Powell's Speech Raises the Possibility that the Fed Is Getting It Right

On Friday, Fred Chair Jerome Powell gave a much-anticipated speech at the Jackson Hole gathering of the world’s movers and shakers in the world of finance. As usual, his words were carefully chosen and moderated and also as usual, lots of people are trying to read too much into something that really means nothing.

I get it. The major stock indices are regularly hitting new highs, even as the Delta variant of Covid-19 causes a resurgence that reminds us that the pandemic is far from over, and unemployment is, while improving, still elevated. The logical reason for that is the massive amount of liquidity that the central bank is pumping into markets every month. All that free money is creating demand for assets that essentially ignores the fundamental drivers of value. The fear is that it must certainly end at some point and when it does, there will be a terrible reckoning as the market adjusts to the real economy. If that is true, then every word uttered by Powell is important.

There is, however, another possibility. It could be that the Fed will get the timing of this about right. It could be that they scale down asset purchases and then eventually start to raise rates just as the economy strengthens enough to bear it. I know that, politically, that is not a popular opinion. Those on the Left hate Powell because he is a Trump appointee, while those on the Right hate him because he has become the poster child for centralized market distortion. No partisan wants to think he could get this right. That, and the fact that headlines about an imminent crash are a lot sexier than those about a slow, steady grind upwards mean that possibility of a happy ending is rarely talked about.

Strip out all the sensationalism, hatred, and partisan bias, however, and there are reasons to think that this is a likely outcome.

To believe that the bubble will burst when the Fed shifts course, you must first believe that there actually is a bubble, and the data indicates that is nowhere near as clear-cut as most people seem to assume. If we look just at the average trailing and forward P/Es of, say, the S&P 500, they are significantly above their historical averages, certainly, but that is hardly surprising.

The last twelve months’ earnings, which are the basis of trailing P/Es, were artificially low because of the pandemic, so the ratio of price to those earnings will inevitably be high, a dynamic that also affects analysts’ projections for earnings over the next twelve months. The same quarter of last year is usually the starting point for estimates, so depressed numbers from a year ago will result in low estimates for a year’s time. We have seen over the last two months that is what has happened. It produced artificially low forecasts, resulting in a massive 87% of S&P 500 companies beating expectations for Q2.

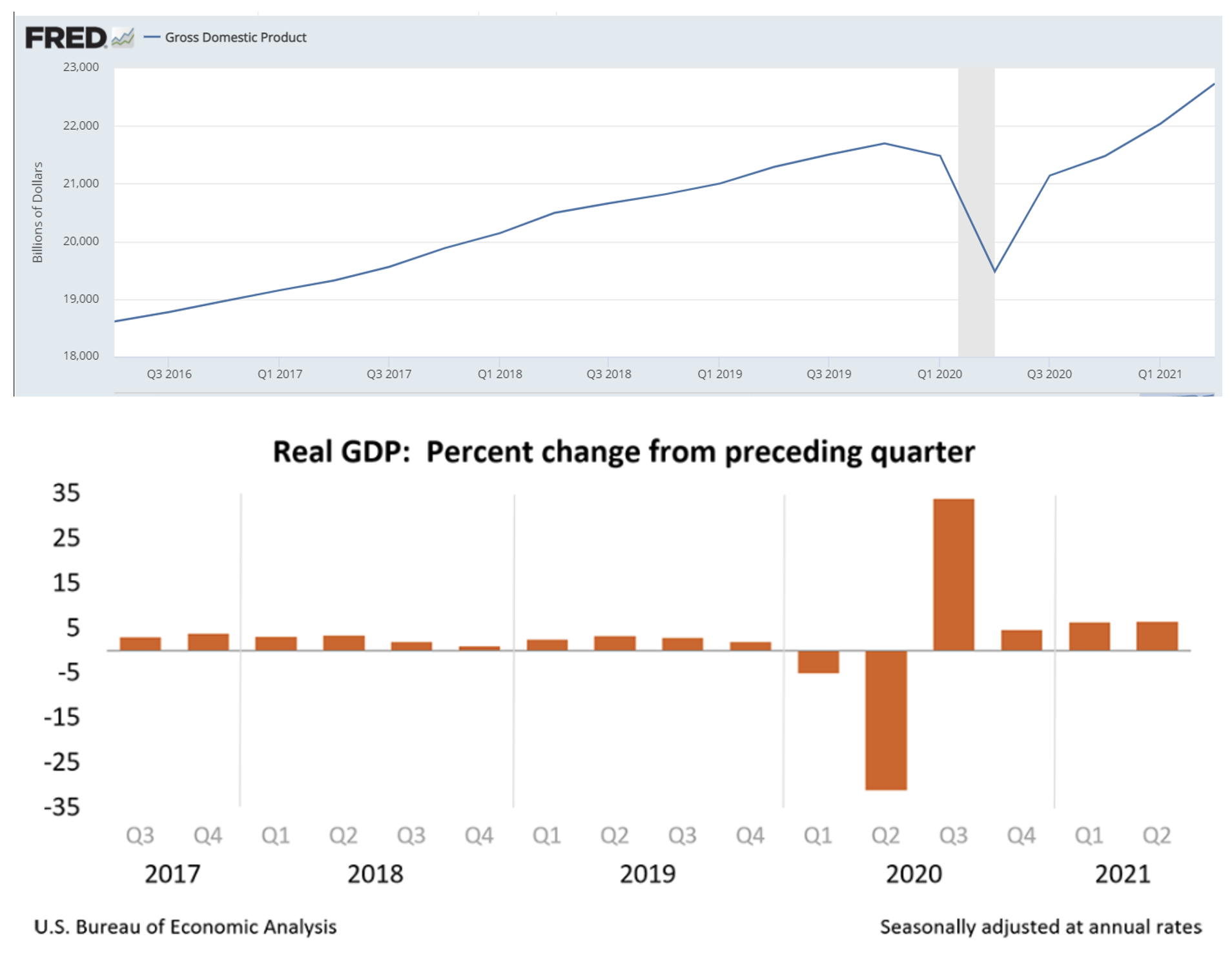

Of course, none of that means anything if the economy is still weak or will get weaker soon, but it isn’t. The U.S. GDP is now significantly greater than it was in Q4 of 2019, when a global pandemic was still the stuff of sci-fi horror, and it is growing at an above average clip.

The job market is also improving, as is productivity. The weak spot is in consumer sentiment, but that is hardly surprising when, as detailed, every pundit is predicting doom and gloom. All in all, that is a picture of a solid and growing economy; one that can easily withstand a slow, steady adjustment to monetary policy.

Tapering asset purchases will reduce investable cash in the system and raising rates will slow growth, but all the Fed is talking about is beginning to gradually taper later this year, and possibly raising rates incrementally a year or so after that. And even that isn’t as sure now as most thought it was. Powell was careful to say that tapering should not be taken as giving any clue as to the timing of future hikes. Meanwhile, the economy is strong and growing stronger.

I have spent years telling investors that it is all about the Fed, but sustained growth is changing the picture. A combination of economic strength and tentative tightening is why the market barely registered Powell’s speech on Friday and is why you too should not overreact either.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.