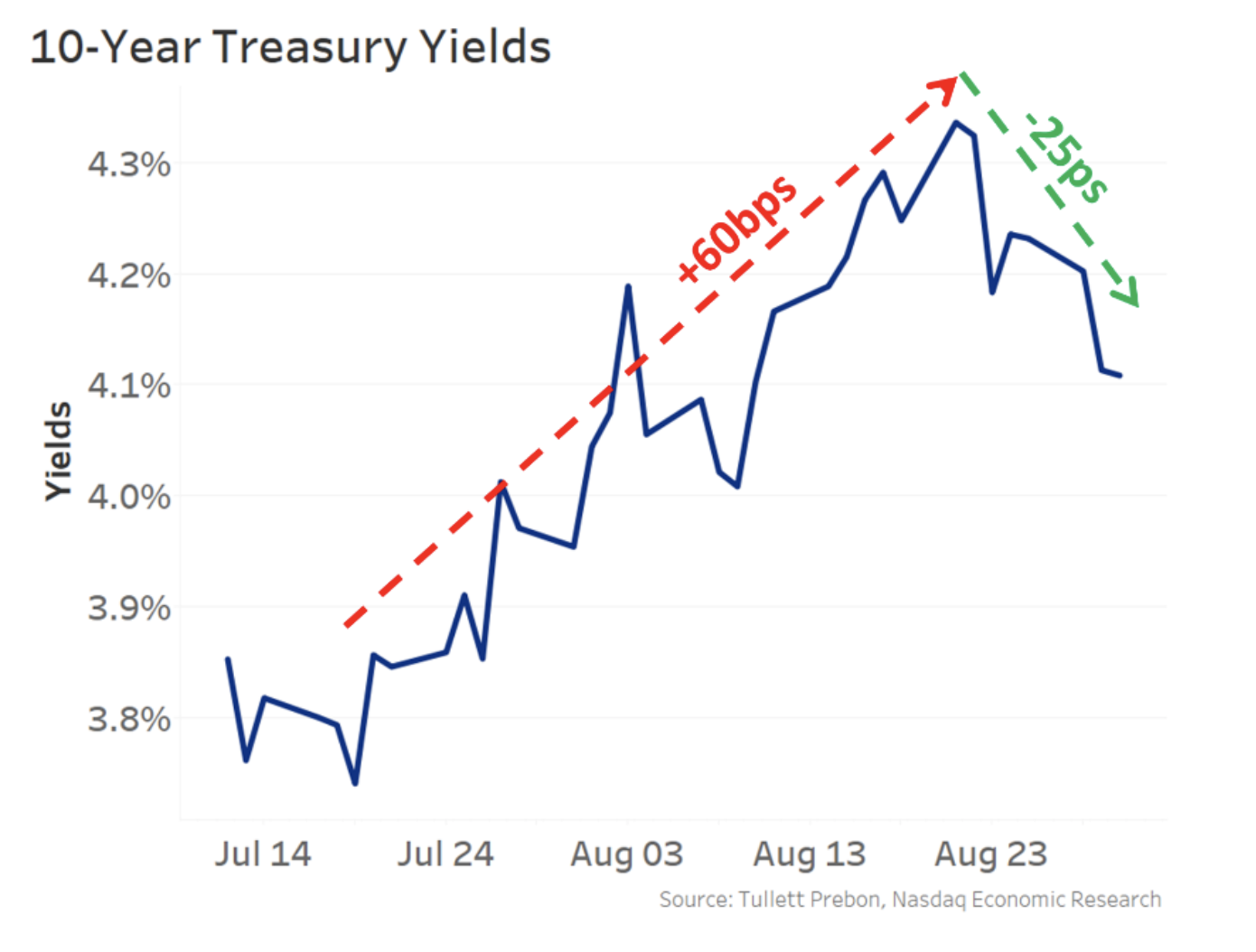

Just last week we wrote about how stronger data had pushed up 10-year Treasury rates by 60bps since mid-July, contributing to the Summer selloff in equities.

What a difference a week makes!

10-year rates down 25bps over the 10 days, contributing to recent equity rally

10-year Treasury rates are down 25bps to 4.1% over the last 10 days, coming off a 16-year high of 4.34%. At the same time, the major equity indices are up 2%-4%.

The job market had been running hot – adding to rate hike odds

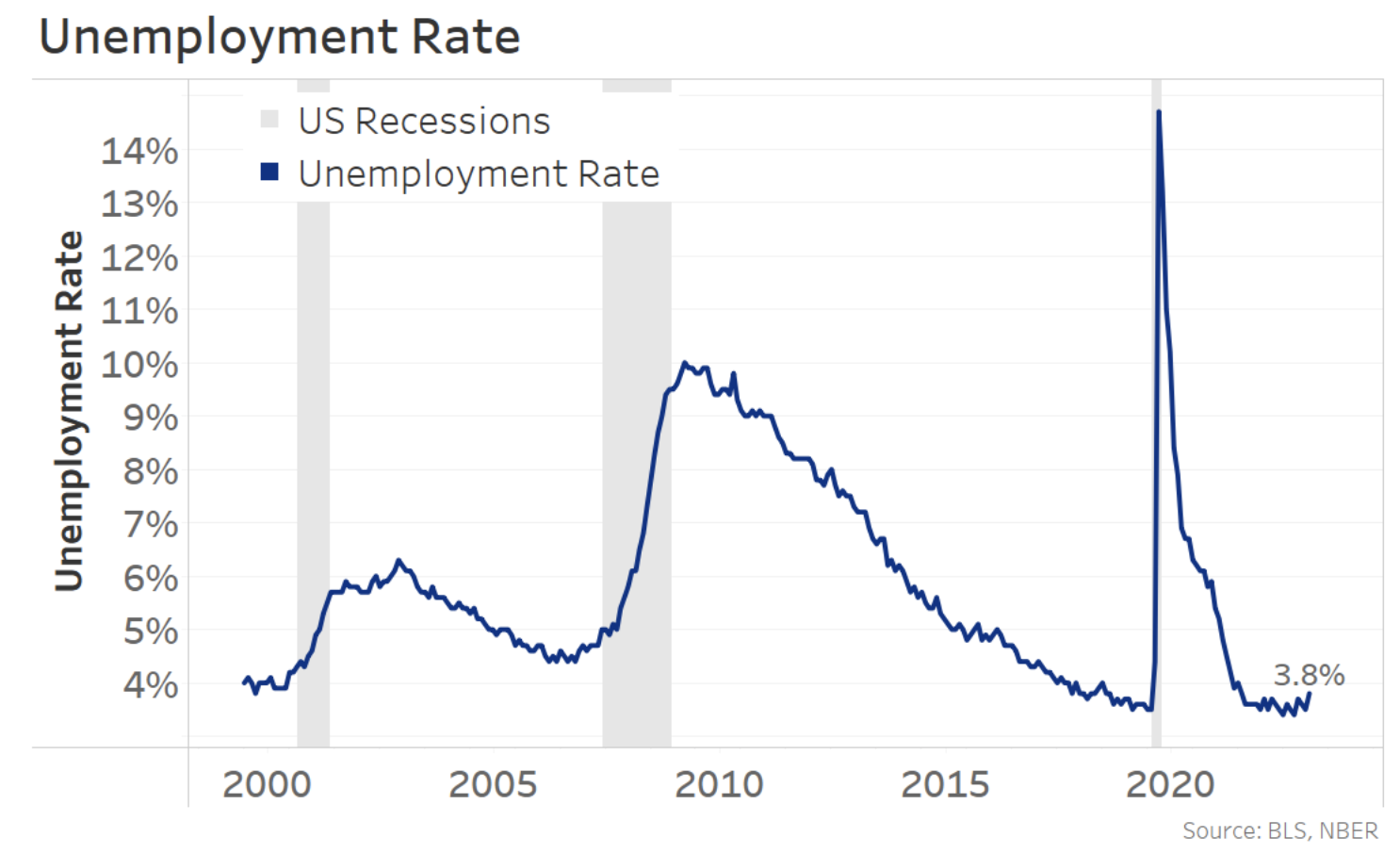

For a while now, inflation has been slowing, but the job market still seemed to be very strong. After all, the unemployment rate is just 3.5% – near its low since 1969.

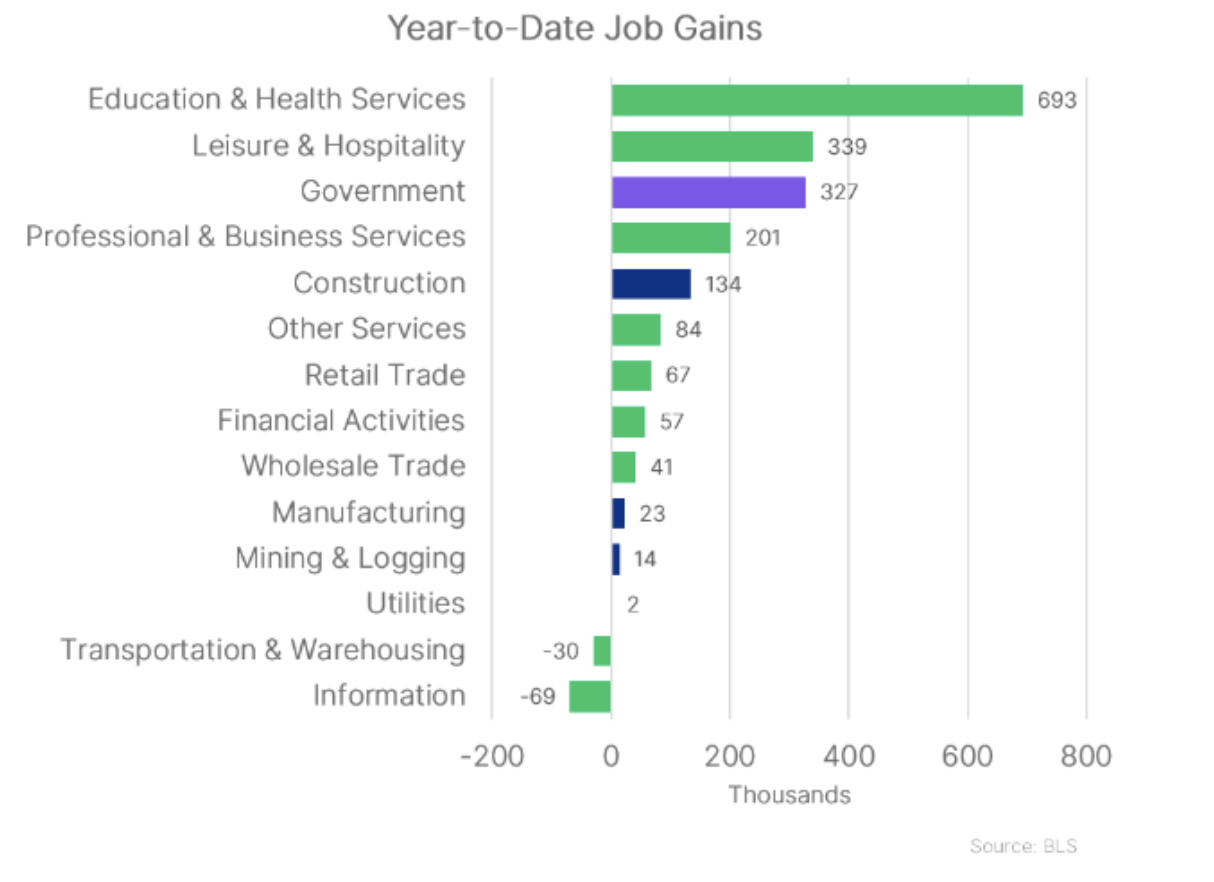

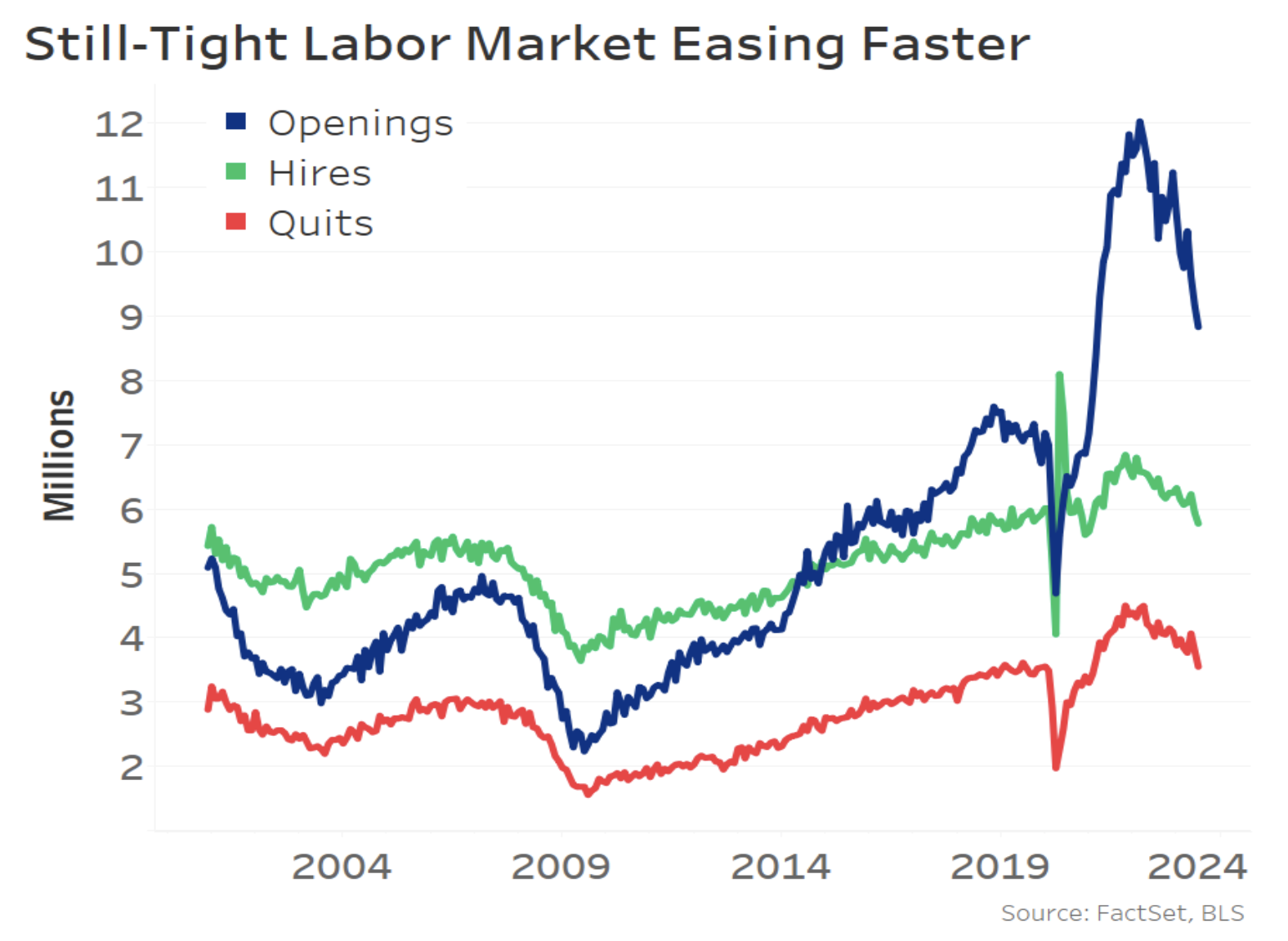

And at one point, we had 2 jobs for every unemployed person. Demand for workers was incredibly strong, especially in some of the sectors still recovering from Covid-era losses – and they’ve been leading the way in year-to-date job gains.

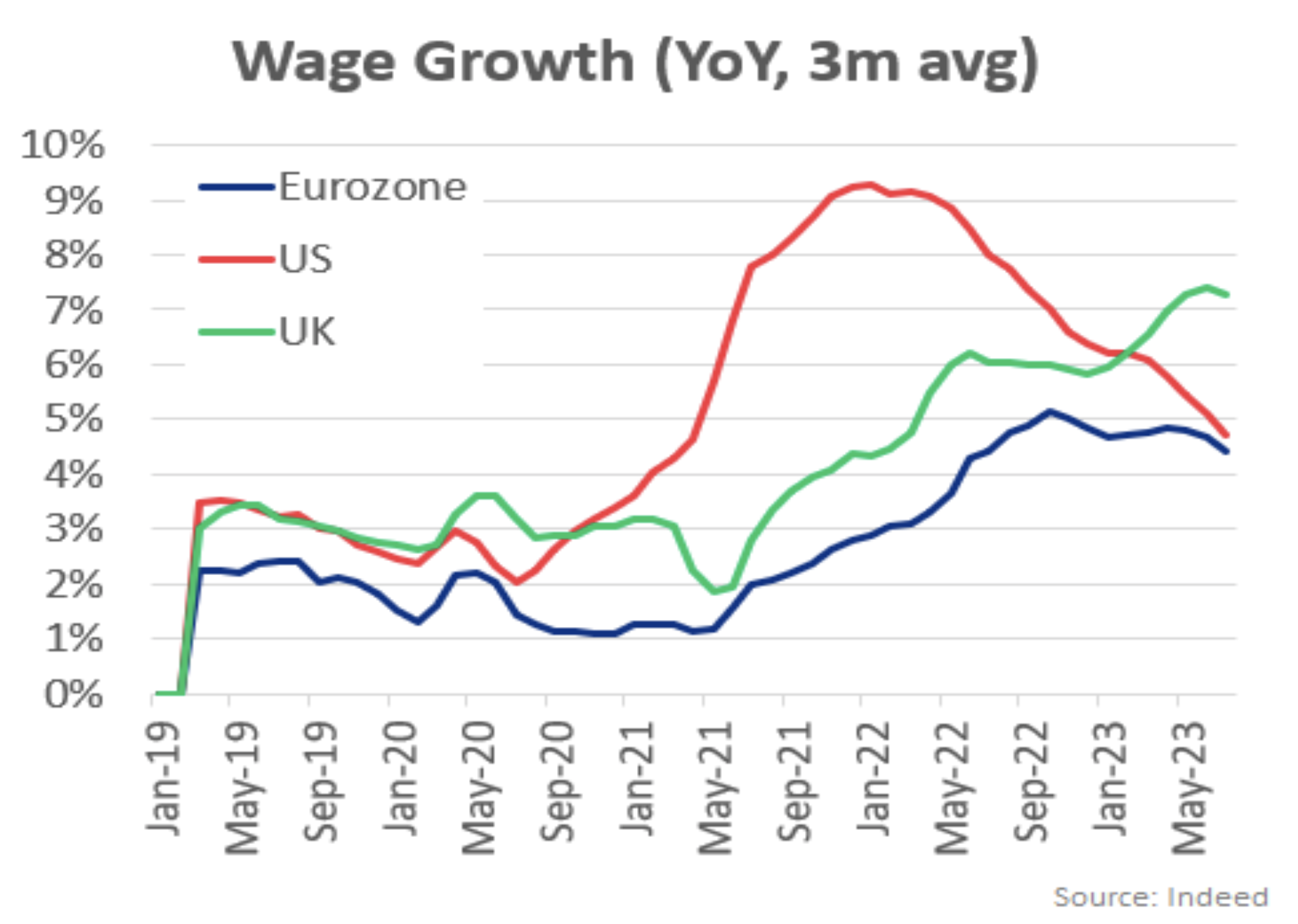

As a result, wages (especially in the USA) had risen, in particular in sectors where workers were slow to return to old jobs.

Signs of labor market softness pushing down rate hike odds

However, this week may be proof we have finally started to get back to normal in the job market. We can already see wage pressures declining (above). This week’s new hiring data showed:

- We’re down to 1.5 job openings per unemployed person, from a peak of 2, and now in a clear downtrend (blue line)

- New Hires are back to pre-pandemic “normal” levels (green line)

- Which has even got people thinking twice about quitting (red line) – the surest sign that labor market confidence is easing

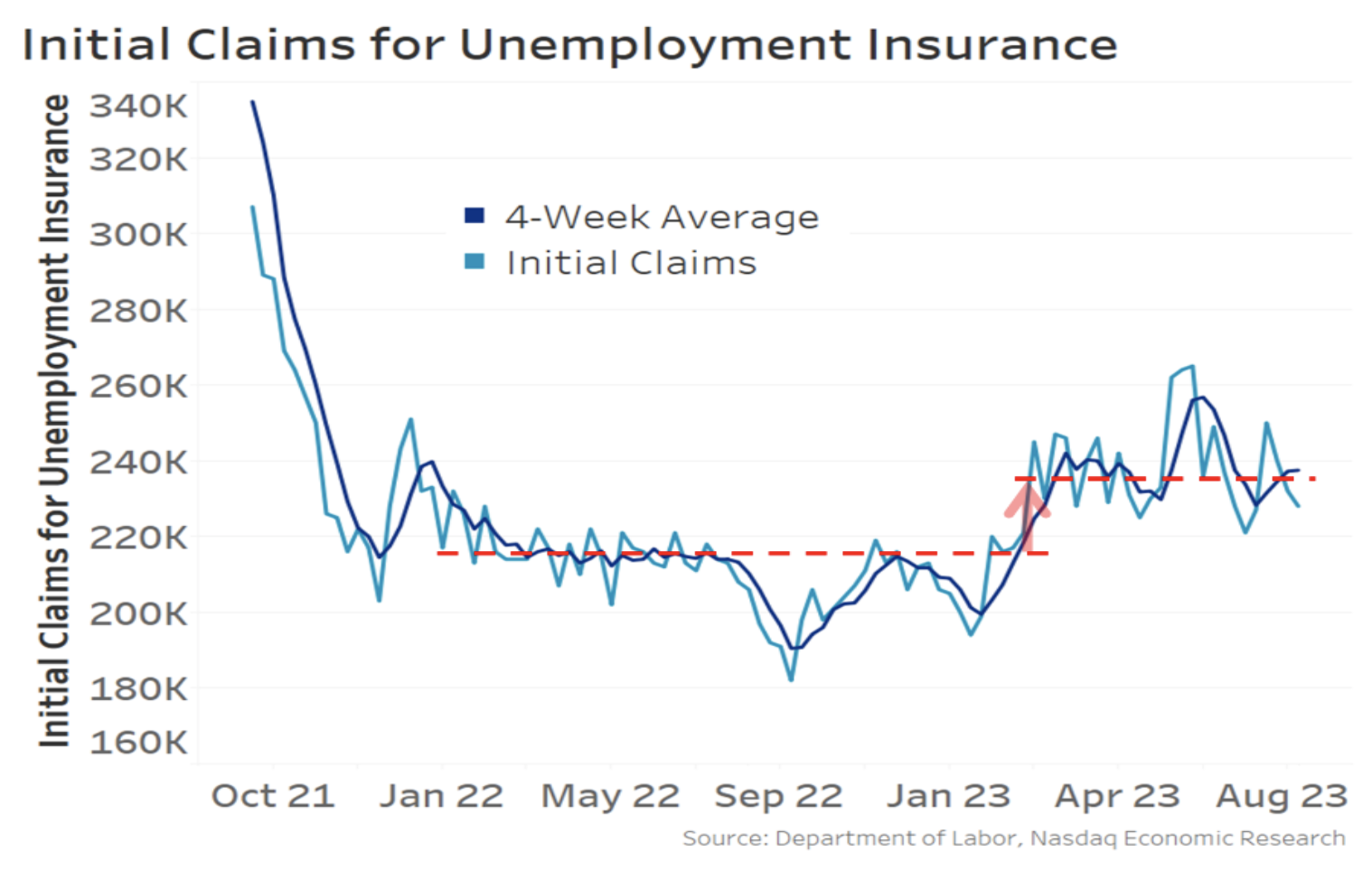

A while ago we also noticed an uptick in people losing their jobs, which has now stabilized, but at a higher level (Although we’d note that this level of claims is still low by historical standards).

Moreover, the unemployment rate staying stable around 3.5% shows that people losing their jobs are finding new work quickly.

This looks like a Goldilocks scenario for the Fed

It seems the labor market is softening in the least painful way possible. Less heat in the market, without causing unemployment.

Despite the Fed increasing rates 5.25% since March 2022, the unemployment rate has increased all the way from 3.4% to ... 3.5%.

Yet the labor market has clearly softened, thanks to job openings falling 25%.

With inflation falling, and the labor market weakening too, the theory is the Fed won’t need to raise rates any (or much) more. Market expectations of one more 0.25% rate hike fell from 67% to 45% after this week’s data, and some Fed officials now think no more rate hikes are needed.

Even more labor market data tomorrow

Friday's employment data will be the next measuring stick for the labor market. Consensus expectations are for 170k jobs added and for the unemployment rate to stay at 3.5%. The Fed (and markets) will also be looking for wage growth slowing a bit further.

If we slow just enough to reduce costs, but not too much to create unemployment, that makes a soft landing for the economy more and more likely.

Editor's note: Since this was published, the jobs report showed that the economy added 187,000 jobs against expectations of 170,000, but wage gains also slowed.