Phillips 66's PSX troubled Alliance refinery in Louisiana is being reviewed by Hilcorp Energy for potential conversion into an oil export terminal, per a report by Reuters.

Oil producer Hilcorp is considering purchasing the Alliance refinery, which occupies 2,400 acres along the Mississippi River and has a processing capacity of 255,600 barrels per day. However, Hilcorp did not reveal any details about its interest in the facility. The conversion of the Alliance site would eliminate it as a source of motor fuel.

In August, Phillips 66 announced plans to divest the Alliance refinery and began meeting with potential buyers. The divestment strategy was due to the continued losses as demand for gasoline and jet fuel declined massively, owing to the coronavirus pandemic. Beside this, power outages and shutdowns caused by major hurricanes kept the company from restoring normal operations at the refinery.

The Alliance refinery has been one big headache, either due to the hurricanes or low profitability. The company was uncertain whether to invest in major repairs or shut down the facility as damages from the storm were severe. Hence, the refinery remained for sale and its marketing process is ongoing.

The Alliance refinery is one of the three refineries along the U.S. Gulf Coast that has been put up for sale this year. The other refineries are LyondellBasell Industries’ LYB 263,776-bpd Houston crude oil refinery and Royal Dutch Shell plc’s (RDS.A) 211,146-bpd Convent Louisiana refinery.

Phillips 66 plans to advance its businesses in renewable diesel, hydrogen and materials for electric-car batteries. This indicates possibilities of its refining business suffering in the long run since the demand for cleaner fuel is increasing. Thus, the conversion of the Alliance refinery into a crude oil storage and distribution terminal can be useful.

Company Profile & Price Performance

Headquartered in Houston, TX, Phillips 66's operations involve refining, midstream, marketing and specialties, and chemicals.

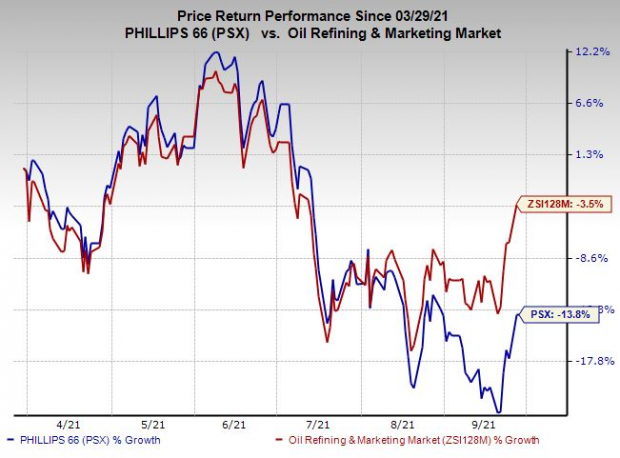

Shares of the company have underperformed the industry in the past six months. Its stock has declined 13.8% compared with the industry’s 3.5% fall.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks Rank & Stock to Consider

Phillips 66 currently carries a Zack Rank #3 (Hold).

One better-ranked player in the energy space is Range Resources Corporation RRC, currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Range Resources’ earnings for 2021 are expected to increase 45.5% year over year.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Dutch Shell PLC (RDS.A): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Phillips 66 (PSX): Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.