South Jersey Industries SJI, through strategic capital investments, aims to strengthen infrastructure and efficiently serve customers. Its improving earnings estimates and steady dividend payments make a strong case for investment in the utility space.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projection & Surprise History

The Zacks Consensus Estimate for 2022 and 2023 earnings per share has moved up 4.3% and 5.5% year over year, respectively.

South Jersey Industries delivered an average earnings surprise of 105.5% in the last four quarters.

Dividend

Currently, SJI has a dividend yield of 3.58% compared with the industry’s 2.6%. SJI has a long history of 71 years of dividend payment and has raised annual dividends for 22 consecutive years. The stable performance of SJI has allowed it to distribute dividends to shareholders at regular intervals.

South Jersey Industries plans to maintain the target of 3% annual dividend growth in the 2021-2025 time frame, subject to the approval of the board of directors.

Stable Investments

South Jersey Industries projects a systematic capital expenditure of $3.5 billion for the 2021-2025 time period, with more than 80% allocated for growth, safety and reliability of customers. It has also planned for 100% reduction in carbon emissions by 2040.

The well-chalked-out capital expenditure of SJI is also driving earnings growth per share. South Jersey Industries expects earnings CAGR of 5-8% within the 2021-2025 time period.

Steady Customer Growth

South Jersey Industries continues to expand the customer base, which will drive the demand for its services. In 2019, SJI was able to add more than 9,500 new customers to the customer base, while in 2020, the company added in excess of 12,000 customers, with more than 70% converted from heating oil or propane.

The same trend was noticed in 2021 as well, with SJI adding more than 10,000 new customers, the majority of them converted from heating oil or propane.

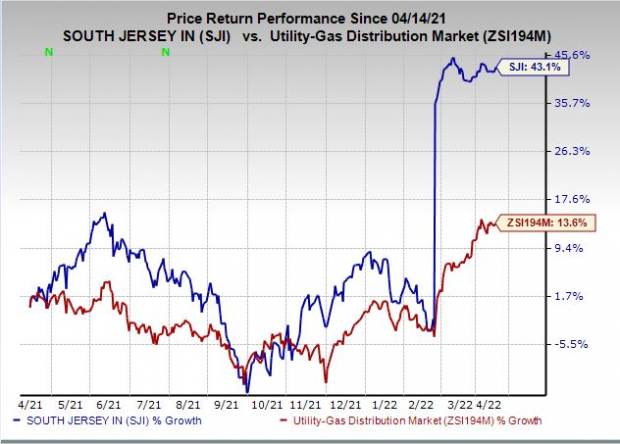

Price Performance

In the past year, the stock has gained 43.1% compared with the industry’s 13.6% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other similar-ranked stocks from the sector include NewJersey Resources NJR, National Fuel Gas NFG and Ameren AEE.

Currently, NewJersey Resources, National Fuel Gas and Ameren have a dividend yield of 3.2%, 2.6% and 2.4%, respectively, compared with the Zacks S&P 500 composite's average of 1.5%.

The Zacks Consensus Estimate for 2022 earnings per share of NewJersey Resources, National Fuel Gas and Ameren has moved up 5.56%, 31.7% and 5.47%, respectively, year over year.

In the past three months, NJR, NFG, and AEE shares have surged 16.5%, 8.6% and 9.8% respectively.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ameren Corporation (AEE): Free Stock Analysis Report

South Jersey Industries, Inc. (SJI): Free Stock Analysis Report

National Fuel Gas Company (NFG): Free Stock Analysis Report

NewJersey Resources Corporation (NJR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.