Q4 earnings season kicked off this week, so we wanted to take a look at what to expect. (We also looked at how earnings impact prices and volumes in Phil’s blog yesterday.)

Most S&P 500 companies reporting Q4 earnings in the next few weeks

So far only 10% of S&P 500 firms have reported Q4 earnings (chart below). But earnings seasons ramps up in the next five weeks, with another 80+% of companies reporting by late February.

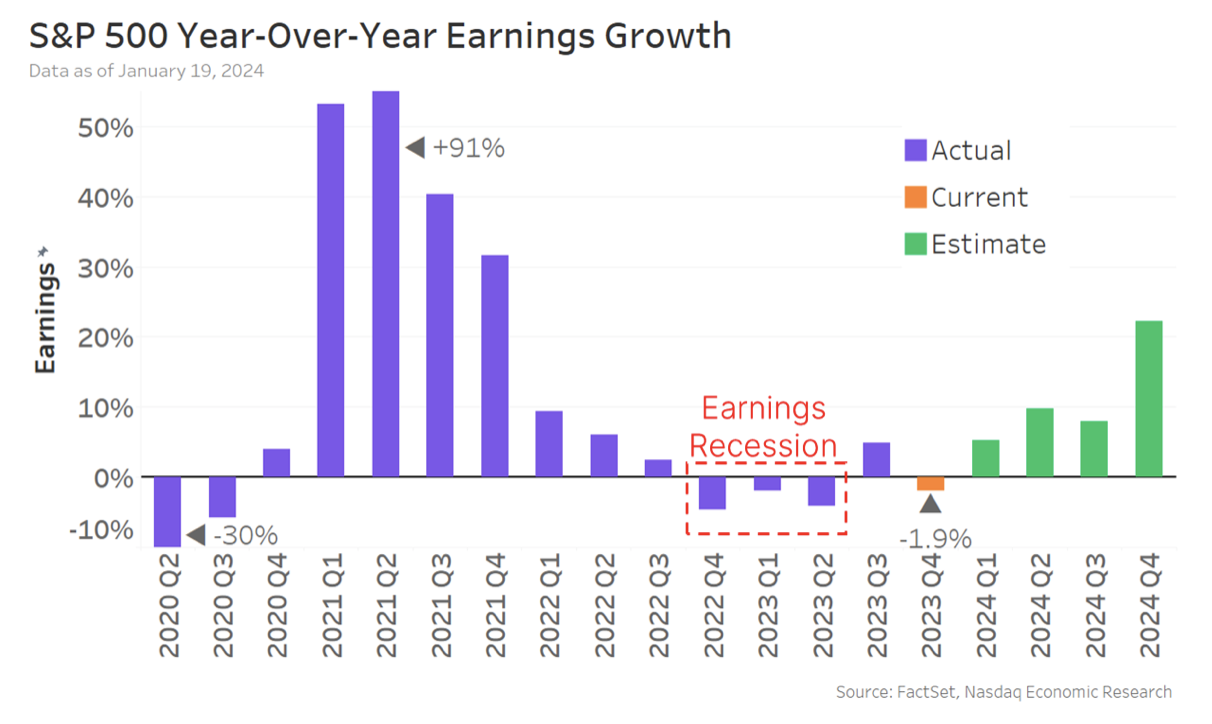

Earnings estimates see dip in Q4 2023 before positive growth throughout 2024

The last time we showed you the chart below, Q4 earnings growth was expected to be positive. Now, though, it’s currently on track for earnings to dip almost 2% YoY (orange bar).

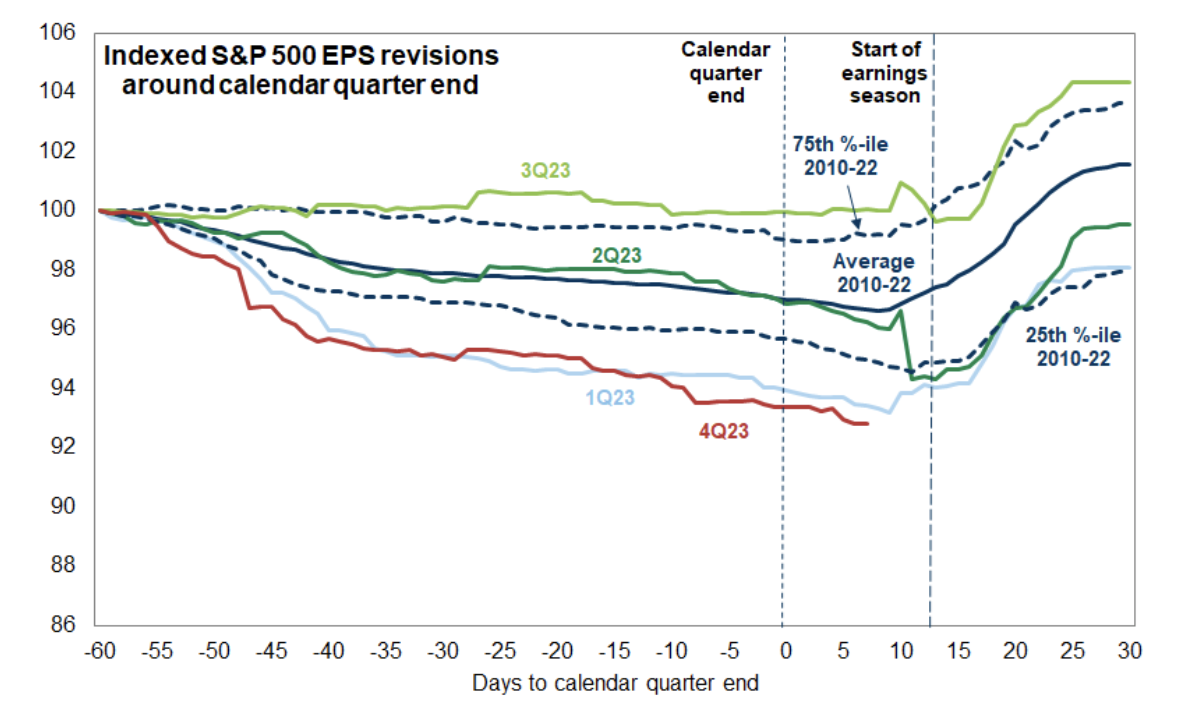

Earnings revision trends suggest Q4 could end up positive

That’s because Q4 has seen larger-than-average downward revisions to earnings estimates (Goldman Sachs’ chart below, red line) thanks to a larger share (65%) of S&P 500 companies issuing negative guidance than is typical (59%) ahead of earnings.

Still, there’s a chance we could see earnings end up positive in Q4 since, as the chart shows, earnings tend to follow a down-then-up pattern.

In the run up to earnings season, companies try to manage expectations lower, pushing down earnings estimates – making it easier for them to eventually beat analysts’ projections (that’s why 77% of companies beat on average).

As earnings season begins and those beats come in, earnings are pushed back up 3-4%, based on the long-term average (dotted lines).

So the average upward revisions we see during earnings season would be enough to push the current negative 2% YoY earnings growth estimate back into positive territory.

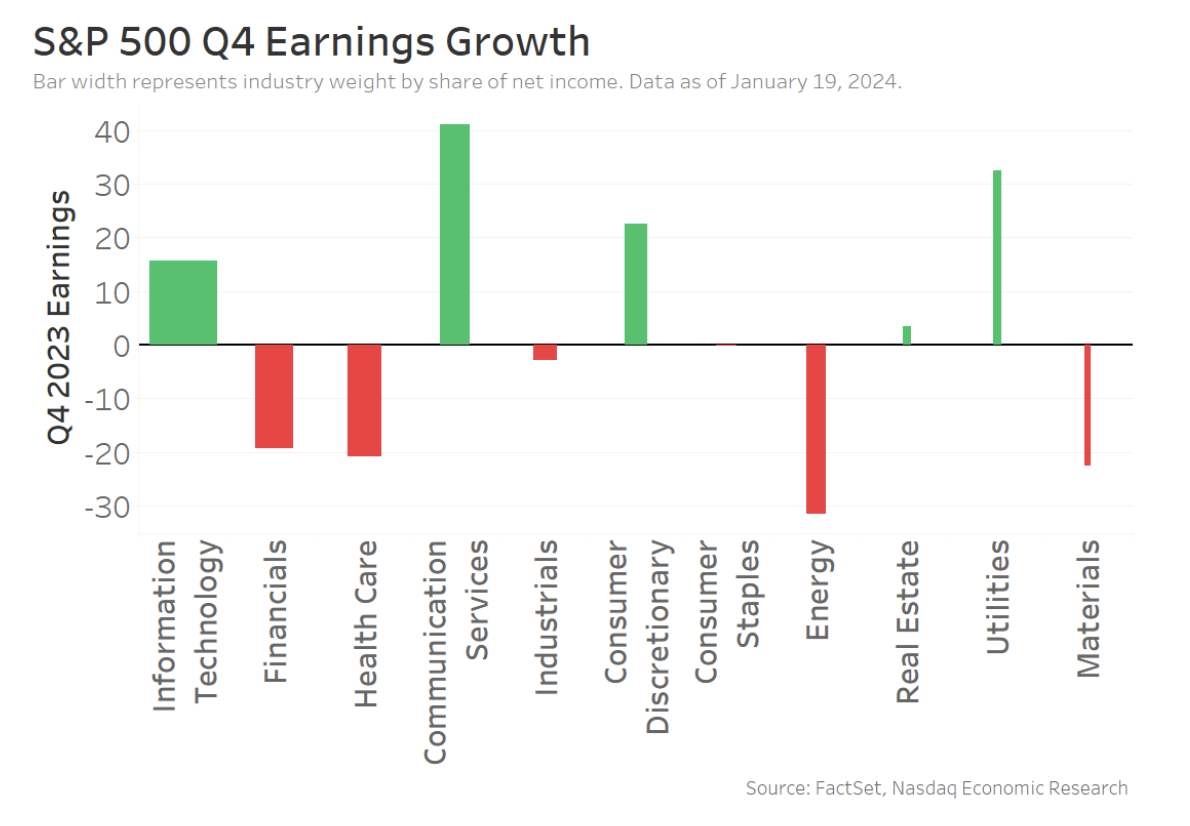

Consumer-driven sectors lead earnings; Energy, Health Care, and Materials lag again

Even though earnings are expected to be negative for the S&P 500 as a whole, estimates vary widely as the sector level.

By sector, Q4 shows a continuation of some trends from the last few quarters:

- Consumer-driven sectors are leading the way, with Communication Services (Netflix, Meta, Google, T-Mobile), Consumer Discretionary (Amazon, Airbnb, Starbucks), and Information Technology (Intel, Nvidia, Microsoft) all on pace for 15+% YoY earnings growth.

- Earnings recessions continue in the same few sectors: Energy (oil prices down 5% and natural gas prices down 50% YoY), Materials (hit from the manufacturing recession), and Health Care (lower Covid-related spending) are all on track to see earnings fall 20% YoY or worse.

We also see some differences:

- Industrials joins Materials in seeing earnings fall due to weaker goods demand (and lower Airline profits as revenge spending slows and fares fall)

- Financials are also seeing negative earnings growth, as banks deal with a mix of slower lending, larger loan losses, and a one-time $9bn payment to the FDIC for the regional bank crisis.

So Q4 earnings looks like a case of haves (consumer-driven sectors with very strong earnings) and have nots (a few sectors with very negative earnings).

Still, since there’s almost always a bounce to earnings as more companies report, there’s still a chance we get back to positive earnings growth in Q4. We’ll see over the next few weeks.

The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice, either on behalf of a particular security or an overall investment strategy. Neither Nasdaq, Inc. nor any of its affiliates makes any recommendation to buy or sell any security or any representation about the financial condition of any company. Statements regarding Nasdaq-listed companies or Nasdaq proprietary indexes are not guarantees of future performance. Actual results may differ materially from those expressed or implied. Past performance is not indicative of future results. Investors should undertake their own due diligence and carefully evaluate companies before investing. ADVICE FROM A SECURITIES PROFESSIONAL IS STRONGLY ADVISED. © 2024. Nasdaq, Inc. All Rights Reserved.