A mostly graphical daily curated roundup of the markets and the economy from Nasdaq's IR team.

| in easy money policy land = "the Nikkei (+0.33%) continuing to post fresh all time highs after the 34 year gap that was filled last week."

-Deutsche Bank, Jim Reid

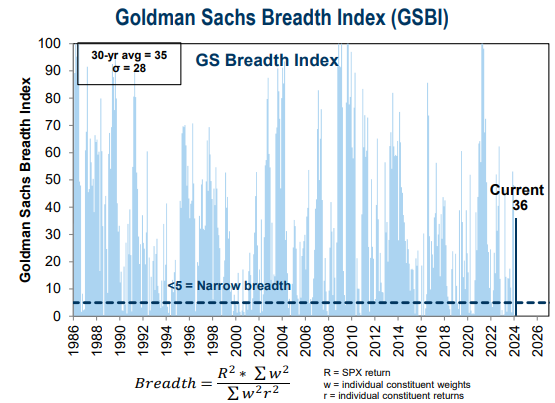

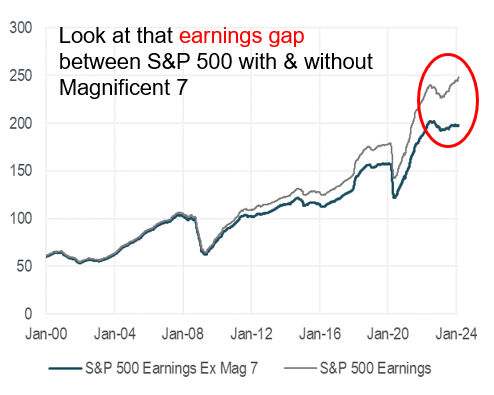

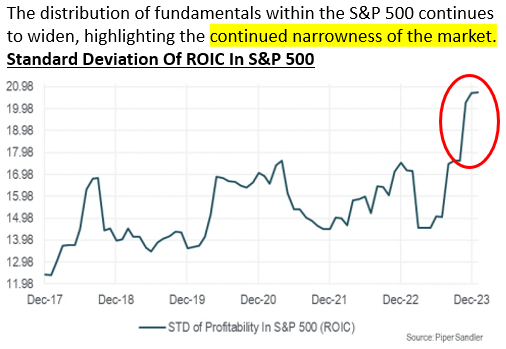

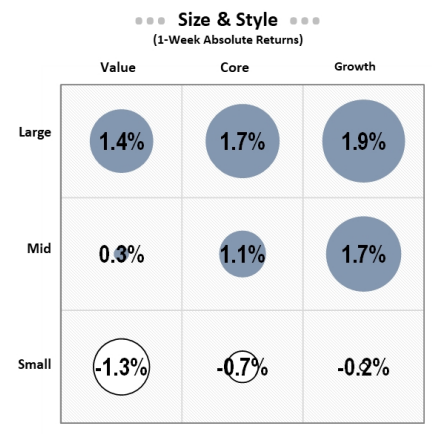

| lack of market breadth = equities driven by a handful of stocks | "our "Monopolistic Bull"…contribution to SPX +25% gain past 12 months of "Magnificent 7" = >60%, contribution of top 10 stocks (add WMT + COST + ELI) = >70%, contribution of top 20 stocks = >80%."

-BofA's Michael Hartnett, The Flow Show

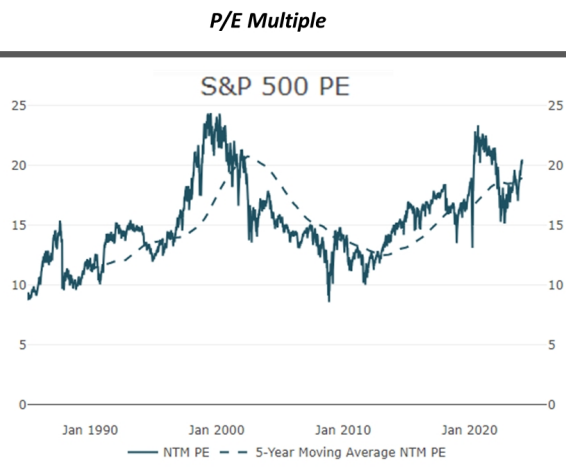

| "...we are very far bubble territory at least for the large cap names by way of valuation (if this is a bubble its one of the lamest one’s we’ve ever seen...NDX at 35x trailing 12m...in the late 90s tech bubble it went into the 90s!)"

-Richard Privorotsky, Goldman Sachs

* source: Goldman Sachs Global Investment Research

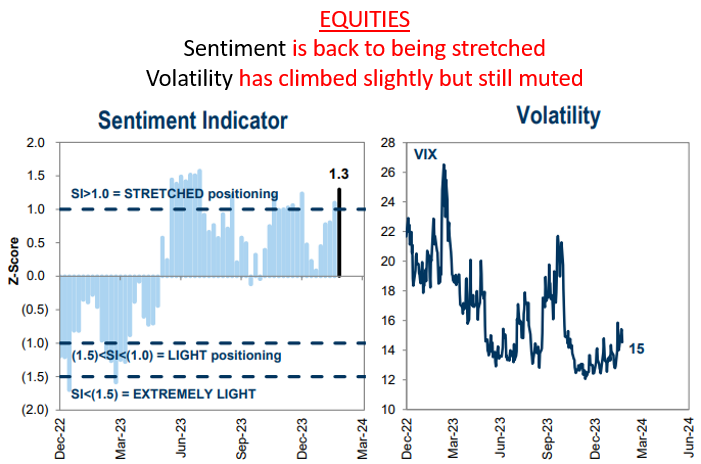

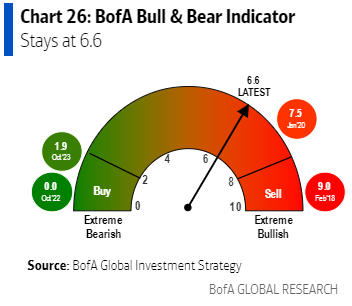

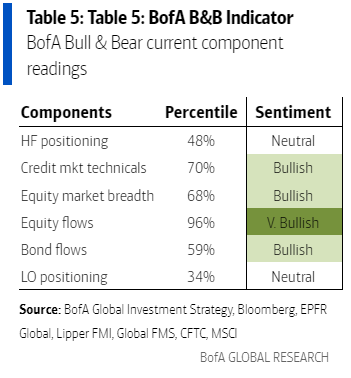

interesting to note that long only + hedge fund positioning is neutral = investors are still somewhat nervous...?

* source: BofA, The Flow Show, Michael Hartnett

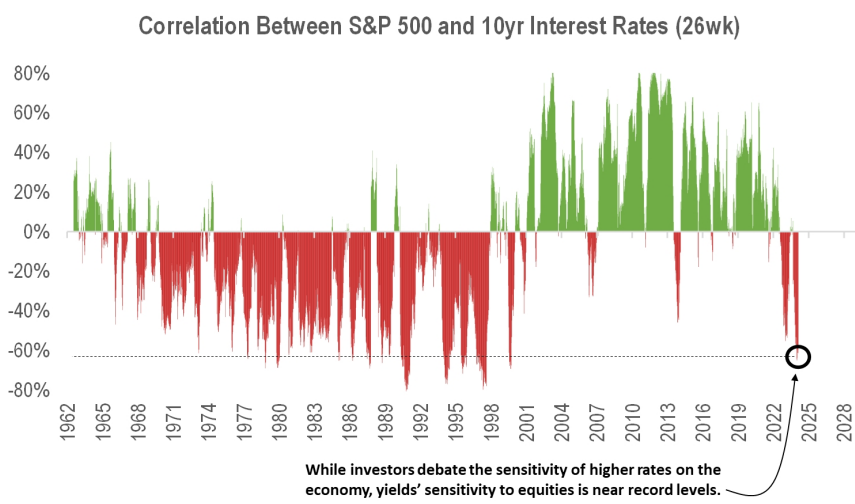

| entering a new regime...?

* source: Piper Sandler

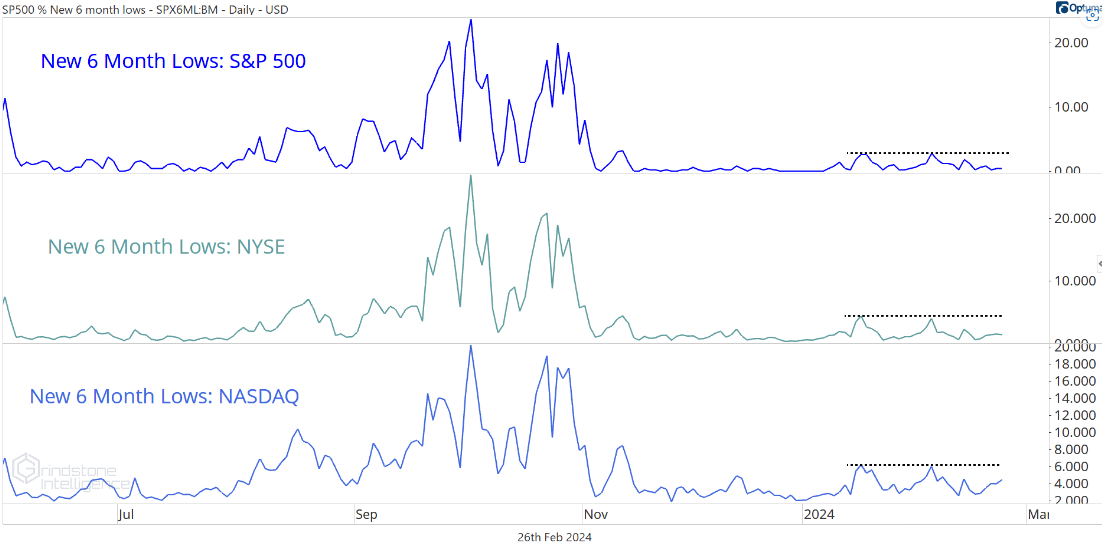

| "list of stocks setting new 52WK highs stopped going up more than 2 months ago BUT list of stocks setting new 6month lows has been subdued all year." -Grindstone Intelligence

* source: Grindstone Intelligence

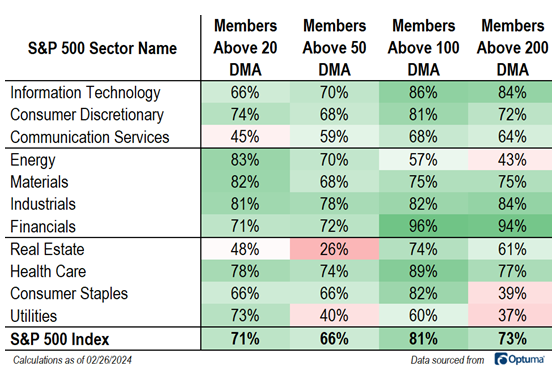

so I guess market breadth is not terrible but not encouraging either...

* source: Goldman Sachs Global Investment Research

so I guess market breadth is not terrible but not encouraging either...

73% of S&P 500 members are above their 200-day moving average

* source: Grindstone Intelligence

| "There are two ways that market breadth can broaden out from here: 1) a broad earnings recovery; or 2) lower bond yields."

-Michael Kantrowitz, Piper Sandler

* source: Piper Sandler

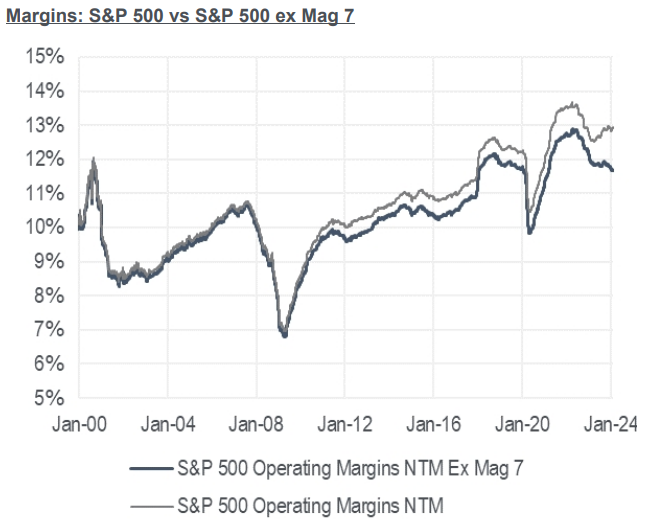

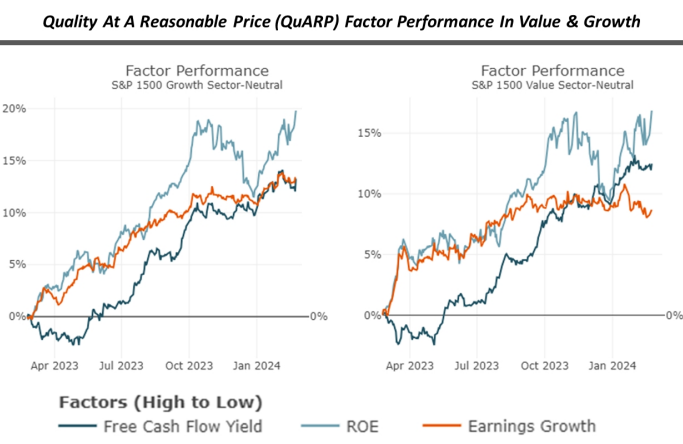

| I would add tax cuts + deregulations here as the catalyst | "we continue to favor QUARP (quality at a reasonable price) – that’s where the earnings strength is! We would recommend that investors avoid low-quality areas (lower ROE, Growth, etc.) until there is a catalyst (i.e. numerous rate cuts) and evidence of a broader earnings recovery taking place"

-Michael Kantrowitz, Piper Sandler

* source: Piper Sandler

| Rocket ships | Other large caps contributing to performance (non Mag 7)...

* source: CNBC

| "Until there is a broad-based recovery in earnings, we recommend a Quality At A Reasonable Price (QuARP) portfolio tilt across all size and style mandates" -Piper Sandler

| "As the rise in multiples continues, there is even more pressure on earnings to deliver in ‘24." -Piper Sandler

* source: Piper Sandler

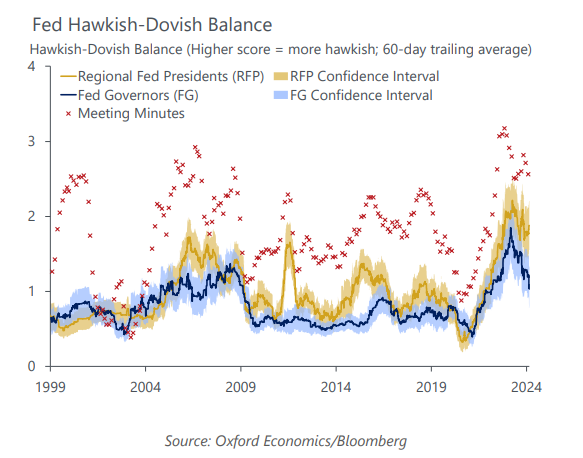

| Reasons for equity market rally | Fed has turned relatively dovish according to Oxford Economics... but is this sustainable?

* source: Oxford Economics

* source: Goldman Sachs Global Investment Research

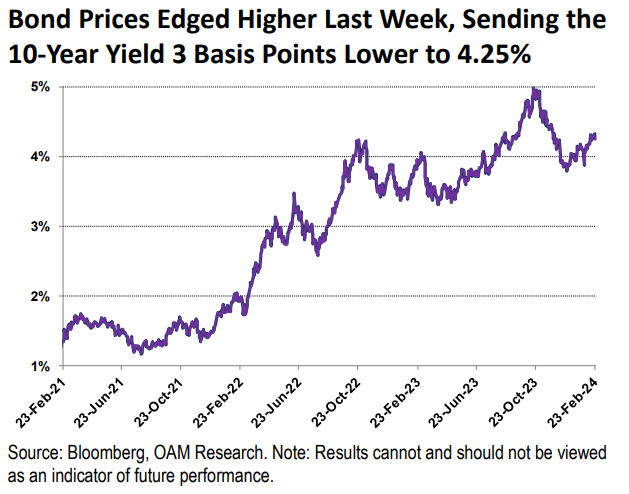

| US10YR yield holding above 4%...

* source: John Stoltzfus, Oppenheimer Asset Management

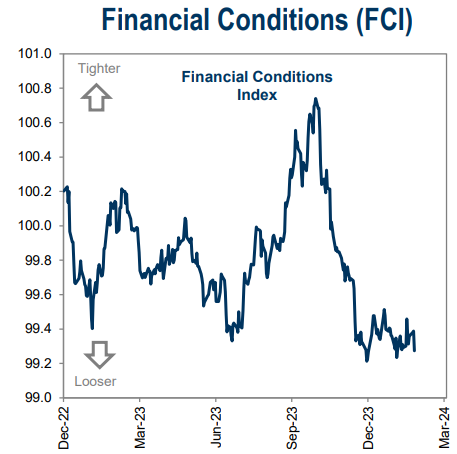

| Credit spreads remain tight, risk appetite is strong...

* source: Oxford Economics

1) KEY TAKEAWAYS

1) Equities + Oil + TYields HIGHER | Dollar + Gold LOWER

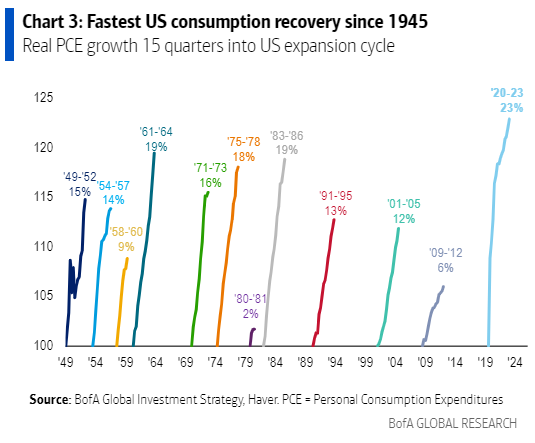

Inflation data in focus on Thursday (PCE) | ISM Manufacturing on Friday

Berkshire shares jump after big profit gain as Buffett’s conglomerate nears $1 trillion valuation -CNBC

DJ +0.2% S&P500 +0.0% Nasdaq +0.1% R2K +0.5% Cdn TSX +0.1%

Stoxx Europe 600 -0.2% APAC stocks MIXED, 10YR TYield = 4.274%

Dollar LOWER, Gold $2,026, WTI +1%, $77; Brent +0%, $82, Bitcoin $51,939

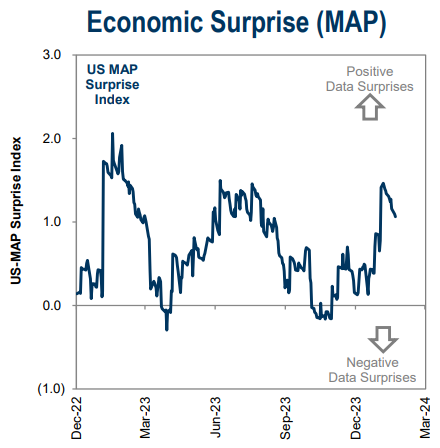

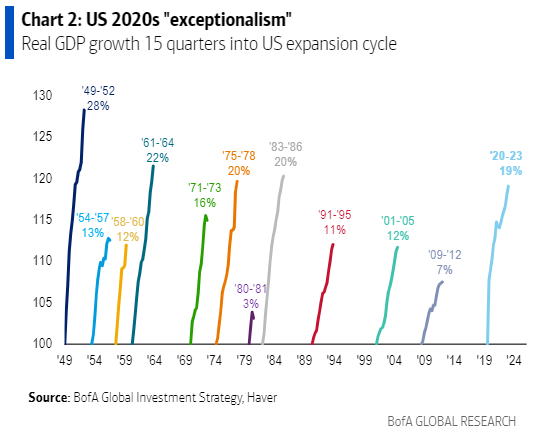

2) Economic surprises have been positive helping with market sentiment but lowering odds of rate cuts...

* source: Yardeni Research

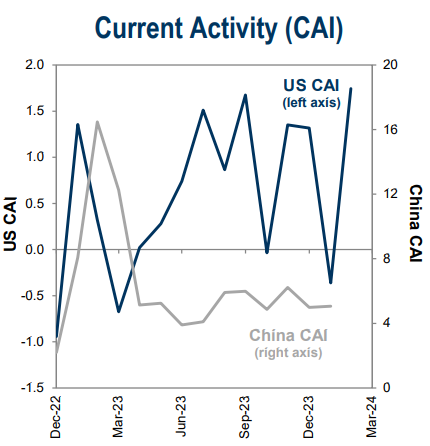

Our Current Activity Indicator measures the growth signal in major high-frequency activity indicators for the US economy, expressed in GDP-equivalent units.

* source: Goldman Sachs Global Investment Research

* source: BofA, The Flow Show, Michael Hartnett

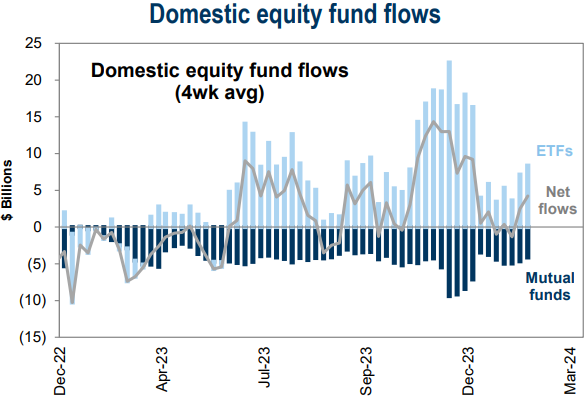

3) FLOWS: Passive > Active

* source: Goldman Sachs Global Investment Research

* source: Piper Sandler

5) THIS WEEK:

"focus will be on the US PCE inflation release, with other inflation reports also due in Europe and Japan. Otherwise, several economic activity indicators will be released for key economies, including PMI gauges in China.

Corporate earnings feature Berkshire Hathaway, Salesforce and Dell."

-Deutsche Bank

2) ESG, COMPILED BY NATHAN GREENE

Farmers protest across Europe, press ministers to act - Reuters

-The 27-nation EU has already weakened some parts of its flagship Green Deal environmental policies, scrapping a goal to cut farming emissions from its 2040 climate roadmap.

China Objects to EU’s Border Carbon Tax, Backs Global Market - BNN

-Collaborating on a global carbon market would be a better option than the EU tax, said Zhao Yingmin the country’s vice minister for the environment. China is also considering an expansion of its domestic carbon trading system, he said

-China is currently at risk of missing its 2025 climate targets, after it ramped up the use of coal to boost its heavy industries in 2023.

3) MARKETS, MACRO, CORPORATE NEWS

- ECB’s Makhlouf in no rush to cut as sigilance on wages needed-Y

- Global house prices rebound as economists predict turning point-FT

- German export sentiment brightens in February-RTRS

- Most UK exporters hit by Red Sea disruption, survey shows-RTRS

- Funds' short yen betsto test Japan's intervention resolve-RTRS

- Iron ore falls to four-month low on weak China steel demand-BBG

- Biden to meet congressional leaders with shutdown clock ticking-RTRS

- Trump pledges to slash taxes if he returns to the white house-BBG

- Billionaire-backed Koch network to stop funding Nikki Haley after defeat-FT

- US hopeful of Gaza ceasefire and hostage deal in ‘coming days’-FT

- US aid package needed within a month, says Volodymyr Zelenskyy-FT

- Libya protests halt Wafa Oil Exports, gas pipeline to Italy-BBG

- China’s weak local borrowing raises hope for more Central aid-BBG

- China state firm sells bonds to help fund LGFV in rare move-BBG

- Broadcom nears $3.8 billion saleof remote access unit to KKR-RTRS

- Rolls-Royce starts talks with partners on narrow-body jet engines-LT

- Disney, reliance said to ink binding India media merger pact-BBG

- Ford halts shipments of new F-150 Lightning EVs-RTRS

- After spurning Zee, Sony sets sights on aha-MINT

- Megaport on M&A watchlists as Slattery heads for exit-AFR

- Ryanair demands compensation from Boeing for aircraft delivery delays-FT

- Alcoa makes $2.2 billion bid for Australian Partner-BBG

- New Jeep CEO cuts prices, expands lineup to regain market share-BBG

Oil/Energy Headlines: 1) US and British strikes on Houthi sites in Yemen answer militants’ surge in Red Sea attacks on ships -AP 2) US says ‘understanding’ reached at Gaza hostage talks but negotiations continue -CNN 3) Oil extends losses on cautious interest rate outlook -RTRS 4) U.S. and U.K. launch fourth round of airstrikes against Houthis in Yemen -AXIOS 5) US says Yemen's Houthis ballistic missile misses US tanker Torm Thor -RTRS 6) Shortage of Oil Tankers at Hand as Red Sea Attacks Divert Trade -BBG 7) China’s Brisk Oil Buying After Holiday Raises Demand Hopes -BBG 8) Libya Resumes Wafa Oil Field, Italy Gas Link After Short Halt -BBG 9) Goldman Sachs lifts its Brent summer peak forecast to $87 a barrel -RTRS

About the author

Massud Ghaussy, CFA, is part of Nasdaq's IR Insights team and delivers daily insights that empowers readers to get a sense of the important issues impacting the day's trading.