Putting a Price on Water: The Nasdaq Veles California Water Index (NQH20)

- By Garrett Conway, Product Analyst Specialist

Nasdaq’s unparalleled commitment to identifying and opening new markets places us squarely at the forefront of financial innovation. Where market challenges present undue inefficiency and risk, we see an opportunity to bring our expertise to engage participants and drive solutions.

Thus, when our partners, West Water and Veles Water, demonstrated a unique ability to capture transaction-level data in the California water market, light bulbs started going off. We had long been interested in developing a means of determining the fair value of water as a commodity as a key to addressing the risks that cyclical drought conditions bring to bear upon water-stressed locations.

However, the lack of a reliable price discovery mechanism stood as a barrier to advancement in this space. Critically, buyers and sellers in this market need symmetrical and transparent information to establish a fair value. Yet, one-off transactions in water rights have historically made for highly variable pricing and provide little insight into supply and demand dynamics at any given point in time.

With a clear understanding of such inefficiencies, Nasdaq and its partners proudly introduced in October 2018, a first-of-its-kind solution in the form of an aggregate, volume-weighted index, the Nasdaq Veles California Water (NQH20) Index, which tracks the spot price of water in the state of California.

Now, in collaboration with CME Group, we are excited to announce the next step in realizing our vision for the California water market: a novel futures contract linked to the NQH20 Index, empowering market participants for the first time, with the unprecedented means to manage water price risk.

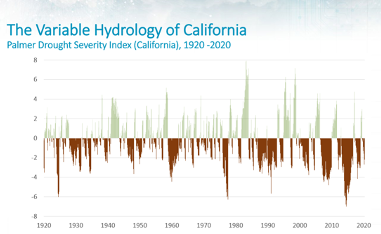

Source: NOAA

It is nearly impossible to overstate the vital role that water plays in our lives. Its abundance, and conversely, its scarcity, have determined the fate of entire civilizations. It stands nearly alone as an unnegotiable requirement for life, and is critical to agriculture production, manufacturing, energy production, and even transportation.

Despite this, advancements in other commodities markets have far outpaced those related to water. For one, the market for water is highly localized given the idiosyncratic nature of hydrology patterns and conditions across the world. Likewise, water is not easily transported and regulatory limitations often further restrict flexibility among participants. As a result, the market has been broadly underserved by the financial sector as markets in bilateral rights transfers have steadily grown in drought-prone regions.

Simply put, water market transactions involve the sale or lease of a wide range of ownership interests in water. A water right entitles the owner to divert or pump water from rivers, streams, and groundwater basins. Water rights are the most commonly traded category of ownership interest. Other commonly traded entitlements include shares in groundwater banks, surface reservoir storage rights, and entitlements to treated wastewater. The introduction of the NQH20 index as a benchmark will allow buyers and sellers in this market to gain much needed visibility in pricing across the market. A volume-weighted index, the published price will reflect the spot price of water, as determined by entitlements transactions over time.

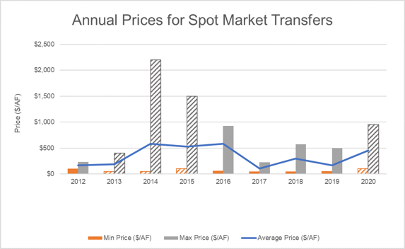

Source: WestWater Research Waterlitix™

Note: Dry or critically dry years are indicated by the striped bars

The overall size of water markets in the western U.S. is relatively small compared to other more commonly traded natural resources. However, given the relative scarcity of water supply, the region has seen a rapid expansion in water rights transactions. In particular, California, which vastly outsizes other states in terms of consumption, accounts for around 9% of total daily usage in the U.S., and as measured by volume traded, is approximately four times larger than all other states. In dollar terms, the market has seen on average approximately $400 million change hands annually since 2014.

With this in mind, it is easy to imagine how high variability in pricing, owing mainly to variable hydrological conditions statewide, makes water management a challenging task. Add to this the consistently robust demand from one of the country’s most important agricultural centers and you have a market poised for evolution. Nasdaq is excited to help write the next chapter of water and offer an innovative solution to an age-old problem.

For more information on the NQH20 index, please visit: Nasdaq.com/waterindexes

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Other Topics

Indexes Innovation Alternative Investments Commodities EnergyContact Us for More Information

Global Indexes