Apple (NASDAQ: AAPL) has been one of Berkshire Hathaway's (NYSE: BRK.A) (NYSE: BRK.B) most successful investments. However, there comes a time to move on from an investment, and I think Warren Buffett and his team are set up to do that in 2025.

But why are they selling? After all, Buffett and his team have been incredibly complimentary toward Apple CEO Tim Cook and the business he's created there. Let's dive in and try to understand better.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Apple used to be a picture-perfect Warren Buffett investment

Berkshire Hathaway first took a position in Apple stock in the first quarter of 2016. However, the company it purchased back then is far different from the current Apple. I'm not talking about what Apple makes or how it markets itself (although those have changed slightly). Instead, I'm talking about the fundamentals of the stock.

Back in Q1 2016, Apple looked like a typical Buffett investment. Apple was a massive and growing consumer brand, and its shares were incredibly cheap, trading for only 10.6 times trailing earnings. This made Apple look like a value stock, and the Buffett purchase made a lot of sense.

But that's not how Apple exists today. Since Q1 2016, Apple's revenue and earnings per share (EPS) have risen 66% and 157%, respectively. Over the long term, stocks usually return around the amount their EPS rises, with one exception: multiple expansion.

Multiple expansion occurs when investors are willing to pay more for a stock than they once were. This is a key component of a value investing philosophy like Buffett's, as they buy something that's cheap and sell it when it's fully valued.

Since Q1 2016, Apple's stock has risen around 850% -- far beyond its revenue or EPS growth. Now, the stock trades for a hefty 41 times trailing earnings. Historically, that's a very expensive mark for any company, and it has led many to believe that Apple has become either fully valued or overvalued.

As a result, I wouldn't be surprised if Buffett continues to unload his position.

The stock isn't attractive right now

In Q3 2023, Berkshire held around 916 million shares of Apple. It's been a steady seller since then since Apple only owns 300 million shares now. Buffett and his team have framed these sales as capturing tax gains in case the corporate tax rate increases from the current 21% level, but with President-elect Donald Trump in office, this likely won't occur.

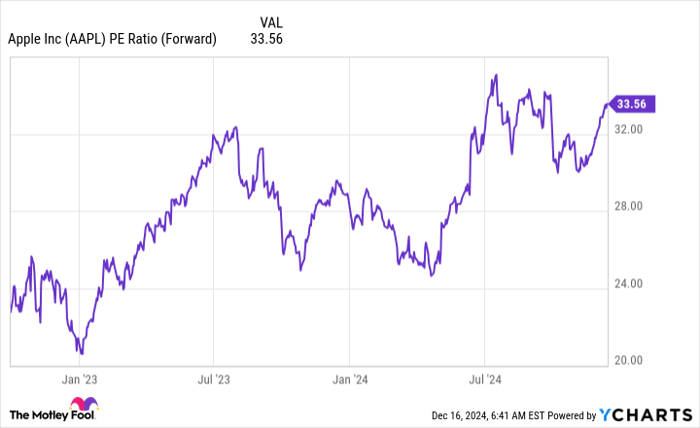

However, investors shouldn't be surprised if Berkshire continues selling Apple stock, as the investment thesis (at least for Buffett) has played out. Compared to other big tech stocks, Apple isn't very attractive right now. It's very expensive at 34 times forward earnings, and 2025 isn't looking like a particularly strong year.

AAPL PE Ratio (Forward) data by YCharts

Wall Street analysts project 6% revenue growth this year, which is pretty weak for the stock's current price. We'll know more about Apple's trajectory once it reports its results from the first quarter of its fiscal 2025, ending around Dec. 31, as that will let investors know if the iPhone 16 has caught on with consumers.

Regardless, numerous other tech companies are trading at cheaper price tags and growing faster, and they look like far more attractive investments than Apple right now. So, even if Buffett and his team stop selling Apple shares in 2025, investors should start looking for other places to invest than Apple.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $790,028!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.