Republic Services, Inc. RSG reported impressive second-quarter 2022 results, with earnings and revenues surpassing the Zacks Consensus Estimate.

Adjusted earnings (excluding 15 cents from non-recurring items) per share of $1.32 outpaced the consensus mark by 11.9% and improved 21.1% year over year.

Republic Services' average recycled-commodity price per ton sold in the first quarter was $218, down $17 on a sequential basis but up $48 year over year.

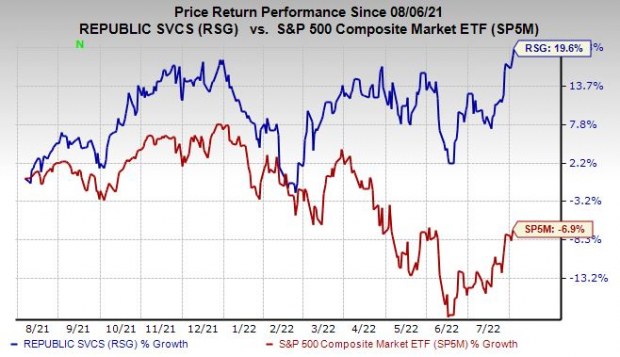

So far this year, shares of Republic Services have gained 19.6% against a 6.9% decline of the industry it belongs to.

Image Source: Zacks Investment Research

Revenues

Quarterly revenues of $3.41 billion surpassed the consensus estimate by 2.5% and increased 21.4% year over year. RSG’s top line includes a favorable impact of 11.1% from internal growth and 10.3% from acquisitions/divestitures.

Republic Services, Inc. Price, Consensus and EPS Surprise

Republic Services, Inc. price-consensus-eps-surprise-chart | Republic Services, Inc. Quote

Revenues in the Collection segment totaled $2.33 billion, up 13.1% year over year. Revenues in the Transfer segment (net) amounted to $191.9 million, rising 9.3% year over year. Revenues in the Landfill segment (net) totaled $406.1 million, increasing 9.5% year over year. Environmental solutions segment’s revenues (net) of $294.3 million surged more than 100% year over year. Other segment’s revenues of $191 million increased 12.9% year over year.

Operating Results

Adjusted EBITDA margin of 27.4% declined 210 basis points (bps) from the prior-year quarter’s levels.

Operating income was $589.6 million, up 13.8% from the year-ago quarter’s levels. The operating income margin declined to 17.3% from the year-ago quarter’s figure.

Total selling, general and administrative expenses were $391.5 million, up 24% from the year-ago quarter’s figure.

Balance Sheet and Cash Flow

Republic Services exited second-quarter 2022 with cash and cash equivalents of $119.4 million compared with $39 million at the end of the prior quarter.

Long-term debt (net of current maturities) was $11.6 billion compared with $9.61 billion at the end of the prior quarter.

RSG generated $857.9 million of cash from operating activities in the reported quarter. The Adjusted free cash flow was $621.1 million.

In the June quarter of 2022, RSG returned $145.3 million of total cash to its shareholders (including $203.5 million of share repurchases and $145.3 million of dividends paid).

During the reported quarter, RSG did not do any share repurchase. As of Jun 30, 2022, the remaining authorized purchase capacity under October 2020 repurchase program was $1.5 billion.

Currently, Republic Services carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dividend Hike

RSG announced that its board approved a dividend hike of approximately 8% to 49.5 cents per share. The new dividend will be paid out on Oct 14 to its shareholders of record as of Oct 3.

2022 Guidance

RSG raised its full-year adjusted EPS guidance to the $4.77-$4.80 range (prior view: $4.58-$4.65). The Zacks Consensus Estimate is pegged lower at $4.67.

Full-year adjusted free cash flow guidance is expected in the range of $1,700 -$1,725 million.

Recent Performances of Some Other Business Services Companies

Equifax EFX reported mixed second-quarter 2022 results, wherein earnings beat estimates but revenues missed the same.

EFX’s adjusted earnings of $2.09 per share beat the Zacks Consensus Estimate by 3% and improved 5.6% on a year-over-year basis. Revenues of $1.32 billion missed the consensus estimate marginally but improved 6.6% year over year.

IQVIA Holdings IQV reported solid second-quarter 2022 results, wherein its earnings and revenues surpassed the Zacks Consensus Estimate.

IQV’s adjusted earnings per share of $2.44 beat the consensus mark by 2.1% and improved 15% on a year-over-year basis. Total revenues of $3.54 billion outpaced the consensus estimate by 1.2% and increased 3% year over year.

Omnicom Group OMC reported impressive second-quarter 2022 results, wherein earnings and revenues surpassed the Zacks Consensus Estimate.

OMC’s earnings of $1.68 per share beat the consensus mark by 7.7% and increased 15.1% year over year, driven by a strong margin performance. Total revenues of $3.6 billion surpassed the consensus estimate by 4.4% but declined slightly year over year.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC): Free Stock Analysis Report

Equifax, Inc. (EFX): Free Stock Analysis Report

Republic Services, Inc. (RSG): Free Stock Analysis Report

IQVIA Holdings Inc. (IQV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.