Earnings season kicks off next week. Investors are more than eager for companies to unveil their quarterly results to understand better how they have navigated the rough economic waters we’ve found ourselves in.

A trio of airliners – United Air Lines UAL, American Air Lines AAL, and Southwest Airlines LUV – are all slated to release quarterly results within the next two weeks.

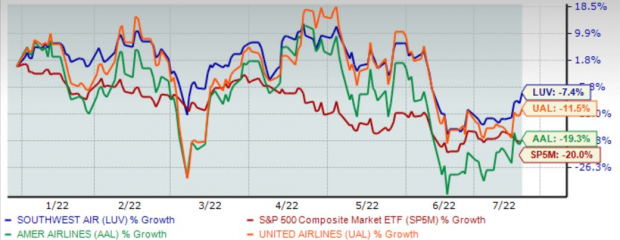

All three companies reside in the Zacks Transportation – Airline Industry, which has tumbled 22% year-to-date. The chart below illustrates the year-to-date performance of all three companies.

Image Source: Zacks Investment Research

It’s worth noting that the COVID-19 pandemic crushed demand but is quickly returning. Additionally, soaring fuel costs have undoubtedly impacted margins, and we saw this in Delta Air Lines’ DAL Q2 report; DAL missed the Zacks Consensus EPS Estimate by a double-digit 16% but posted a 1.6% top-line beat.

Let’s take a closer view of each company to see how they shape up heading into next week.

United Air Lines

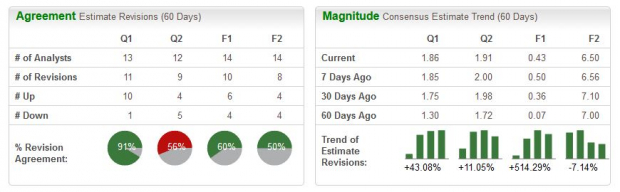

United Air Lines UAL is currently a Zacks Rank #3 (Hold) with an overall VGM Score of an A. Over the last 60 days, analysts have substantially raised their earnings outlook across several timeframes.

For the quarter to be reported, the Consensus Estimate Trend has increased by 43%.

Image Source: Zacks Investment Research

The Zacks Consensus EPS Estimate for the upcoming quarter resides at $1.86, penciling in a massive triple-digit increase in earnings of nearly 150% year-over-year.

In addition, the quarterly revenue estimate of $12 billion notches a triple-digit 120% expansion in the top-line from the year-ago quarter.

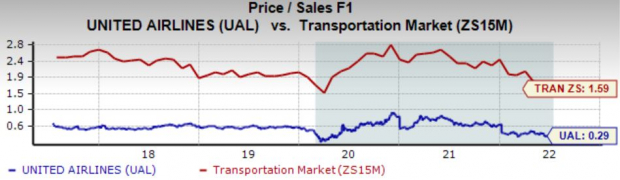

Image Source: Zacks Investment Research

The company sports a 0.3X forward price-to-sales ratio, nicely below its five-year median value of 0.5X and well underneath highs of 0.9X in 2020. In addition, the value represents an enticing 83% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

UAL’s bottom-line results have primarily been mixed; over its last ten quarterly reports, the airliner has exceeded the Zacks Consensus EPS Estimate five times.

American Air Lines

American Air Lines AAL is a Zacks Rank #3 (Hold) with an overall VGM Score of a B. Analysts have extensively upped their earnings estimates for the current fiscal year and the upcoming quarter over the last 60 days.

The Consensus Estimate Trend for the upcoming quarter has soared by 44%.

Image Source: Zacks Investment Research

Currently, the Zacks Consensus EPS Estimate resides at $0.79, reflecting a triple-digit 145% uptick in quarterly earnings from the year-ago quarter.

Furthermore, the airliner is forecasted to generate $13.4 billion in revenue, good enough for a sizable double-digit 80% increase in quarterly revenue year-over-year.

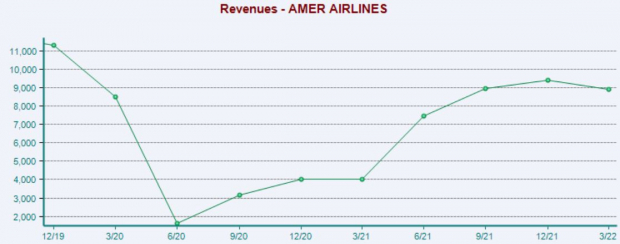

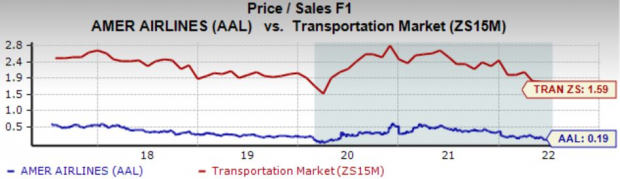

Image Source: Zacks Investment Research

American Airlines boasts a 0.2X forward price-to-sales ratio, just above its five-year median value of 0.1X and nowhere near highs of 0.6X in 2020. Additionally, the value represents a solid 89% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

AAL has recently displayed consistency within its bottom-line, exceeding the Zacks Consensus EPS Estimate in seven consecutive quarters.

Southwest Airlines

Southwest Airlines LUV is a Zacks Rank #3 (Hold) with an overall VGM Score of an A. Similar to AAL and UAL, analysts have positively revised their earnings estimates substantially across several timeframes.

The Consensus Estimate Trend for the upcoming quarter has climbed 18.5% over the last 60 days.

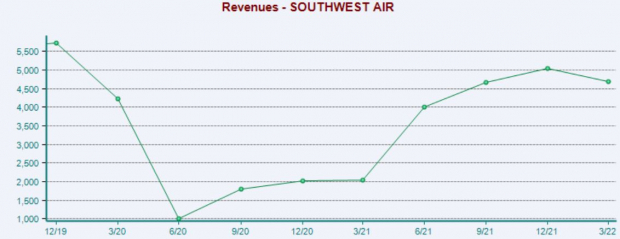

Image Source: Zacks Investment Research

For the upcoming quarterly release, the Zacks Consensus EPS Estimate resides at $1.15, reflecting a jaw-dropping 430% growth in quarterly earnings year-over-year.

In addition, Southwest is forecasted to rake in $6.7 billion in revenue for the quarter, notching a 70% increase in revenue from the year-ago quarter.

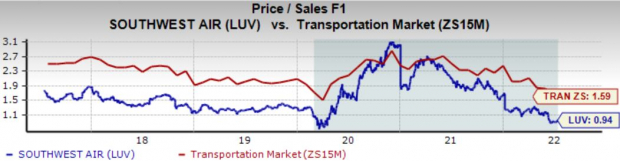

Image Source: Zacks Investment Research

Southwest currently sports a 0.9X forward price-to-sales ratio, which is well below its five-year median value of 1.5X and nowhere near highs of 3.1X in 2020. Furthermore, the value represents a 36% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

The company has primarily reported bottom-line results above expectations; Southwest has exceeded the Zacks Consensus EPS Estimate seven times over its last ten quarterly reports.

Bottom Line

All three companies are expected to register substantial top and bottom-line growth, a reflection of the travel industry recovering following a once-in-a-lifetime pandemic that locked the world inside.

However, soaring costs are expected to weigh heavily on margins, a common theme we will see during the second round of quarterly results in 2022.

Delta Air Lines’ DAL quarterly report revealed that higher fuel costs negatively affected its bottom-line. In addition, shares didn’t react well to the quarterly release; shares lost nearly 5% in value following the report. Investors should be aware of the soaring costs that these airliners have had to face.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

Southwest Airlines Co. (LUV): Free Stock Analysis Report

American Airlines Group Inc. (AAL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.