Qualcomm Incorporated QCOM is scheduled to report fourth-quarter fiscal 2024 earnings on Nov. 6, 2024. The Zacks Consensus Estimate for revenues and earnings is pegged at $9.9 billion and $2.56 per share, respectively. Earnings estimates for QCOM have improved from $10.05 per share to $10.08 for 2024 and from $10.92 per share to $10.93 for 2025 over the past 90 days.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

QCOM Estimate Trend

Image Source: Zacks Investment Research

Earnings Surprise History

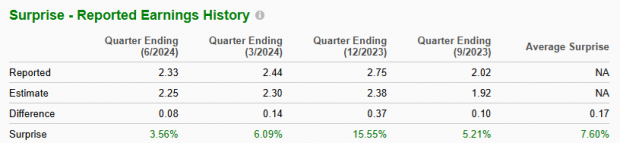

The chip manufacturer delivered a four-quarter earnings surprise of 7.6%, on average, beating estimates on each occasion. In the last reported quarter, the company pulled off an earnings surprise of 3.6%.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model predicts an earnings beat for Qualcomm for the fiscal fourth quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is perfectly the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Qualcomm currently has an ESP of +0.48% with a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Shaping the Upcoming Results

With the accelerated rollout of 5G technology, Qualcomm is benefiting from investments toward building a licensing program in mobile. The company is well-positioned to meet its long-term revenue targets driven by solid 5G traction, greater visibility and a diversified revenue stream. The company intends to harness artificial intelligence (AI) to meet increased demands for essential products and services that are the building blocks of digital transformation in a cloud economy. Qualcomm envisions solid growth opportunities within the mobile space, driven by the strength of its Snapdragon portfolio.

During the fiscal fourth quarter, Qualcomm announced that Samsung deployed its advanced Snapdragon 8 Gen 3 Mobile Platform across the new Galaxy Z series smartphones, Galaxy Z Fold6 and Galaxy Z Flip6 models. The Snapdragon 8s Gen 3 mobile platform boasts an immersive Snapdragon Elite Gaming feature and AI-enhanced photos to help users capture and edit photos with improved quality and creativity. It highlights Qualcomm's growing prowess in the AI chip market, demonstrating its commitment to bringing top-tier AI experiences to end users.

In the fiscal fourth quarter, Qualcomm collaborated with Aramco to deploy generative AI-powered Internet of Things (IoT) solutions to accelerate digital transformation initiatives in Saudi Arabia. The solution suite includes a Rapid Response Solution that bolsters situational awareness and minimizes operational disruptions with the help of on-device AI and computer vision. The system features autonomous AI drones with generative AI flight control that respond quickly and effectively to onsite incidents.

The Factory Monitoring Solution delivers real-time insights and predictive analytics to enhance operational efficiency and safety with advanced video surveillance. Utilizing multimodal inputs and hybrid AI in conjunction with on-device AI and edge cloud AI processing, the Equipment Maintenance Solution streamlines maintenance practices. Moreover, its AI native worker assist technology effectively predicts and prevents equipment failures, optimizing performance, lowering maintenance costs and reducing downtime. These initiatives are likely to be reflected in the upcoming results.

Price Performance

Over the past year, Qualcomm has gained 37.8% compared with the industry’s growth of 51.1%, outperforming peers like Hewlett Packard Enterprise Company HPE but lagging Broadcom Inc. AVGO.

Image Source: Zacks Investment Research

Key Valuation Metric

From a valuation standpoint, Qualcomm appears to be relatively cheaper compared to the industry and below its mean. Going by the price/earnings ratio, the company shares currently trade at 14.96 forward earnings, lower than 21.62 for the industry and the stock’s mean of 17.6.

Image Source: Zacks Investment Research

Investment Considerations

Qualcomm is one of the largest manufacturers of wireless chipsets based on baseband technology. The company is focusing on retaining its leadership in 5G, chipset market and mobile connectivity with several technological achievements and innovative product launches. It is likely to help users experience a seamless transition to superfast 5G networks, delivering low-power resilient multi-gigabit connectivity with unprecedented range and Qualcomm's best-in-class security. This, in turn, offers the flexibility and scalability needed for broad and fast 5G adoption through accelerated commercialization by OEMs.

The company is reportedly the only chipset vendor with 5G system-level solutions spanning both sub-6 and millimeter wave bands and one of the largest RF (radio frequency) front-end suppliers with design wins across all premium-tier smartphone customers. Leveraging the technology roadmap for a focused approach to innovation, it aims to connect millions of devices to the ‘connected intelligent edge.’

In addition, solid growth opportunities within the mobile space led by innovations in the Snapdragon portfolio for premium-tier Android handsets and a firmer footing in the emerging market of driver-assistance technology with the Snapdragon Ride Advanced Driver Assistance Systems portfolio are tailwinds.

End Note

With solid fundamentals and healthy revenue-generating potential driven by robust demand trends, Qualcomm appears to be a solid investment proposition. It also looks cheaper relative to its valuation metrics. Further, a strong emphasis on quality, diligent execution of operational plans and continuous portfolio enhancements are driving more value for customers. With improving earnings estimates, the stock is witnessing a positive investor perception.

Riding on a robust earnings surprise history and favorable Zacks Rank, it appears primed to record solid quarterly results in the ensuing earnings. Hence, investors are likely to profit if they bet on this high-flying stock now.

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpQUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.