Q3 Earnings so far Suggest Fears About Q4 are Overdone

We are at about the halfway point in the Q3 earnings season so far. By the end of today, 285 companies in the S&P 500 will have released their earnings and, as usual, the most important thing for investors is to be careful not to pay too much attention to the headlines when assessing the impact of all this information. Some high-profile misses garner a lot of attention, but the two most important factors for the long-term trajectory of the market are the average performance of stocks in the index and the forward guidance offered and, on both those fronts, this is an earnings season that will serve to strengthen the rally and that suggests a strong fourth quarter.

On average over the last fifteen years, well over two-thirds of companies beat expectations every quarter. That may lead you to wonder why analysts even bother to calculate estimates, or at least why they get paid so much to get things wrong with such remarkable consistency, but that is an argument for another day. The thing is, there are structural reasons to do with methodology and human nature for that enduring trend.

Earnings estimates are based initially on the previous year’s same quarter results and on management's guidance and comments on what they expect going forward. The guidance side of that equation is always biased to the low side because CEOs would generally rather underpromise and overdeliver than mislead investors with false optimism. That tendency to underestimate is even more pronounced this year, given that last year was so heavily impacted by the pandemic. That is why well over 80% of companies are recording beats this quarter, and the effect will continue into Q4.

There is some trepidation among observers about what the important holiday season will bring, given the well-publicized issues with the supply chain around the world but, so far, this quarter’s earnings suggest that American companies are doing what they do best: adapting to changing conditions and coping with them. Where companies have underperformed expectations, those issues have, of course, been quoted as the reason, but among the majority who have recorded beats in terms of sales and profits, it has been a story of overcoming these challenges and, more importantly, believing that they can continue to do so.

That same “will do” spirit that is such an important component of a capitalist system is also why I am skeptical of those that fear a weak fourth quarter this year. Companies have overcome supply chain problems by improving their control over that side of their business, which has prompted an increase in investment.

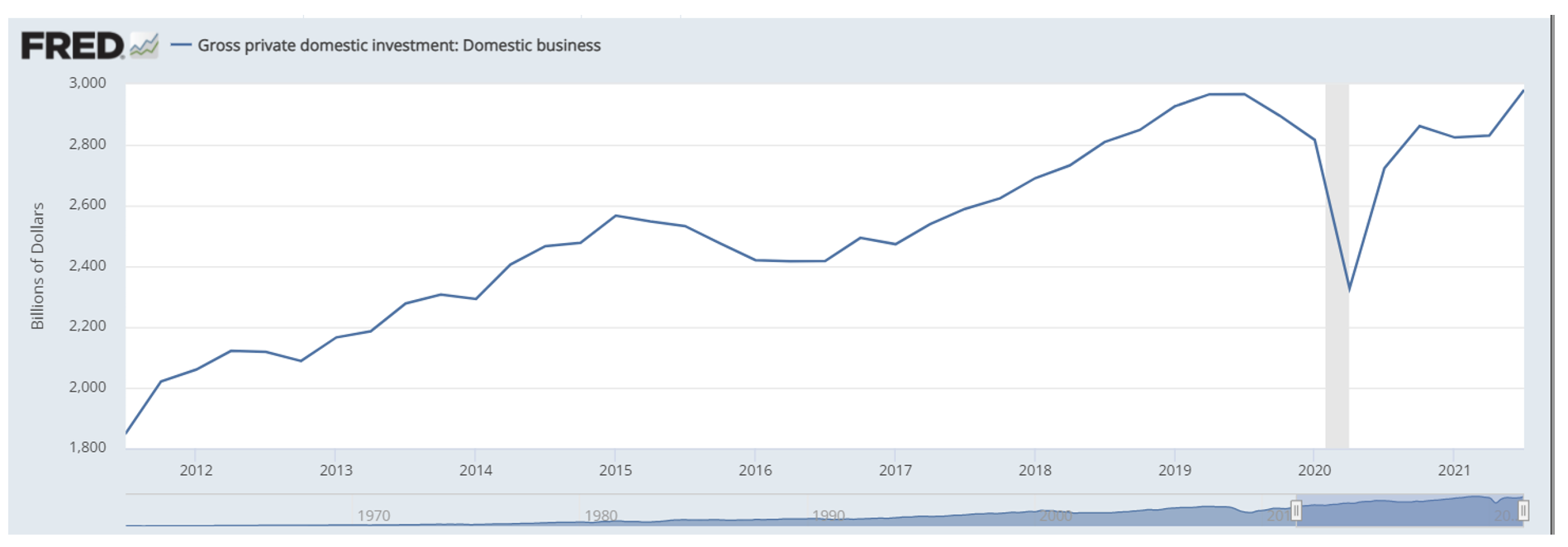

Gross domestic investment is now back above pre-pandemic levels and nudging $3 trillion. That, however, is still relatively low as a percentage of GDP, leaving room for further increases in coming months. The nature of that spending favors the heavily-weighted tech sector, which hints at continued outperformance by the Nasdaq as compared to the more manufacturing-oriented Dow, but it also suggests that the supply chain issues will fade as the effects of it are felt.

So, when there are disappointing results such as those from Apple (AAPL) and Amazon (AMZN), it is important to look beyond the sensational headlines and ask yourself a couple of pertinent questions. Does this quarter represent the beginning of a continuing problem for those companies, or is this a dip that results from an economy that is running hot and getting a bit ahead of itself? Are these problems that will persist, or will the market do its thing and allow the “invisible hand” of price incentives to force adjustments?

The recovery of investment spending indicates that the latter is true, and I, for one, am happy to put my trust in the market to continue to adjust, adapt, and overcome.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.