The S&P 500 (SNPINDEX: ^GSPC) is having a very strong year, with a 27.3% gain so far. That's more than twice its average annual return going all the way back to 1957.

However, the Vanguard Growth ETF (NYSEMKT: VUG) is performing even better, with a 30.9% year-to-date gain. That's because technology stocks are leading the S&P higher in 2024 thanks to trends like artificial intelligence (AI), and this Vanguard exchange-traded fund (ETF) assigns them a much higher weighting.

The Vanguard ETF actually has a strong track record when it comes to outperforming the S&P 500, beating the index every year (on average) since it was established in 2004.

The technology sector is likely to continue leading the broader market higher, so here's why I predict the Vanguard ETF will beat the S&P 500 yet again in 2025.

Image source: Getty Images.

Big positions in America's top growth stocks

The Vanguard ETF invests exclusively in U.S. large-cap growth companies. It holds 182 stocks from 12 different sectors, but the tech sector represents the largest chunk of its portfolio by far, with a weighting of 58%.

By comparison, the S&P 500 is home to 500 different companies, and the technology sector accounts for 31.7% of its portfolio. That means the Vanguard ETF is far more concentrated, which can lead to some additional risk during periods when tech stocks are underperforming.

The top three holdings in the Vanguard ETF are in the technology sector, and they account for over one-third of the value of its entire portfolio on their own. Its top five holdings are rounded out by Amazon (which is in the consumer discretionary sector) and Meta Platforms (which is in the communication services sector). Their individual weightings relative to the S&P 500 are below:

|

Stock |

Vanguard ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

11.71% |

7.11% |

|

2. Nvidia |

10.94% |

6.76% |

|

3. Microsoft |

10.80% |

6.26% |

|

4. Amazon |

6.00% |

3.61% |

|

5. Meta Platforms |

4.70% |

2.57% |

Data source: Vanguard. Portfolio weightings are accurate as of Oct. 31, 2024, and are subject to change.

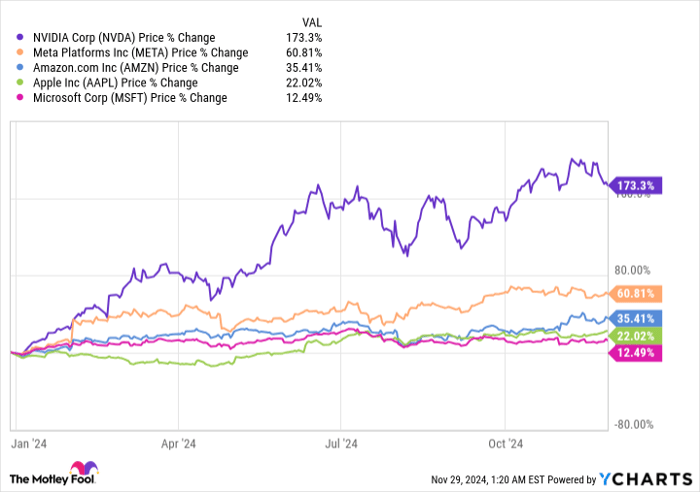

Those five companies operate at the forefront of the AI revolution, dominating both the hardware and software sides of this emerging industry. Their stocks have delivered an average return of almost 61% in 2024, led by Nvidia, which has soared by 173% thanks to incredible demand for its AI data center chips:

Since the Vanguard ETF assigns a higher weighting to those five stocks than does the S&P 500, it's no surprise it has delivered a better return in 2024.

Outside of its top five positions, the ETF holds several other strong-performing stocks in the AI space, including Tesla, Alphabet, and Broadcom.

But it isn't all about tech. Stocks like Eli Lilly, Visa, Costco Wholesale, and McDonald's are among the top 20 holdings in the ETF.

The Vanguard ETF can beat the S&P 500 again in 2025

The Vanguard ETF has delivered a compound annual return of 11.4% since its inception in 2004, which is better than the 10.1% average annual return in the S&P 500 over the same period.

That outperformance accelerated over the last 10 years, with the Vanguard ETF delivering a compound annual return of 15.2%, compared to a 13.2% average annual gain in the S&P.

If AI stocks continue to lead the market higher in 2025, the Vanguard ETF should have no problem outperforming the S&P 500 yet again since they represent such a large portion of its portfolio. However, a market correction could shake things up because that's when investors shy away from momentum-driven stocks and flock to safer dividend payers instead.

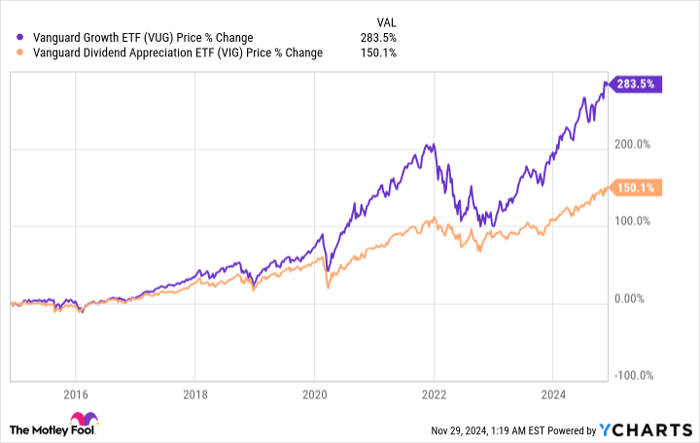

The Vanguard Growth ETF consistently performs better than the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG). But looking at the below chart, the Growth ETF suffers much steeper declines during turbulent periods, which implies growth stocks could easily underperform dividend stocks during any single year of broader market weakness:

The S&P 500 isn't cheap right now. Its price-to-earnings (P/E) ratio of 24.7 is around 36% higher than its long-term average of 18.1 going back to the 1950s. Growth stocks are responsible for most of that premium -- each of the Vanguard ETF's top five holdings, for example, trades at a higher P/E ratio than the S&P.

As a result, I can't rule out the possibility of a correction at some point in 2025. However, as long as the U.S. economy remains strong, it will most likely be a short-lived buying opportunity with growth stocks bouncing back to lead the market higher once again.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of November 25, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, Microsoft, Nvidia, Tesla, Vanguard Dividend Appreciation ETF, Vanguard Index Funds-Vanguard Growth ETF, and Visa. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.