The PNC Financial Services Group, Inc. PNC has completed the previously announced merger with BBVA, S.A.’s BBVA subsidiary BBVA USA Bancshares, Inc. including its U.S. banking unit BBVA USA. The transaction is already effective Jun 1, 2021.

The deal with BBVA USA, which is part of PNC’s efforts to expand its presence in the international markets, was announced in November 2020.

Notably, the acquisition positions PNC as the fifth largest commercial bank in the United States (in terms of assets and presence) with assets worth above $560 billion and a national franchise accommodating a full spectrum of products and services to retail customers and business clients in 29 of the top 30 largest markets in the country.

CEO and president William S. Demchak stated, “Our acquisition of BBVA USA accelerates our national expansion and positions us to increase shareholder value over time by bringing our industry-leading technology and innovative products and services to new markets and clients."

PNC will update its BBVA USA customers with relevant information on the expected conversion of their accounts in October 2021. Until then, customers will continue to be assisted through their respective BBVA USA and PNC branches, websites, mobile applications, financial advisors and relationship managers.

Our Take

The acquisition and merger between BBVA USA and PNC will likely open up a pool of opportunities and boost shareholder value. Aided by its solid liquidity position, PNC is consistently making strategic investments. With these acquisitions, the company can expedite the expansion of its customer base and geographical presence.

Markedly, it plans to extend the reach of its middle-market corporate banking franchise to uncharted territories and broaden its retail banking brand, nationally. Thus, the company’s bottom line is likely to get further support if it continues to make strategic investments.

Moreover, the combined entity will likely give tough competition to some of the nation’s biggest banks, namely Truist Financial Corporation TFC and U.S. Bancorp USB in terms of assets per branch.

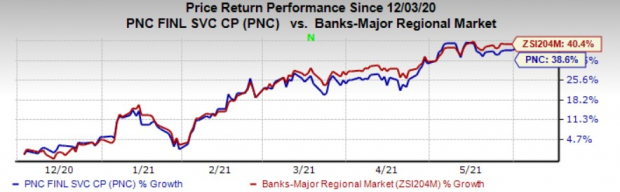

Shares of this currently Zacks Rank #3 (Hold) company have surged 38.6% over the past six months compared with the industry's growth of 40.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

U.S. Bancorp (USB): Free Stock Analysis Report

The PNC Financial Services Group, Inc (PNC): Free Stock Analysis Report

Banco Bilbao Viscaya Argentaria S.A. (BBVA): Free Stock Analysis Report

Truist Financial Corporation (TFC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.