Alpha Showcase from Director of Operations, Jeffrey Corrado

Market Polygraph? Helios flags shifts in corporate sentiment as executives get rigorous coaching.

The technology once standard for autonomously analyzing company earnings and other corporate releases, predictive modeling and natural language processing of corporate text-based communications, is becoming increasingly less effective as investor relations specialists and technology providers offer solutions that allow corporates to better optimize their language to maximize the sentiment of these bots. Practitioners seeking alternative methods to monitor markets should seek out Helios Life Enterprises, a novel data provider focused on analyzing patterns in the tone of voice. Helios underlying technology seeks to cuts through the noise of market optimized text-based C-suite communication and generates returns and volatility forecasts solely based on executive vocal patterns.

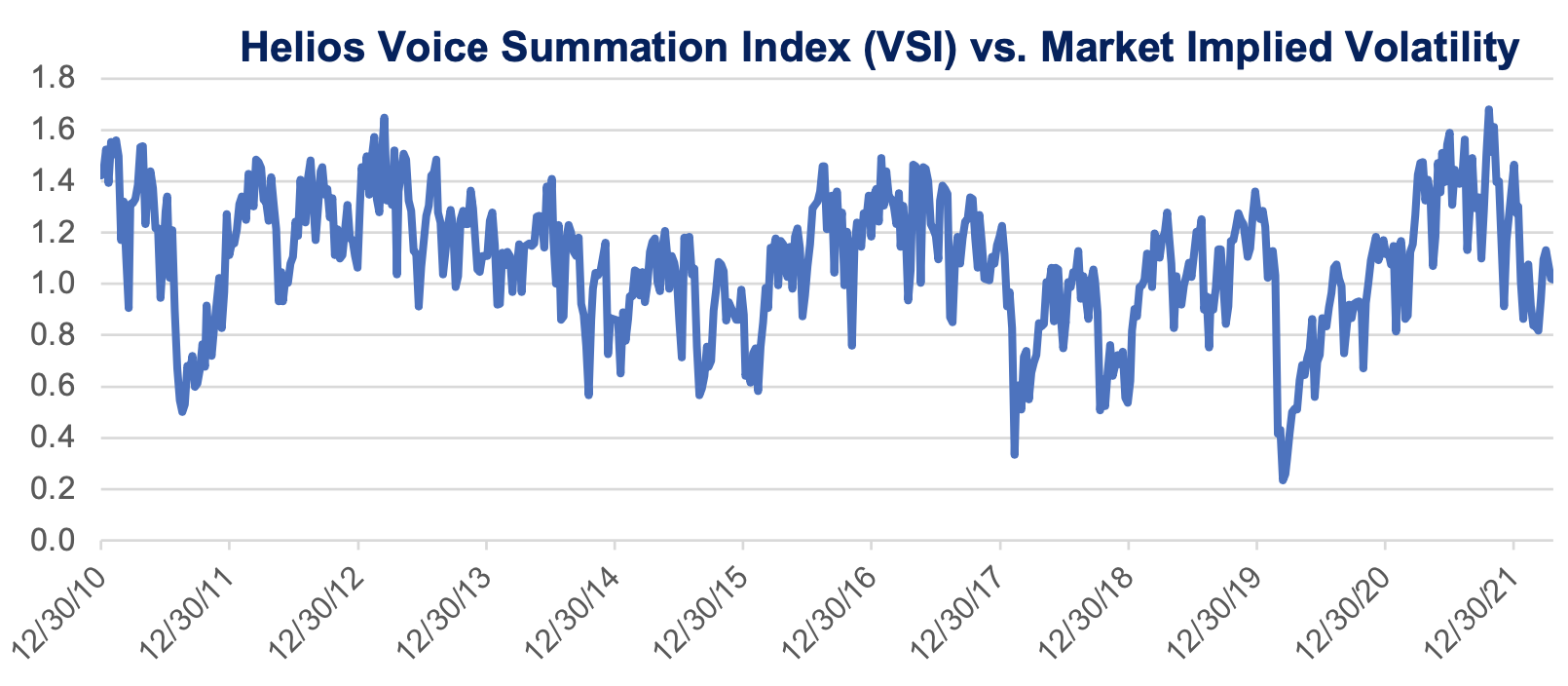

Helios Life Enterprises recently released the Helios Voice Summation Index (VSI), a volatility index which measures the market's belief in corporate communications using tone of voice exclusively. Differing from the Nasdaq-100 Volatility Index (VOLQ), , which is based on the option prices of the Nasdaq-100, VSI is based on the features of the voice of executives at corporate events like earning calls. Helios' proprietary algorithm generates a daily index value which represents a forecast of the forward 30-day annualized volatility. Volos analyzed the Helios VSI and derived an options-based signal which can be utilized as an active parameter within Volos’ Strategy Engine, a highly flexible no-code options backtesting engine.

Signal Summary

Volos designed a signal that alerts investors when the ratio between the VSI and the market’s implied volatility reaches an extreme.

The signal becomes bearish when market implied volatility is widely elevated compared to Helios’ forecast. The signal becomes bullish when that trend stops persisting and the ratio begins to normalize.

Helios VSI driven signals triggering during recent volatility events

Strategy Rules

Using Volos’ Strategy Engine, we designed a set of Calendar Short Put Spread strategy using Nasdaq-100 index options that:

- Sells a 2-month 5% out of the money NDX Put

- Buys a 4-month 15% out of the money NDX Put Option and rolls the option every two months.

- When the Helios signal is bearish, the strategy buys back the short put option so the only exposure is a long put position.

- When the Helios signal is bullish, the strategy rolls out and restrikes the short put option to collect more income and sells the long put option to preserve the value of the put.

Findings

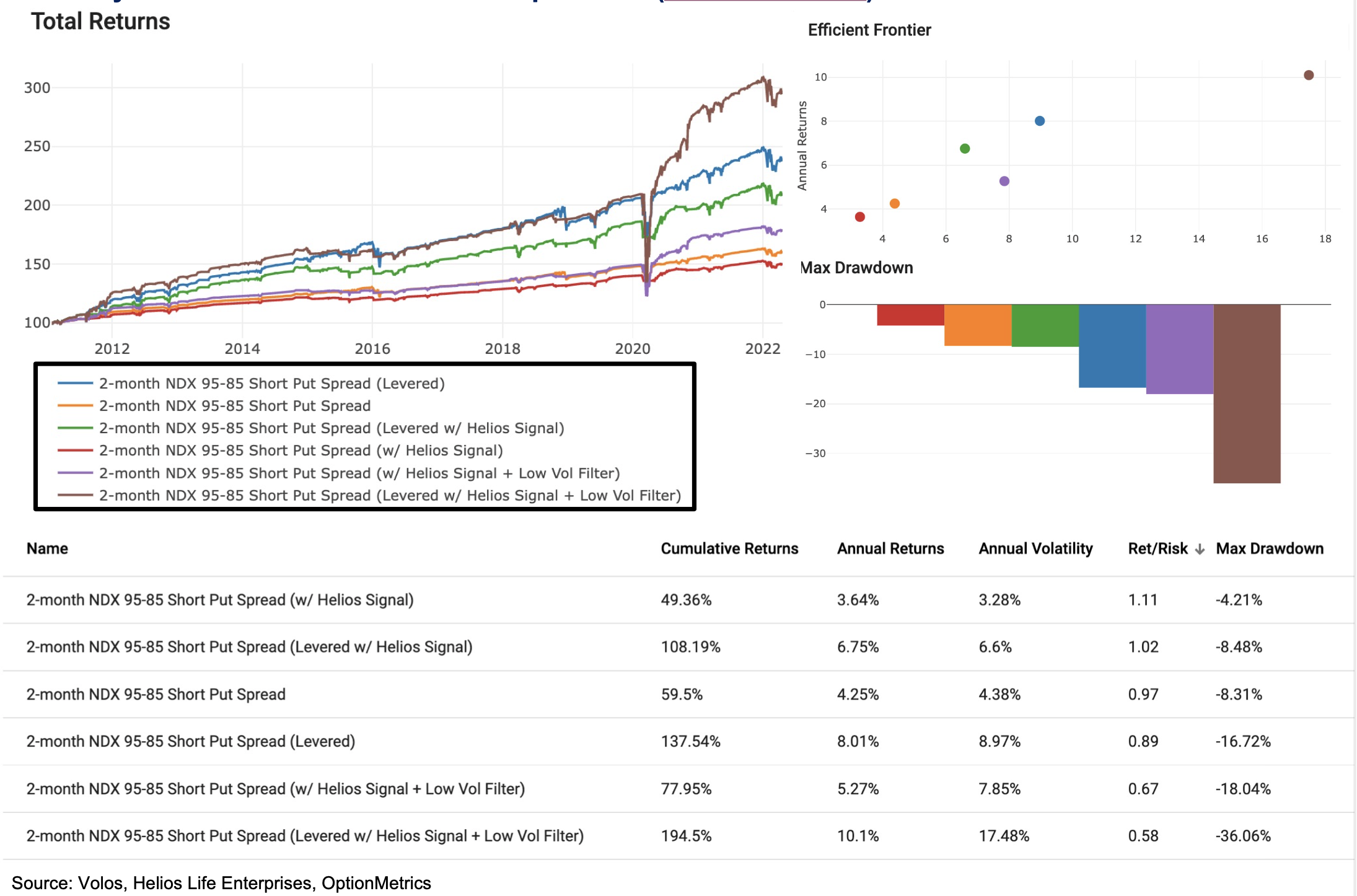

- Initial versions of VSI Enhanced NDX Short Put Spread strategies indicated that the signal successfully increased the risk-adjusted returns of the strategies (see table below) and dramatically reduced drawdowns. These strategies, however, were significantly more conservatively run than their passive equivalents.

- Volos developed a second set of more aggressive strategies with a low volatility filter that prohibits these strategies from applying bearish risk measures when the market implied volatility is above At the expense of risk efficiency, these strategies had significantly higher performance mainly due to the actions the strategy took during the COVID-induced correction.

- Analyzing Helios’ tonal forecasts at the asset class, region, sector, and security level and their respective volatility forecasts against the market’s implied volatility warrants a thorough exploration.

Summary of Performance – Jan 2011 to April 2022- (View Interactive)

About Volos: Allocators, investment managers, and advisors use Volos’ Strategy Engine, to tailor options programs to meet their organization or end client’s investment objective. Volos’ Strategy Engine enables the design of both simple passive and sophisticated active options strategies. Please email jeff.corrado@volossoftware.com to learn more on our enterprise solution.

Historical and simulated index performance is not necessarily indicative of future results. These products do not offer investment advice. The company is not an investment advisor. The company accepts no responsibility whatsoever for any loss or damage of any kind arising out of the use of all or any part of the company products and the information contained therein.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.