier level for 7 of the 16 Zacks sectors, with the biggest declines in the Medical, Autos, Energy, and Transportation sectors.

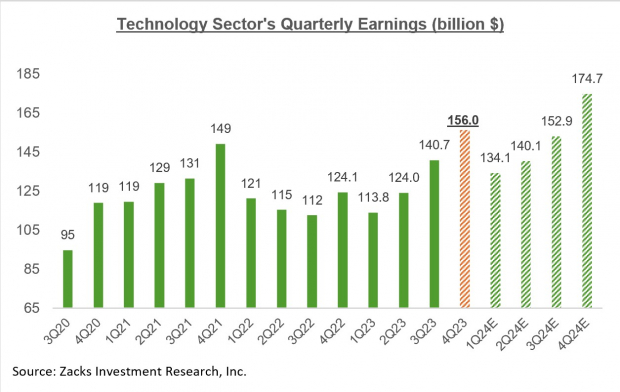

Third, the Tech sector is firmly back in the growth mode now, and the trend is expected to continue going forward.

For the 79.4% of Tech companies in the S&P 500 index that have reported Q4 results already, total earnings are up +20.5% on +6.1% higher revenues, with 83.3% beating EPS estimates and 71.7% beating revenue estimates.

Looking at Q4 results for the sector as a whole, combining the results that have come out with estimates for the still-to-come companies, total Tech sector earnings are on track to be up +25.7% from the same period last year on +8.2% higher revenues.

The sector went through a period of post-Covid adjustment in 2022 and the first half of 2023 when it became a drag on the aggregate growth picture.

Please remember that Tech isn’t just any other sector but rather the biggest earnings contributor to the S&P 500 index. The sector is currently expected to bring in 28.6% of the index’s total earnings over the coming four-quarter period, with the second and third biggest contributors in Finance and Medical at 17.8% and 12.5%, respectively.

This means that the Tech sector’s growth profile has a very big impact on the aggregate picture, both negatively and positively. The sector dragged down the aggregate growth picture in 2022 and the first half of 2023, now appearing ready to resume its historically positive growth role.

You can see this growth profile in the chart below, which also shows that the sector’s Q4 earnings are on track to reach a new all-time quarterly record of $156.0 billion.

Image Source: Zacks Investment Research

Please note that the Tech sector is instrumental in keeping the aggregate growth picture in positive territory in Q4. Of the reported results, the +5.1% earnings growth drops to a decline of -0.7% when Technology is excluded from the results.

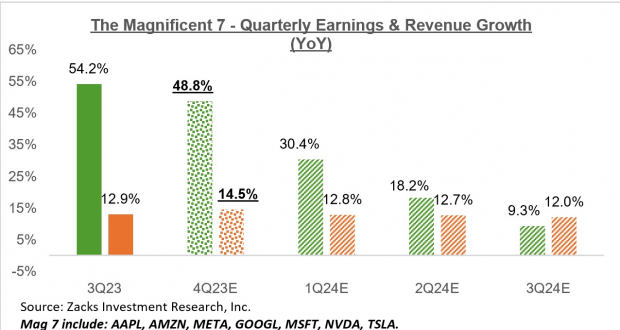

Fourth, related to the Tech sector’s strong showing is the dominance of the so-called Magnificent 7 companies – Apple AAPL, Amazon AMZN, Alphabet GOOGL, Microsoft MSFT, Meta META, Nvidia NVDA and Tesla TSLA.

Each of the Mag 7 companies relies on technological innovation to dominate its respective space. But strictly speaking, not all of them are in the Tech sector, as we at Zacks have Amazon as part of the Zacks Retail sector and Tesla as part of the Zacks Auto sector.

Nvidia will report its Q4 results on February 21st, but the rest of the Mag 7 members have already reported results. For Q4 as a whole for the group, combining the actuals that have come out for the six group members with estimates for Nvidia, total Mag 7 earnings are expected to be up +48.8% on +14.5% higher revenues.

The Mag 7 companies are expected to bring in 20% of all S&P 500 earnings in 2024 and currently account for 29.5% of the index’s total market capitalization.

Image Source: Zacks Investment Research

Please note that S&P 500 earnings growth for Q4 would be in negative territory if not for the heavy lifting from Mag 7: -3% vs. +5.4%.

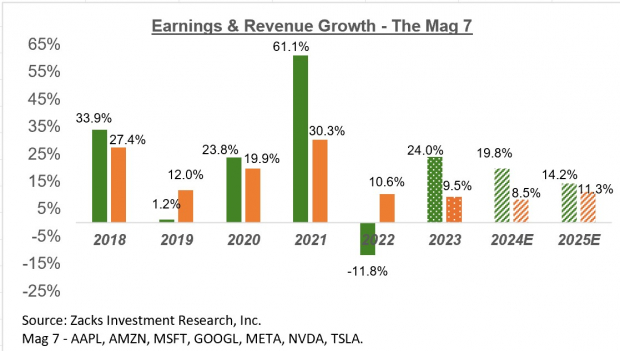

The chart below shows the Mag 7 earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

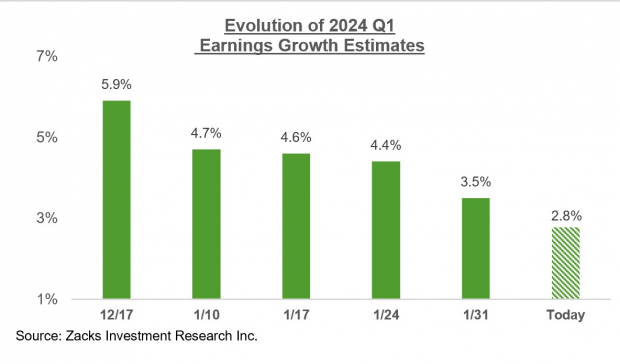

Five, the revisions trend has notably stabilized after appearing to turn substantially negative at the start of 2023 Q4.

Estimates for 2024 Q1 and full-year 2024 are modestly coming down, with negative revisions from some sectors mostly getting offset by positive revisions from others. The chart below shows how the earnings growth expectations for the period have evolved in recent months.

Image Source: Zacks Investment Research

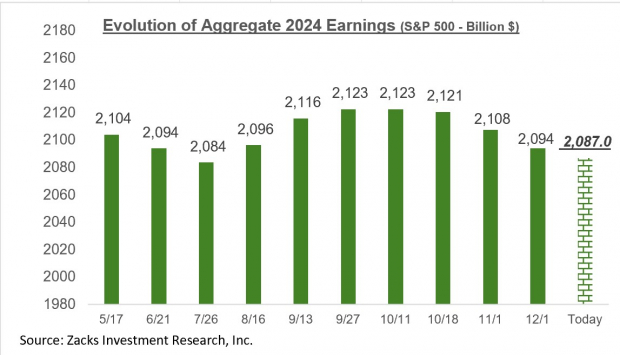

The chart below shows how the aggregate earnings expectation for full-year 2024 has evolved.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Q4 Results Paint a Positive Earnings Picture

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.