Relative Strength Investing Trends: The Great Rotation

John Lewis, CMT, provides insights on noteworthy leadership changes taking place in the market, including improvements in many sectors of the market that had been previous laggards. He also takes a look at several measures of market breadth to gauge the overall health of this market as well as shares some key lessons learned about implementing relative strength strategies.

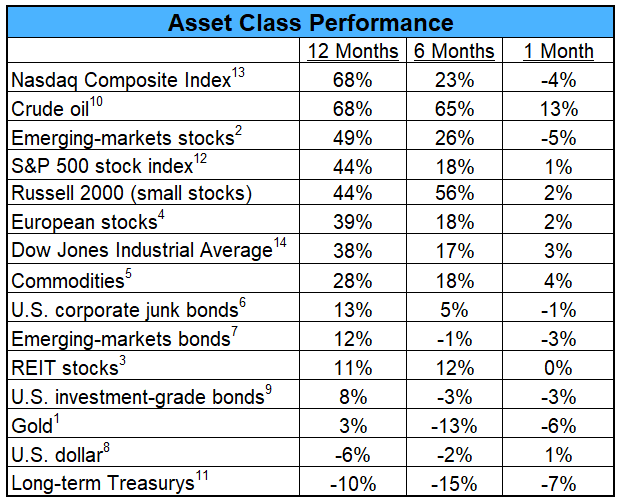

What’s Hot…and Not

How different investments have done over the past 12 months, six months, and one month. Never before has it been easier for investors to invest in the strongest trends wherever they might be found in the world due to the global nature of financial markets. Relative strength offers a disciplined framework for allocating among those trends. Markets are global, and your portfolio should be too. As of 3/11/21:

Past performance is not indicative of future results.

See disclosures in Appendix A, which includes the ETFs and Indexes used for this performance table. Performance numbers include dividends but do not include all transaction costs. Investors cannot invest directly in an index. Indexes have no fees. Past performance is not indicative of future results. Potential for profits is accompanied by possibility of loss.

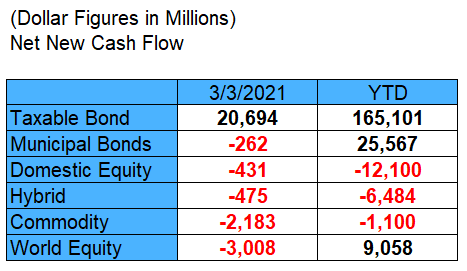

Fund Flows

Total estimated inflows to long-term mutual funds and net exchange-traded fund (ETF) issuance collected by The Investment Company Institute.

See disclosures in Appendix A.

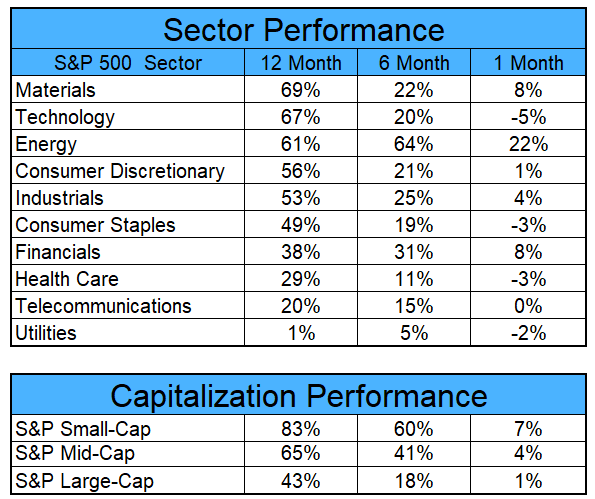

Sector and Capitalization Performance

Past performance is not indicative of future results. As of 3/11/21

See disclosures in Appendix A.

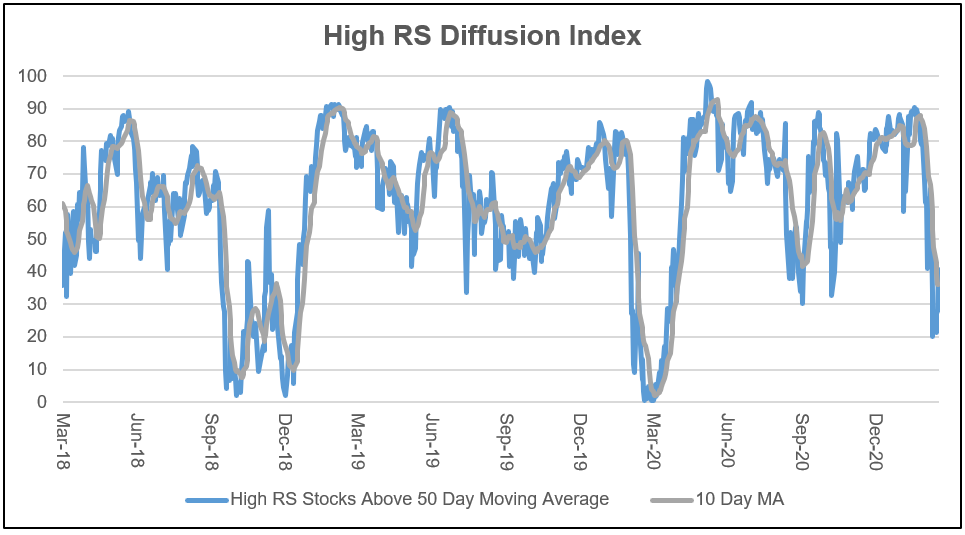

High RS Diffusion Index

As of 3/11/21:

The 10-day moving average of this index is 36%, and the one-day reading is 41%. This index measures the percentage of high relative strength stocks (top quintile of the ranks) which are trading above their 50-day moving average. Pullbacks in this index have often provided a good entry point for new money to relative strength strategies.

See disclosures in Appendix A.

Relative Strength Spread

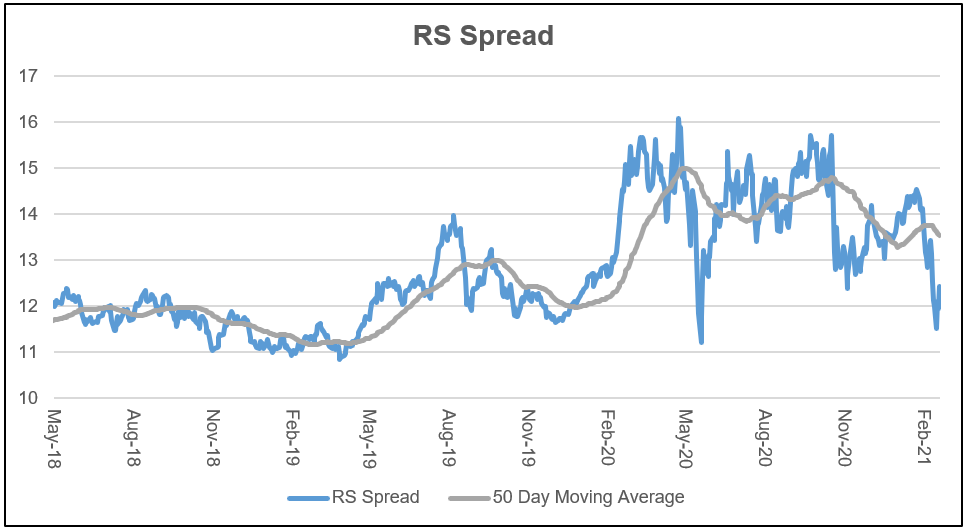

The chart below is the spread between the relative strength leaders and relative strength laggards (universe of mid and large-cap stocks). When the chart is rising, relative strength leaders are performing better than relative strength laggards. As of 3/11/21:

The RS Spread has dropped in recent months as we have seen the RS laggards have a sustained period of outperformance versus the RS leaders. If this strength continues, many of the RS laggards will continue to rise in the ranks until they will be the new RS leaders.

See disclosures in Appendix A.

Q&A with John Lewis, CMT

John Lewis, CMT, is the Senior Portfolio Manager at Nasdaq Dorsey Wright and has been with the firm since 2002. In this Q&A, John provides his insights into key market developments.

What are some of the key measures of market breadth that you follow, and what are those indicators suggesting today?

We look at a number of market indicators at Dorsey Wright. One of our favorites is the NYSE HILO indicator, which measures the percentage of stocks making new 52 week highs versus making new lows. That indicator is very bullish right now. There are a ton of stocks making new highs. On March 11, there were 511 new highs on the NYSE. That is the highest total since May 2013. Filtering out clusters, it is only the 9th time we have had a total that high since 1980! The average returns looking out 12 and 24 months have been very good when we get conditions like this. We also like to look at the percentage of high momentum stocks trading above their own 200-day moving average. This is an indicator that gives some insight into the health of the specific types of stocks our models tend to buy. That indicator is also very bullish right now, up around the 90% mark. We have seen a ton of rotation at a sector and capitalization level, but the overall market picture is positive. We think it will continue to remain very important to replace stocks as they break down and continue to rotate into the new leadership. But the extreme breadth numbers the emerging leadership should be able to carry the broad market higher as the old leadership fades.

If you turn back the clock to when you were developing the Tactical Fixed Income strategy, what were some of the factors/objectives that led to the strategy being designed the way that it is?

Tactical Fixed Income is an interesting strategy because we view the fixed income market so differently than most managers. We use a simple trend, following method rather than doing economic forecasting or individual credit analysis. This works very well with the kind of “risk-on, risk-off” methodology we adhere to. Three things really drove the construction of this strategy. First, we believe riskier bond sectors deliver superior performance until they don’t. The “until they don’t” part is what we try to avoid by de-risking the strategy at certain times. We will never get every risk-off move correct, but we believe there are significant opportunities in being active, and over time we will be right enough to deliver solid performance. The second thing we needed to account for was the different economic conditions that exist over time. Rates rise and fall. The economy expands and contracts. Different types of bonds perform well under different conditions, and we believe we have given ourselves good options to find strength in a number of different environments. The final thing that drove the construction of the strategy was the realization that fixed income markets are extremely complex, so we just needed to let the market tell us what to do. By examining price action and following trends, we can cut through all of the noise and focus on what matters most: price movement.

Can you speak to some of the noteworthy leadership changes that you are seeing from a sector, style, asset class, and capitalization perspective?

There have been massive leadership changes over the past few months. Investors have been waiting for the “Great Rotation” to come, and we may be in the early stages of it. Large-cap growth and Technology had been the main leadership for years. That has changed quickly. Technology stocks have fallen off, and we have seen things line Energy and Financials move toward the top of the ranks. Small-cap growth and value have also moved to the top of the style rankings. This has caused a number of changes in our strategies, and we have had higher than normal turnover so far this year. These types of changes take time to make as the old leadership gradually wanes and new areas of strength emerge.

Can you tell us about how your experience with testing relative strength strategies over the years has informed your decisions about the tradeoffs involved in using a more sensitive and less sensitive measure of relative strength?

All relative strength strategies need some way to filter out the noise. The entire purpose is to trade the trend and ignore as much of the noise as possible. That is a lot easier said than done. Financial markets are volatile, and there is a lot of short-term mean reversion. That noise can be filtered out in a number of ways. In point and figure relative strength, the box size becomes the noise filter. If you are using a price lookback, the length of that lookback becomes the filter. If you look at the last month of price data, you will wind up trading a lot of the noise. Sure, you will be able to rapidly adjust your holdings when things change, but there is so much short-term mean reversion you will make too many changes. The sweet spot for equities tends to be around six months at the short end and 12 months at the upper end. People tend to think looking at 12 months of price history, for example, just requires too long to make changes. But all the data we have seen shows that you need to be willing to let your winners work for you and go through their ups and downs over time. Let’s face it—huge winners don’t grow on trees, or else this business would be extremely easy. So when you find one, hold on to it for dear life because you only need a couple of them to make your entire year. Eventually, you will have to part ways with said winners, but it’s usually not as soon as you think. If you allow your winners to work for you, there will be times when you should have sold earlier, and you will look for reasons why you should have sold. The reality is that you’re never going to be perfect. The data shows it pays off in the long run to give your winners the benefit of the doubt. If you don’t, you just wind up trading on short-term noise and getting killed by the paper cuts.

The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Relative Strength is a measure of price momentum based on historical price activity. Relative Strength is not predictive and there is no assurance that forecasts based on relative strength can be relied upon to be successful or outperform any index, asset or strategy. In all securities trading there is a potential for loss as well as profit.

Other Relative Strength Sources

- Brush, John S. "Eight Relative Strength Models Compared." Journal of Portfolio Management (1986).

- Berger, Israel, Moskowitz. "The Case for Momentum Investing." AQR Capital Management. 2009.

- Jegadeesh and Titman. "Returns to Buying Winners and Selling Losers." Journal of Finance (1993).

- O'Shaughnessy, James P. What Works on Wall Street. McGraw Hill, 1997.