Red River Bancshares, Inc.’s RRBI board of directors has approved the renewal of the company’s stock repurchase program. With the approval, it is authorized to purchase up to $5 million of outstanding shares of common stock, commencing Sep 1, 2021, through Aug 31, 2022.

The new stock buyback program replaces the previous $3-million one, which was authorized on Aug 27, 2020. The buyback program expired on Aug 27, 2021.

Blake Chatelain, the company’s president and chief executive officer, noted, “we are pleased to renew our stock repurchase program. Approval of this plan shows our ongoing commitment to creating long-term value for our shareholders.”

The company’s capital deployment program seems encouraging and showcases the company’s efforts to reward shareholders handsomely. In the first half of 2021, it repurchased 41,314 shares of its common stock for $2.2 million and had $701,000 available under the $3-million repurchase program at the second-quarter end.

Aside from this, it began paying dividends quarterly from first-quarter 2020. It currently pays a quarterly dividend of 7 cents per share. Considering the last day’s closing price of $50.17, Red River’s dividend yield currently stands at 0.6%. Dividends are not only attractive to income investors but also represent a steady income stream. In fact, the company’s current payout ratio of 6.18% is lower than its industry’s average of 28.5%, indicating scope for its steady dividend increase.

Red River has a solid balance sheet and liquidity position. As of Jun 30, 2021, the company had total cash and due from banks of $241.4 million, and no subordinated debt or other borrowings. Thus, its earnings strength and robust liquidity imply that it will be able to meet any debt obligations in the near term, even if the economic situation worsens.

Its earning strength indicates that Red River’s capital deployments are sustainable and will continue enhancing shareholder value.

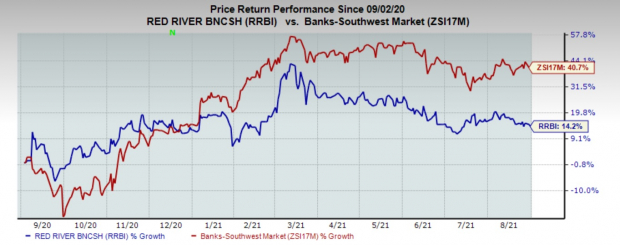

Shares of Red River have rallied 14.2% over the past 12 months, underperforming the industry’s growth of 40.7%.

Image Source: Zacks Investment Research

As investors are always on the lookout for companies with a track record of encouraging capital deployment activities to bet their money on, solid dividend payouts and share repurchases are, therefore, arguably the biggest enticement for investors. Such moves also boost investors’ confidence in the stock and will likely bump up the company’s shares in the upcoming period.

Currently, Red River carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Similar Moves by Other Banks

Over the past few months, several banks have announced share-repurchase programs. Some of these are WesBanco, Inc. WSBC, First Financial Northwest, Inc. FFNW and Zions Bancorp. ZION.

WesBanco’s board of directors authorized the buyback of up to 3.2 million shares with no expiration date.

First Financial Northwest announced a share-repurchase program, under which it will buy back about 5% of the outstanding common stock or 476,000 shares.

Zions announced that its board of directors authorized additional share repurchases worth up to $200 million for the third quarter of this year. In July, the company announced the third-quarter repurchase authorization worth up to $125 million. Thus, now, the total buyback authorization for the third quarter is $325 million.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zions Bancorporation, N.A. (ZION): Free Stock Analysis Report

WesBanco, Inc. (WSBC): Free Stock Analysis Report

First Financial Northwest, Inc. (FFNW): Free Stock Analysis Report

Red River Bancshares, Inc. (RRBI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.