Q&A With Nasdaq on How Japanese Investors Can Capture Global Growth Opportunities via the Nasdaq-100

The article was first published in Nikkei Shimbun on June 25, 2022. Click image to view original article in Japanese.

In Japan, rising concerns about higher costs could increasingly take a toll on households’ purchasing power, and pressure to safeguard the value of assets is growing. How can (Japan’s) retail investors make investment gains while mitigating risks? We recently asked Ms. Joyce Ip about the advantages of leveraging global investment opportunities through the Nasdaq-100® to diversify your investment portfolio as a means of securing returns while mitigating risks.

Can you introduce us to the Nasdaq 100?

The Nasdaq-100 is one of the world’s pre-eminent large-cap growth indexes. It includes 100 of the largest U.S. domestic and international non-financial companies listed on the Nasdaq Stock Exchange based on market capitalization. Japan’s investors should view the Nasdaq-100 as more than just an index. We can effectively say it is home to global growth, innovation and performance.

I believe that Japanese investors are showing more interest in diversifying their investment portfolio via “globalization.” And for companies today, being able to innovate is key to remaining competitive, thereby delivering sustainable results.

The Nasdaq-100 represents this conviction, which has enabled it to outperform over the past two decades.

Can you elaborate further on the constituents and also the index’s sector exposure?

Remember the buzzwords I cited earlier: global growth, innovation and performance. These investment convictions are reflected in the constituents of the Nasdaq-100. Currently, technology companies account for about 56% of the index’s weight and they also represent the world’s leading players in innovation that improve people’s lives. Japan’s investors should be very familiar with companies such as Apple, Microsoft, Alphabet (which manages Google) and Facebook.

At the same time, 22% of the current constituents are consumer services companies, namely brands such as Amazon, Starbucks and Costco. Not to mention Netflix and Tesla, which account for part of the 7% consumer goods companies within the constituents. They are recognized as disruptors, bringing new and game-changing concepts to their sectors.

So for Japanese investors, how can they get access to investment opportunities via the Nasdaq-100 products?

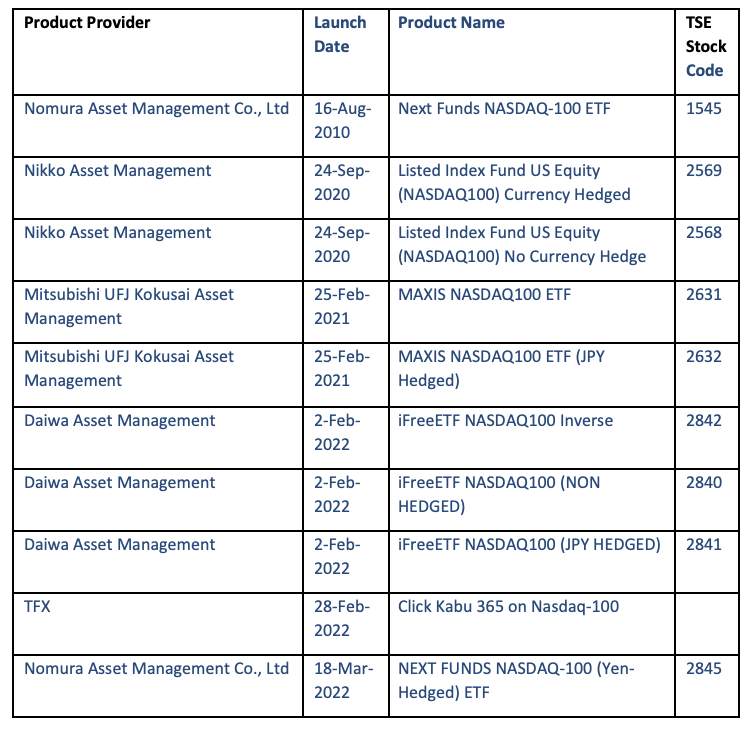

There are a number of ways to tap into the investment opportunities of the Nasdaq-100, such as via ETFs, Index Funds and Futures.

We noticed that some of these ETFs and index funds are currency hedged. Can you help educate Japanese investors about the difference between a normal product versus one that is currency-hedged?

Typically, a currency-hedged ETF, or a currency-hedged index fund, is basically the same as an existing ETF (or index fund) but it is denominated in a non-USD currency.

While ETFs and index funds as investment products already offer diversification, a currency-hedged ETF or index fund provides investors with a means to mitigate against currency fluctuations, because you won’t need to worry about the impact of exchange rate hits on the values of the ETF if it is hedged against the local currency of where you are based.

For Japanese investors, such risk mitigation is becoming more important now and in the near future in view of the Yen fluctuation against the USD as witnessed in the past two months or so.

We understand that you have been working recently with Tokyo Financial Exchange (TFX) to launch a Nasdaq-100 underlying investment product.

Yes, TFX launched the world’s first Nasdaq-100 CFD product in Japan a few months ago. TFX is the first and only Nasdaq-100 licensee in Japan for CFD.

It sounds like Japan is a key market for Nasdaq in terms of offering Nasdaq-100 investment products.

We continue to work with our partners in Japan to offer expanded investment opportunities on the Nasdaq-100 for local investors. Earlier in May, a new index fund launched which offers 2.5 times leverage on the Nasdaq-100 using the fund manager’s own strategies.