By Stjepan Kalinic

This article first appeared on Simply Wall St News.

After an impressive recovery and a new all-time high in 2020, QUALCOMM Incorporated(NASDAQ:QCOM) is underperforming the market, with stock being down 4% year to date.

This article will look at the returns over the last 5 years and examine the latest attempts to turn the stock back to the winning territory again.

Benchmarking Returns

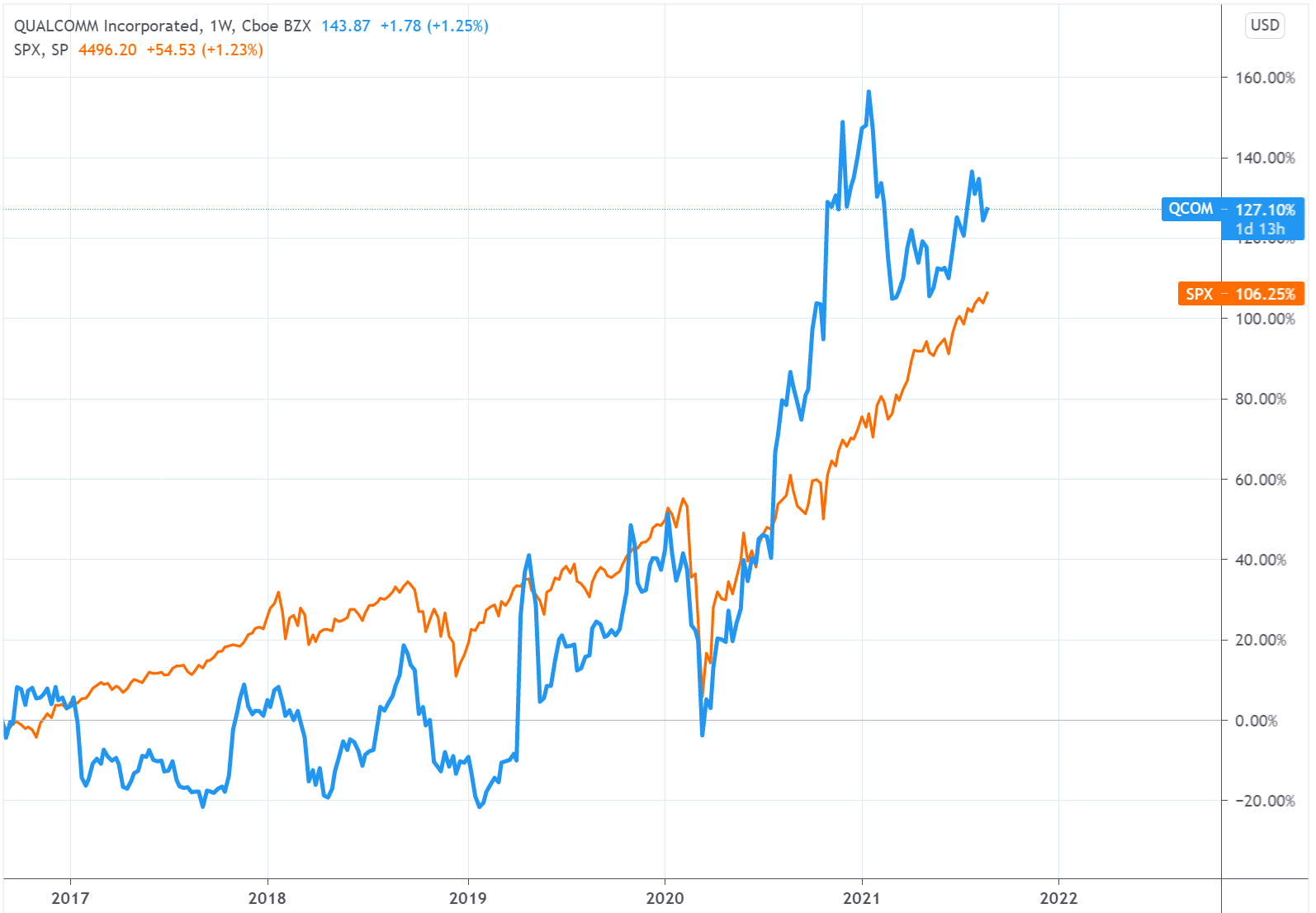

While the stock returned 127% over the last 5-years, it lagged the S&P500 for most of the time and only outperformed in the last 12 months.

Now it's worth having a look at the company's fundamentals, too, because that will help us determine if the long-term shareholder return has matched the performance of the underlying business.

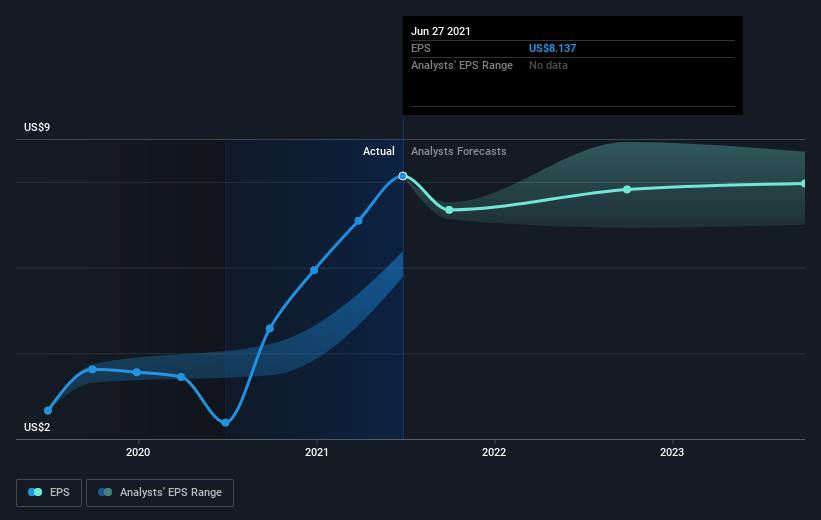

One way to examine how market sentiment has changed over time is to look at the interaction between its share price and its earnings per share (EPS).

During the last half-decade, QUALCOMM became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) are depicted in the image below (click to see the exact numbers).

It is, of course, excellent to see how QUALCOMM has grown profits over the years, but the future is more important for shareholders. This free interactive report on QUALCOMM's balance sheet strength is a great place to start if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return and the share price return for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a complete picture for stocks that pay a dividend.

As it happens, QUALCOMM's TSR for the last 5 years was 168%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

Back to Mergers

Qualcomm is on the M&A path once again. However, that didn't fare well for the company in the last years as the bid to buy NXP Semiconductors failed in 2018. Interestingly, Broadcom's attempt to bid for Qualcomm at the same time fell through as well.

The company is now looking to expand its smallest segment (Automotive) by bidding for Veoneer, a Swedish market leader for software and hardware automotive safety solutions. In the process, Qualcomm is trying to outbid another automotive supplier Magna by offering an 18% higher bid, or US$4.6b in cash.

Headsets are Still Winning

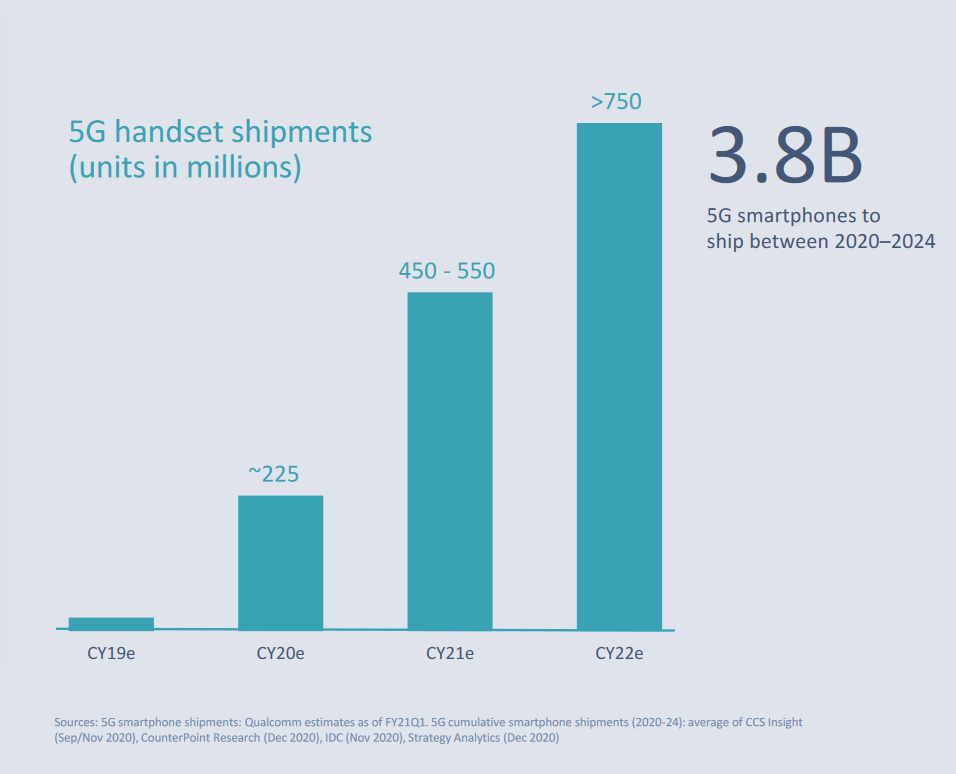

It is not a secret that Qualcomm made a bank in the handset market. That segment has been a core of their operations, and the company has been leading the market through 3G and 4G adoption. Obviously, 5G is where the market is heading next, and forward projections are promising. Full-year 2020 results showed 7% growth y/y.

While technology replacement seems to be a cash-making machine for Qualcomm, it is important to note that the 5G rollout has been slower than anticipated due to lockdowns and even health concerns.

While it is well worth considering the different impacts of market conditions on the share price, other factors are even more important.

For instance, we've identified 1 warning sign for QUALCOMM that you should be aware of.

If you are interested in more investment opportunities, take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market-weighted average returns of stocks that currently trade on US exchanges.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.