The first earnings season of the New Year will get underway on January 10th, with the big banks reporting results for the last quarter of 2024.

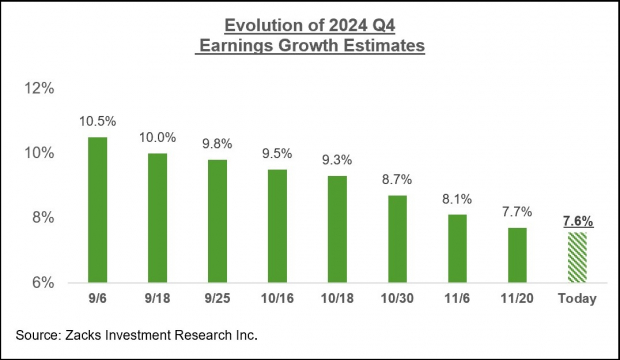

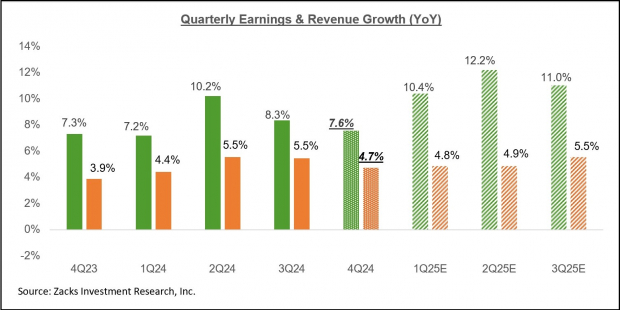

The expectation is that 2024 Q4 earnings for the S&P 500 index will be up +7.6% on +4.7% higher revenues. This would follow the +8.3% earnings growth in Q3 on +5.5% higher revenues.

As we have noted here all along, the revisions trend ahead of the start of the Q4 earnings season has been fairly stable, as can be seen in the chart below that shows how the Q4 earnings growth expectations have evolved over time.

Image Source: Zacks Investment Research

At the sector level, estimates have been cut for 11 of the 16 Zacks sectors since the quarter got underway, with the biggest declines at the Aerospace, Industrial Products, Energy, Conglomerates, and Basic Materials sectors. On the positive side, estimates have increased since the quarter underway for 5 of the 16 Zacks sectors. These sectors are Finance, Consumer Discretionary, Technology, Business Services, and Autos.

The positive revisions trend for the Finance sector can be seen in how estimates for some of the major banks have unfolded. For example, Wells Fargo WFC will kick off the reporting cycle for the sector on January 10th, and JPMorgan JPM will report on January 15th.

Wells Fargo is expected to bring in $1.33 per share in Q4 EPS, up +3.1% from the year-earlier period on essentially flat revenues at $20.5 billion. Wells Fargo’s $1.33 per share earnings estimate for the period has inched up from $1.31 per share two months back and $1.27 per share three months back.

JPMorgan is expected to earn $3.86 per share in Q4, down -2.8% from the year-earlier period, on +5% higher revenues at $40.5 billion. Analysts have raised their estimates for JPMorgan steadily, with the current $3.86 per share estimate up +1.3% over the past month and up +2.7% over the past three months.

JPMorgan and Wells Fargo shares are off their late-November 2024 highs but have still been solid performers over the preceding year, handily outperforming the S&P 500 index as well as the Zacks Finance sector, as the chart below shows.

Image Source: Zacks Investment Research

For the Finance sector as a whole, 2024 Q4 earnings are expected to be up +12.1% from the same period last year on +5% higher revenues. This would follow the sector’s +5.9% earnings and revenue growth in 2024 Q3.

The Finance sector is one of only three Zacks sectors that are expected to enjoy double-digit earnings growth in Q4; Technology (earnings growth of +14.9%) and Medical (+15.3%) are the other two.

Tech & The Mag 7 Remain Growth Drivers

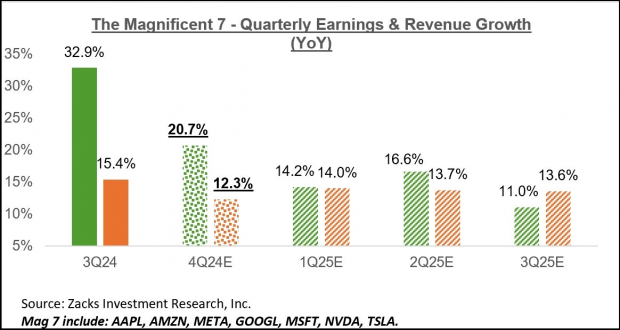

The Magnificent 7 group is expected to remain in growth mode in Q4, with total Mag 7 earnings expected to be up +20.7% from the same period last year on +12.3% higher revenues. Total index earnings would be up only +3.6% instead of +7.6% had it not been for the substantial Mag 7 contribution.

Image Source: Zacks Investment Research

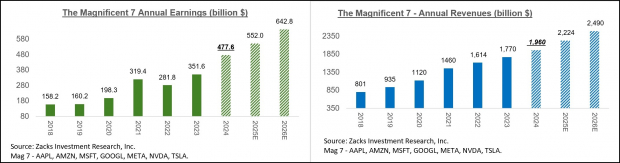

As this chart shows, the magnitude of Mag 7 growth is decelerating. But that is hardly a surprise given how massive the base numbers are, as shown in the chart below.

Image Source: Zacks Investment Research

The Earnings Big Picture

The chart below shows the Q4 earnings and revenue growth expectations in the context of where growth has been in the preceding four quarters and what is expected in the coming three quarters.

Image Source: Zacks Investment Research

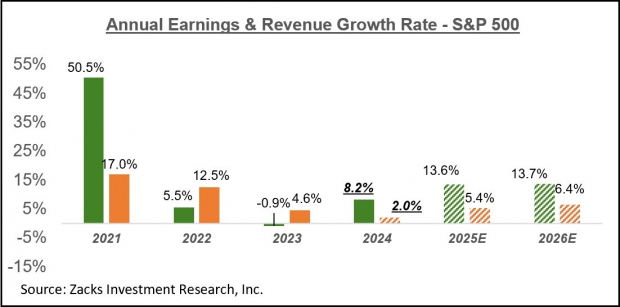

The chart below shows the overall earnings picture on a calendar-year basis, with double-digit earnings growth expected in 2025 and 2026.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Earnings Growth Expected to Broaden Beyond Tech

Research Chief Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.