Another one bites the dust: Conference Board walks back U.S. recession call

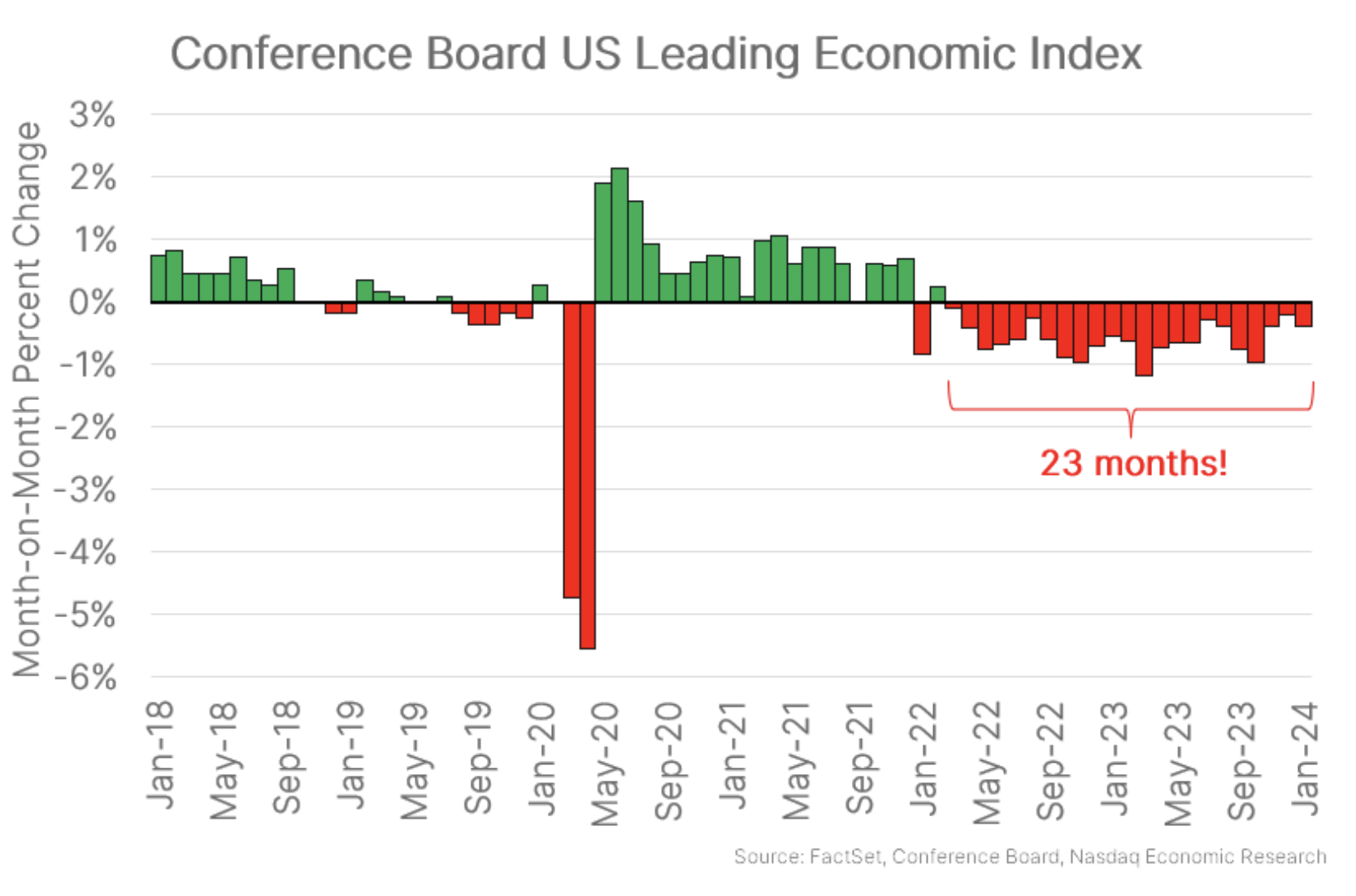

This week has been a quiet one for data. The Conference Board’s Leading Economic Index (LEI) was the one big release we got.

As a leading indicator of the economy, the LEI is meant to predict when the U.S. economy is headed for recession. Well ... the latest data show it has contracted for the 23rd straight month!

Despite this, the Conference Board became the latest forecaster to walk back its U.S. recession prediction.

The persistent weakness of the LEI mainly comes from two areas: manufacturing and consumer sentiment. But this hasn’t translated to recession. That’s because:

- Manufacturing is only about 10% of the U.S. economy, compared to 70% for services. So strength in services can overwhelm weakness in manufacturing.

- Consumer spending has stayed strong, even though consumers say they’re not confident despite falling inflation, solid real wage gains, and a still strong labor market.

So the U.S. has avoided recession.

Not all major economies avoiding recession

But that hasn’t been the case for some other major economies.

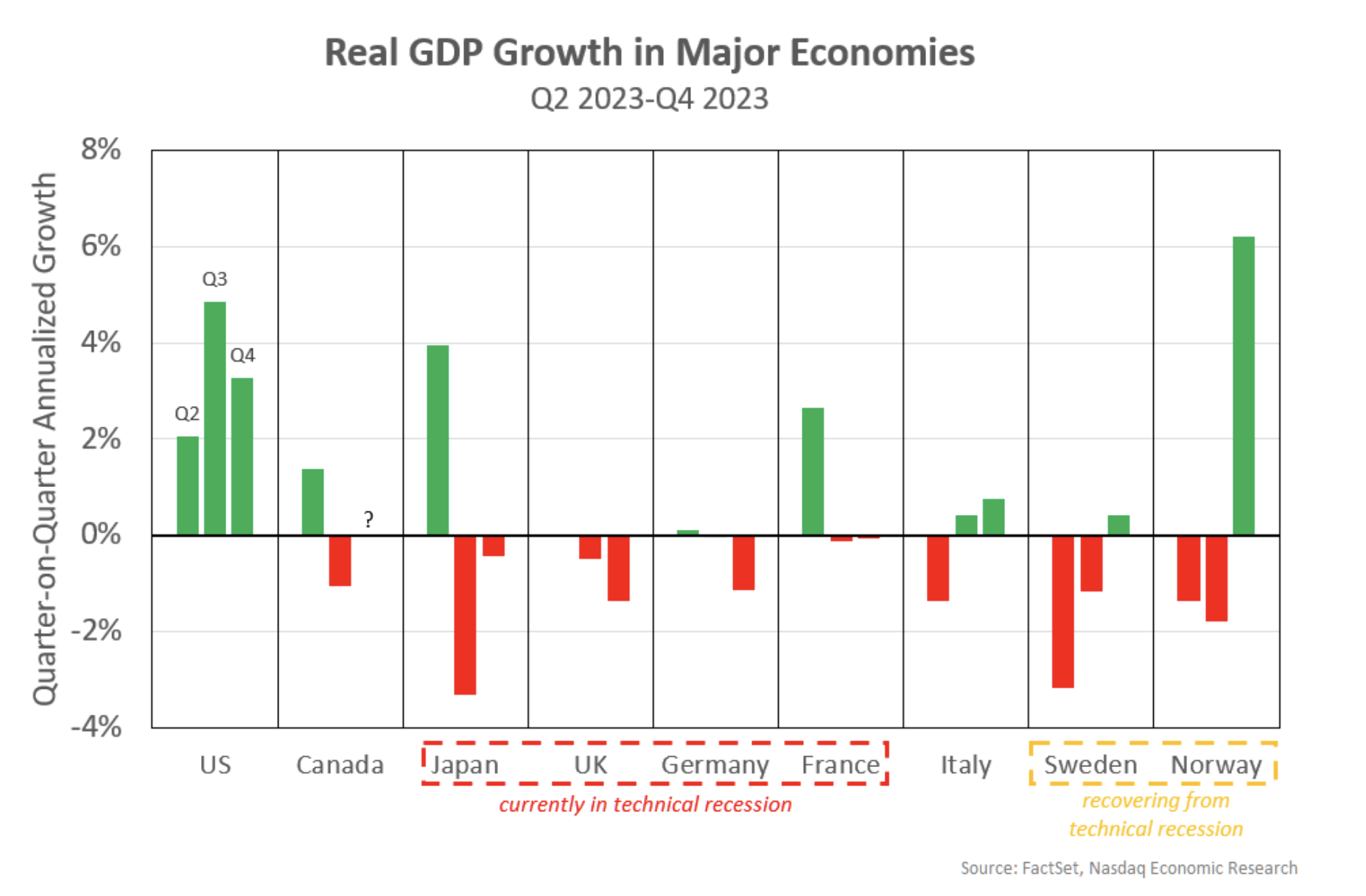

Several major economies are now in or just came out of “technical” recessions (two or more quarters of negative GDP growth). Fortunately, these recessions have generally been mild.

The chart below looks at real GDP growth for the last three quarters of 2023. Six of the nine economies shown are either currently in a technical recession (Japan, the UK, Germany, and France) or exited one in Q4 (Sweden and Norway).

Only the U.S., Canada, and Italy have avoided recession.

Still not all doom and gloom

Still, only looking at GDP is a crude way to judge the health of an economy. That’s why the NBER looks at measures of employment, income, and sales in addition to output to determine U.S. recessions.

In fact, despite these technical recessions, many of these economies still have solid labor markets (the unemployment rate is just 3.7% in Norway, 3.1% in Germany, and 2.4% in Japan).

So most of these economies are in an okay spot. And the recessions have mostly been mild (so far). One other positive is that recessions make it easier for central banks to justify cutting rates.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.