Pinnacle West Capital Corporation’s PNW ongoing capital investment will further enhance its infrastructure and help create a clean generation portfolio. PNW’s strong growth opportunities make it a solid investment option in the utility sector.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) company a good investment option at the moment.

Growth Projections & Long-term Earnings Growth

The Zacks Consensus Estimate for Pinnacle West Capital’s 2023 earnings per share (EPS) has moved up 3.5% to $4.18 in the past 90 days.

The consensus estimate for 2023 sales is pinned at $4.55 billion, indicating year-over-year growth of 5.2%.

PNW’s long-term (three- to five-year) earnings growth rate is 6.46%.

Return on Equity

Return on equity (ROE) indicates how efficiently a company has been utilizing the funds to generate higher returns. Currently, Pinnacle West Capital’s ROE is 6.55%, higher than the industry’s average of 5.41%. This indicates that the company has been utilizing the funds more constructively than its peers in the utility electric power industry.

Debt Position

Currently, PNW’s total debt to capital is 59.12%, better than the industry’s average of 61.13%.

The time to interest earned ratio at the end of second-quarter 2023 was 2.5. The ratio, being greater than one, reflects the company’s ability to meet future interest obligations without difficulties.

Dividend Yield

Pinnacle West Capital continues to increase shareholders’ value through dividend payments. Currently, the company’s quarterly dividend is 86.5 cents per share, resulting in an annualized dividend of $3.46 per share. PNW’s current dividend yield is 4.67%, better than the utility electric power industry’s 3.9%.

Systematic Investments

Pinnacle West Capital’s consistent investments to upgrade and maintain the existing infrastructure help provide reliable services to its expanding customer base. The company has a capital plan of $5.32 billion for 2023-2025, at an average annual growth rate of 5-7%. It expects new investments and establishment of businesses to further increase demand for its services.

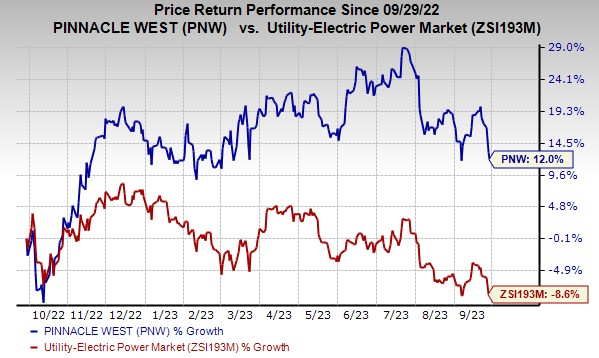

Price Performance

In the past year, Pinnacle West Capital’s shares have risen 12% against the industry’s average 8.6% decline.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are TransAlta TAC and Vistra Corp. VST, both sporting a Zacks Rank #1 (Strong Buy), and ALLETE ALE, holding a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TAC’s 2023 EPS indicates a year-over-year increase of 1,912.5%. It delivered an average earnings surprise of 107.1% in the last four quarters.

The Zacks Consensus Estimate for VST’s 2023 EPS indicates a year-over-year improvement of 220.4%. The same for sales indicates a year-over-year increase of 47.8%.

ALE’s long-term earnings growth rate is 8.1%. The Zacks Consensus Estimate for 2023 EPS implies year-over-year growth of 8.6%.

Top 5 ChatGPT Stocks Revealed

Zacks Senior Stock Strategist, Kevin Cook names 5 hand-picked stocks with sky-high growth potential in a brilliant sector of Artificial Intelligence. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

Today you can invest in the wave of the future, an automation that answers follow-up questions … admits mistakes … challenges incorrect premises … rejects inappropriate requests. As one of the selected companies puts it, “Automation frees people from the mundane so they can accomplish the miraculous.”

Download Free ChatGPT Stock Report Right Now >>Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

TransAlta Corporation (TAC) : Free Stock Analysis Report

Allete, Inc. (ALE) : Free Stock Analysis Report

Vistra Corp. (VST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.